Stock Market Stagnates, Leading to Significant Losses for Many Investors

Vietnam’s stock market experienced a volatile week, with the VN-Index facing pressure from both domestic and international factors. After a strong start in the first two sessions, the index approached its historical peak of 1,700 points but failed to sustain the momentum, resulting in four consecutive days of decline.

By the end of the week, the VN-Index closed at 1,658 points, a 0.52% drop compared to the previous week. The HNX-Index retreated to 276 points (down 0.9%), while the UPCoM-Index remained nearly flat at 111 points.

From its peak of 1,700 points, the index lost approximately 35 points. However, many stocks experienced deeper declines, causing investors to suffer more significant losses than the overall market decline.

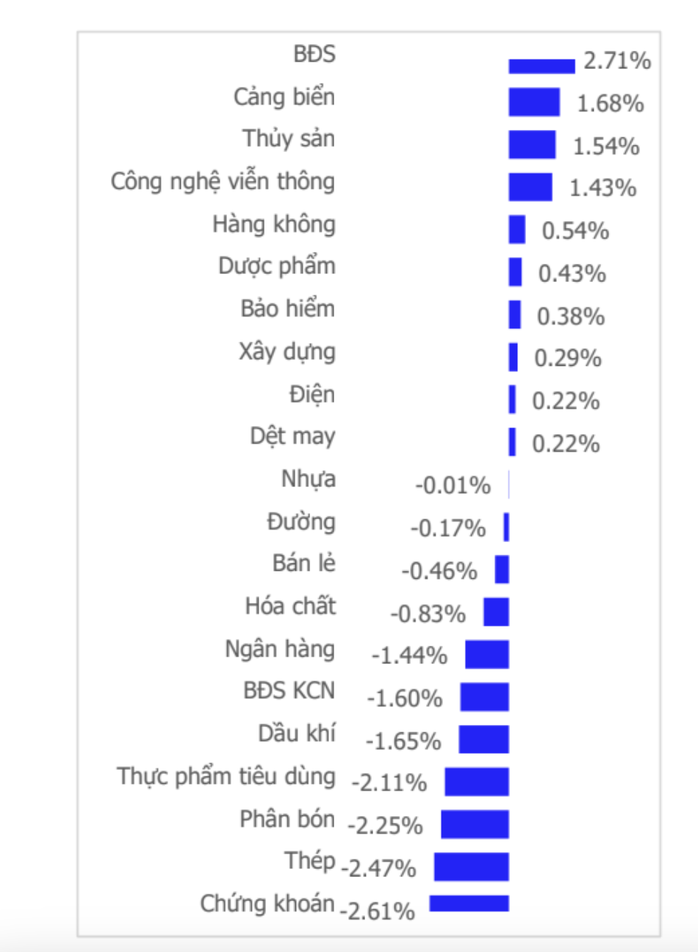

Market liquidity averaged just over 28 trillion VND per session, 15% lower than the previous week. Trading volume concentrated primarily on a few pillar stocks in the real estate sector, notably VIC. Without this support, the VN-Index’s decline could have been more severe.

Meanwhile, the securities sector, which was expected to benefit from market upgrades, disappointed with a widespread 5-10% decline. Banking and real estate, two major sectors, also lost an average of 3-7%. Some individual stocks plummeted by up to 15% in just two weeks, causing substantial portfolio erosion.

Mr. Le Quoc, an investor from Ho Chi Minh City, reported that his portfolio, comprising securities, real estate, and banking stocks, had declined by 10-15% over the past two weeks. “While the VN-Index only dropped a few dozen points, my account lost hundreds of millions due to the sharp fall in stock prices,” he shared.

Stock market stagnation persists in recent days

Foreign Investors Continue Net Selling, Experts Advise Holding Cash

Another pressure point was the net selling activity by foreign investors. Last week, foreign investors offloaded over 2 trillion VND, focusing on large-cap stocks in the banking and steel sectors. This marked the third consecutive week of net selling, further dampening market sentiment.

International factors also played a significant role. The U.S. Federal Reserve’s recent 0.25% rate cut, expected to support global markets, was overshadowed by recession concerns and cautious investor sentiment following new U.S. economic data. Additionally, updates on Vietnam’s potential market upgrade to emerging status under FTSE standards failed to shift the market dynamics.

According to Dinh Viet Bach, an analyst at Pinetree Securities, the market’s “lull and chop” pattern, characterized by mild declines interspersed with sideways movement, is testing investors’ patience. The derivative expiration date and ETF portfolio rebalancing activities further exacerbated index volatility.

SHS Securities warned that with low liquidity and continued foreign net selling, the VN-Index could breach the 1,603 support level if selling pressure intensifies. Conversely, a clear market trend would require a liquidity surge, with trading values exceeding 35-37 trillion VND.

CSI Securities also noted that the likelihood of the VN-Index surpassing the 1,700 peak next week is low, with a higher probability of consolidation and adjustment. Investors are advised to maintain higher cash levels, avoid margin trading, and patiently await opportunities at more attractive price points.

Sector performance fluctuations over the past week

Unleashing the IPO Boom: A Resurgence After Years of Silence

Vietnam’s stock market is poised to welcome a massive IPO wave, with an estimated value of up to $47 billion over the next three years.

VN-Index Remains Favorable in the Medium Term, but Key Support Levels to Watch

ABS highlights that when the market confirms a close below the short-term moving average, stocks in the account breaking through the moving average… serve as a technical signal confirming a correction.

Dr. Can Van Luc: Vietnamese Public Servants Need Nearly 26 Years of Work to Afford an Apartment, Compared to Global Average of 15 Years

Dr. Can Van Luc asserts that the real estate market is grappling with significant volatility, as housing prices are rising faster than incomes, making it increasingly difficult for people to afford homes. He urges businesses to restructure, manage risks, and accelerate digital and green transformations. Additionally, he calls on the government to implement measures aimed at reducing overall price levels.