Following a short-term peak in the first week of September, the stock market continued to trade within a narrow range during the week of September 15-19. The VN-Index experienced a volatile week, influenced by significant market news. After a positive recovery early in the week, the index faced resistance near the 1,700-point mark, leading to a decline in the following four sessions due to weakening liquidity. By the end of the week, the VN-Index closed at 1,658.62 points, down 0.52%, but remained above the psychological support level of 1,600 points.

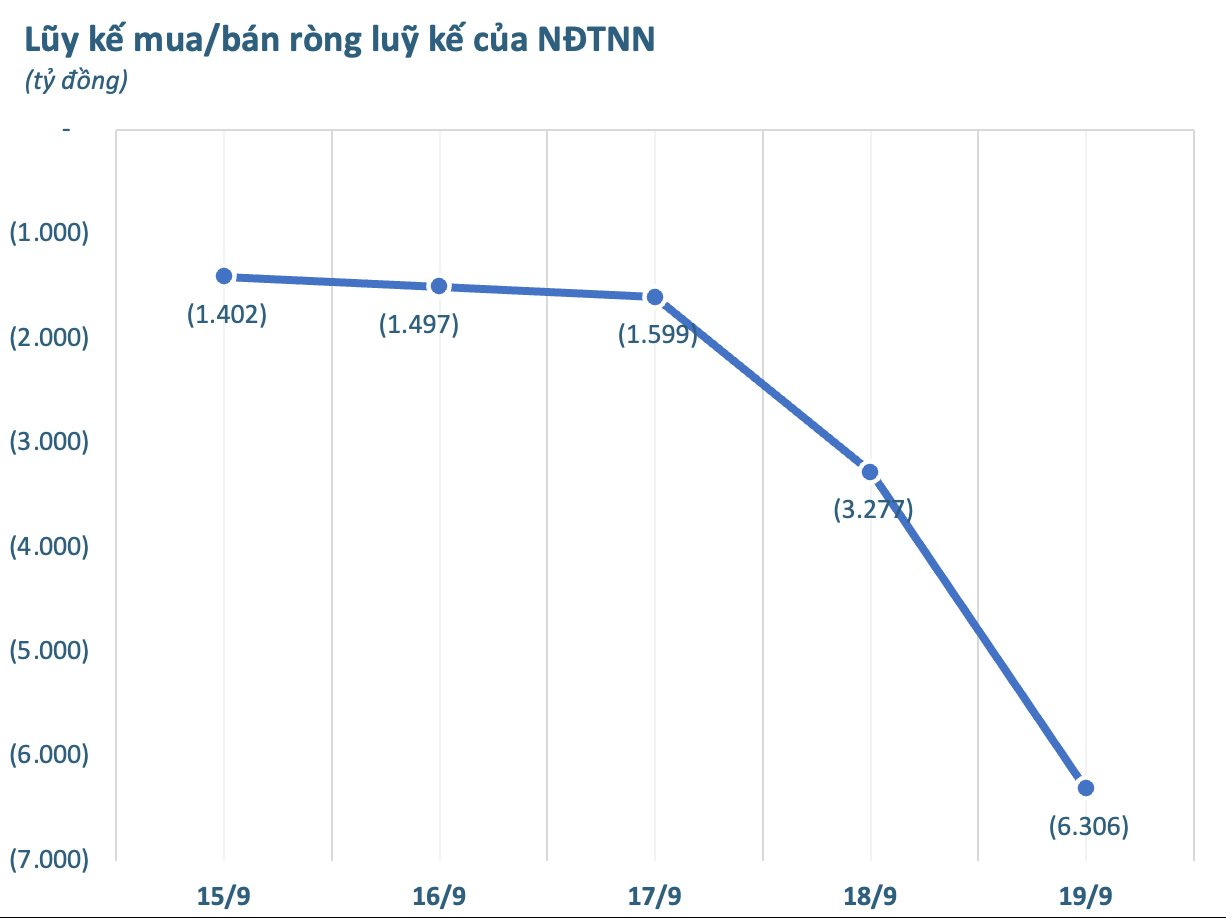

In terms of foreign investor trading value, this group continued to exert strong net selling pressure, totaling thousands of billions of dong. Over the cumulative 5 sessions, foreign investors net sold more than 6,306 billion dong.

Breaking it down by exchange, foreign investors net sold 5,729 billion dong on HoSE, 474 billion dong on HNX, and 103 billion dong on UPCoM.

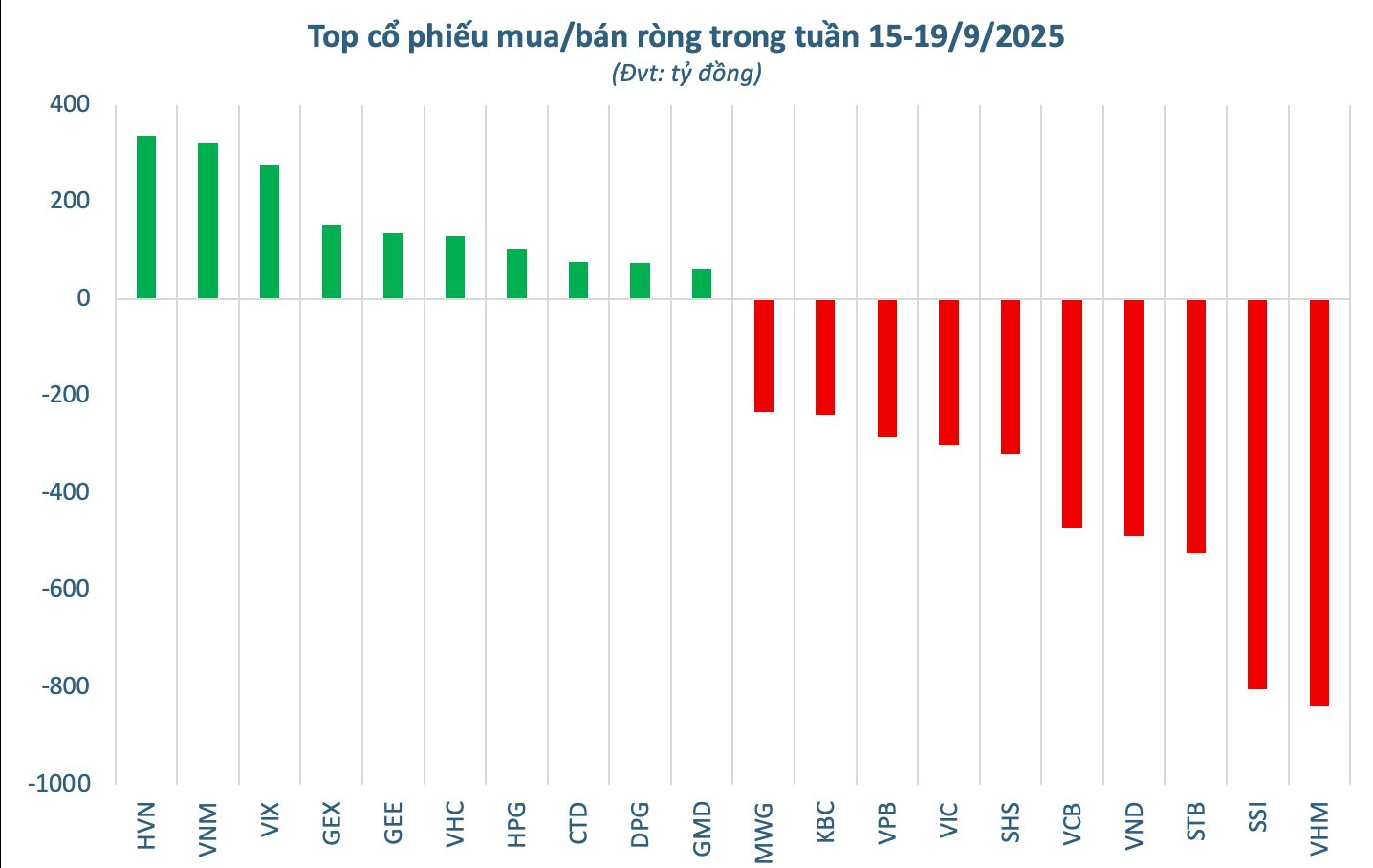

Analyzing individual stocks, VHM was the most heavily net sold, with a value of -838 billion dong, closely followed by SSI at -803 billion dong. Other large-cap and banking stocks also faced significant capital outflows, including STB (-523 billion dong), VND (-487 billion dong), VCB (-470 billion dong), and SHS (-320 billion dong). Additionally, stocks like VIC (-302 billion dong), VPB (-283 billion dong), KBC (-238 billion dong), MWG (-233 billion dong), VRE (-227.5 billion dong), and DXG (-207 billion dong) all recorded net selling exceeding 200 billion dong each.

On the buying side, HVN led with a net purchase value of 337 billion dong, followed by VNM (322 billion dong) and VIX (276.5 billion dong). Other stocks attracting foreign investment included GEX (154 billion dong), GEE (136 billion dong), VHC (130 billion dong), and HPG (105.5 billion dong). Additionally, stocks like CTD, DPG, GMD, ACB, and MBB saw net buying ranging from 50 to nearly 80 billion dong.

Daily Investment in Vietnam’s Largest Bank: What’s the 16-Year Profit?

With a calculated investment of approximately 208 million VND over 16 years, the current value of the investment stands at an impressive 680 million VND.

Unveiling Vietnam’s New Stock Market Capitalization King

Vingroup’s market capitalization soared to the highest level on the entire exchange, surpassing Vietcombank. VIC shares emerged as the strongest driver, significantly curbing the decline of the VN-Index during today’s session (September 18). However, the benchmark index failed to reverse its downward trend.