Saigon-Hanoi Securities Joint Stock Company (SHS, listed on HNX) has recently disclosed its transaction report regarding the sale of SHB shares issued by Saigon-Hanoi Commercial Joint Stock Bank.

According to the report, SHS did not sell any of the 20 million SHB shares it had previously registered for sale between August 21 and September 17, citing changes in its business strategy as the reason.

As a result, SHS currently holds 67.2 million SHB shares, including 7.73 million shares received as dividends, representing 1.463% of SHB’s charter capital. Collectively, SHS and its related parties own 194.5 million shares, accounting for 4.236% of SHB’s total capital.

Notably, Mr. Do Quang Vinh, Chairman of the Board of Directors and Strategic Committee at SHS, also serves as Vice Chairman of the Board and Deputy General Director at SHB.

Mr. Le Dang Khoa, a member of the Board of Directors and Audit Committee at SHS, concurrently holds the position of Deputy General Director at SHB.

Additionally, SHS has registered to sell its entire holding of 1.36 million PMC shares in Pharmedic Pharmaceutical Materials Joint Stock Company.

This transaction, representing 14.6% of PMC’s capital, is scheduled to take place between August 15 and September 13 through negotiated agreements, aimed at restructuring SHS’s investment portfolio. Upon completion, SHS will no longer hold any PMC shares or maintain its status as a Pharmedic shareholder.

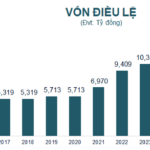

In other developments, SHS is currently in the process of issuing 5 million shares under its 2025 Employee Stock Ownership Plan (ESOP).

These shares will be subject to a one-year transfer restriction from the end of the issuance period. The payment for these shares is expected to be received between September 3 and 23, 2025.

Priced at VND 10,000 per share, the company anticipates raising VND 50 billion, which will be allocated to enhance its operational capital.

According to the previously announced list, 313 employees are eligible to purchase shares in this ESOP issuance. Leading the list, Mr. Nguyen Chi Thanh, General Director, is entitled to purchase 624,720 shares. Following him, Mr. Do Quang Vinh, Chairman of the Board, can acquire 200,000 shares, and Mr. Le Dang Khoa, Board Member, is eligible for 70,000 shares.

Regarding financial performance, in the first half of 2025, SHS reported total operating revenue of VND 1,255.4 billion, a 7.9% increase compared to the same period last year. Pre-tax profit for the first six months of 2025 reached VND 788.7 billion.

For the full year 2025, SHS has set a revenue target of VND 2,519.8 billion and a pre-tax profit goal of VND 1,600.6 billion. Thus, the company has already achieved 57.6% of its annual profit target.

Dual Benefits for TNG Chairman’s Family: Dividend Advance and ESOP Issuance

The upcoming 5% cash dividend advance, coupled with the ESOP issuance at 10,000 VND per share, will elevate TNG’s chartered capital to 1,287 billion VND. Notably, nearly 40% of the preferential shares will be allocated to the family of Chairman Nguyễn Văn Thời.

Hano-vid Records Significant Positive Momentum in First Half of 2025

The 2025 semi-annual financial report of Hano-vid Real Estate Joint Stock Company reveals a strengthening financial foundation and underscores the company’s commitment to sustainable growth in the coming years.