The Personal Income Tax Law is being revised to target e-commerce businesses. Illustration: TBKTVN

Proposed Deduction of Reasonable Expenses in Tax Calculation

The Ministry of Finance has noted that new business models have generated additional income streams for individuals, beyond those already taxed. In response, the draft Personal Income Tax (PIT) Law proposes expanding the list of taxable income sources. Notably, the taxation of e-commerce workers has sparked significant debate.

Nguyen Nhat Thanh Duong, an Affiliate Marketing specialist in Hanoi, highlights the informal nature of this work, lacking traditional employment contracts. He argues that affiliates face a progressive tax rate of up to 35%, akin to salaried workers, without access to social insurance benefits. Additionally, tax authorities lack mechanisms to deduct legitimate business expenses.

“I propose categorizing digital economy workers (affiliates, freelancers, content creators) separately from salaried employees. Instead of progressive taxation, apply a flat tax of 3-10% after allowing expense deductions,” Duong suggests.

Nguyen Quang Thu from Ho Chi Minh City emphasizes the need to monitor cross-border digital transactions. While taxing YouTubers, affiliates, and international traders is fair, he warns against blanket assumptions of tax evasion. Thu advocates for clear, realistic tax policies.

“PIT is levied on revenue, not profit. Online sellers and traders incur significant costs (advertising, transaction fees), yet deductions aren’t permitted. Taxing revenue without allowing for losses is unfair and impractical. The PIT policy also lacks support for freelancers. A voluntary, simplified tax scheme would encourage compliance,” Thu proposes.

Thu further notes the ambiguity surrounding international financial investments (Forex, crypto, global stocks). While not yet legalized, there are indications of potential taxation, creating confusion and risk for taxpayers.

The Ministry of Finance acknowledged these concerns, pledging to refine PIT regulations for individual income sources.

The revised PIT Law is scheduled for National Assembly submission in October, significantly impacting citizens and businesses.

Concerns Over Crypto Asset Taxation

The draft PIT Law introduces a 0.1% tax on digital asset transfers (virtual and crypto assets). Binance, a leading crypto exchange, suggests classifying such income as capital gains, aligning with international practices. They cite the Digital Technology Industry Law, which recognizes digital assets as legal property.

“Most countries (Australia, Singapore, UK) treat crypto investment profits as capital gains. Adopting global standards would ensure consistency and a competitive tax environment for crypto investors,” Binance recommends.

The Ministry of Finance confirmed that the proposed rate mirrors securities taxation. Previously, the lack of legal framework hindered crypto taxation. However, the Digital Technology Industry Law, effective 2026, provides the necessary legal basis.

The Tax Policy Department (Ministry of Finance) stated that taxable activities involving digital assets include VAT, PIT, and corporate income tax. The initial 0.1% PIT rate per transaction balances administrative feasibility with practical implementation.

Personal Income Tax on Gold Transactions: Can It Curb Speculation and Narrow Price Gaps?

After a series of price hikes, with a difference of approximately $1,700 per tael since the beginning of the year, gold has emerged as an attractive investment channel, offering lucrative returns. Experts support the proposal to impose personal income tax (PIT) on gold transactions. However, the implementation of this tax should follow a gradual roadmap, distinguishing between investment and accumulation activities to prevent any shock to the public.

Revamped Personal Income Tax Law: Upcoming Amendments Unveiled

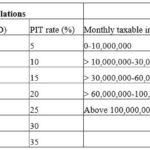

Under the newly proposed Personal Income Tax (PIT) bill by the Ministry of Finance, monthly taxable income will be subject to a progressive tax rate ranging from 5% to 35%.

Finance Ministry: Tax Exemption for Public Sector Employees Likely to Spark Backlash

During the consultation process for the draft amendment to the Personal Income Tax Law, the Ministry of Public Security proposed exempting personal income tax on salaries funded by the state budget. However, the Ministry of Finance argued that the regulation should apply uniformly to all individuals whose income reaches the taxable threshold, as any deviation could provoke public backlash.

Proposed Benefits for Millions of Workers to Take Effect Next Year

Once the proposal is approved, numerous middle-income earners will either be exempt from paying personal income tax or experience a significant reduction in their tax liabilities.