The State Bank of Vietnam has recently issued Circular No. 27/2025, providing guidance on the implementation of certain provisions of the Anti-Money Laundering Law.

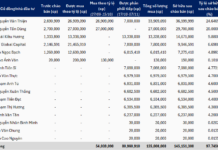

The circular outlines reporting requirements for electronic money transfers. Specifically, reporting entities are obligated to collect information and submit electronic reports to the Anti-Money Laundering Department in the following scenarios: domestic transactions involving organizations with a value of VND 500 million or more, or equivalent foreign currency; international transactions involving organizations outside Vietnam with a value of USD 1,000 or more.

Electronic transactions of VND 500 million or more must be reported.

The circular also specifies value thresholds and documentation requirements for customs declarations when carrying foreign currency, Vietnamese currency, negotiable instruments, precious metals, and gemstones across borders.

For precious metals (excluding gold) and gemstones, the threshold is VND 400 million. Negotiable instruments also have a threshold of VND 400 million. Foreign currency, Vietnamese currency, and gold must be declared to customs upon departure or entry, in accordance with existing State Bank regulations on carrying such items across borders.

The circular will take effect on November 1, 2025. To allow reporting entities adequate preparation time, transitional provisions have been included for certain adjustments.

Reporting entities may continue to follow existing internal regulations and risk management procedures until December 31, 2025.

From January 1, 2026, reporting entities must: update internal regulations and risk management processes, implement software systems for screening against blacklists, watchlists, and politically exposed persons, and monitor transactions to detect and flag suspicious activities related to anti-money laundering, terrorism financing, and proliferation financing.

Domestic Money Transfers of 500 Million VND or More Require Reporting

The State Bank of Vietnam (SBV) has recently issued Circular 27/2025/TT-NHNN, providing guidance on the implementation of key provisions within the Anti-Money Laundering Law. This regulatory update introduces several new measures designed to enhance the effectiveness of monitoring and preventing money laundering and terrorist financing activities within the financial sector.

Banks Must Maintain a Minimum Capital Adequacy Ratio of 8% Effective September 15th

The State Bank of Vietnam has mandated that banks maintain a minimum capital adequacy ratio of 8%, with an additional capital buffer, effectively raising the consolidated standard to 10.5% over a four-year period.