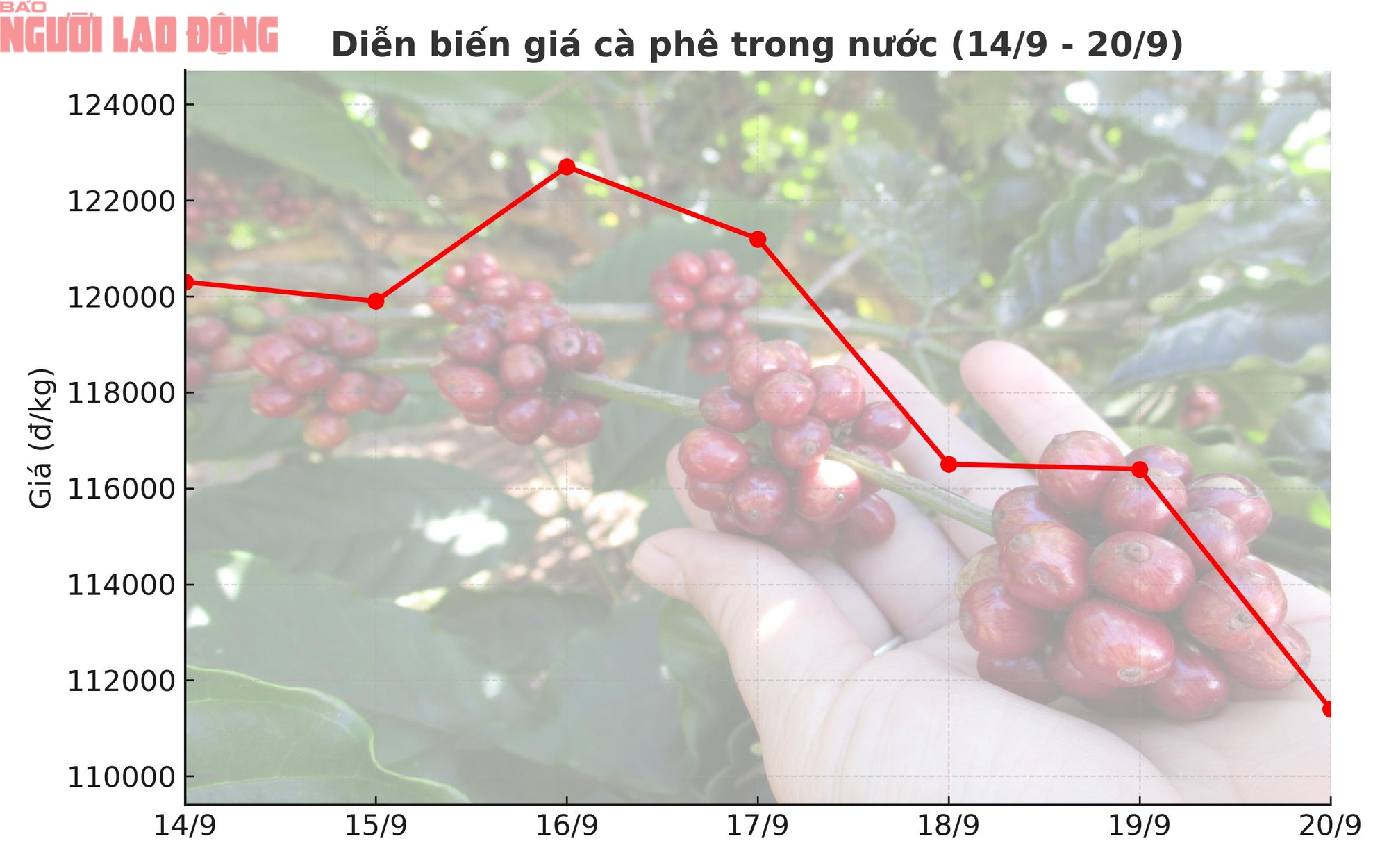

Today, September 21st, domestic coffee prices stand at 111,400 VND/kg, a decrease of 5,000 VND/kg compared to the previous session.

Domestic Coffee Prices Decline Less Than Global Rates

Earlier, during the final trading session of the week, the November 2025 Robusta coffee futures contract on the London exchange dropped by 312 USD/ton, equivalent to 8,250 VND/kg.

Compared to the previous week, domestic coffee prices have fallen by a total of 8,900 VND/kg, a 7.4% decrease.

Meanwhile, Robusta prices closed the week at 4,135 USD/ton, down 466 USD/ton, or 10%.

Domestic coffee prices have declined at a slower pace than global prices due to dwindling supply and farmers’ dissatisfaction with the current rates. Domestic prices are currently 2,000 VND/kg higher than international levels.

Coffee prices experienced a sharp rise earlier in the week, followed by a steep decline, influenced more by financial factors than supply and demand dynamics.

Domestic coffee price trends over the past week

Coffee Exports to the U.S. Surge by 84%

In related news, a report from the Import-Export Department of the Ministry of Industry and Trade highlights a significant increase in coffee exports to the U.S. following the implementation of countervailing duties.

In August 2025, Vietnam’s total coffee exports reached 84,062 tons, a 17.6% decrease compared to July 2025. Among the top 10 importing markets, the U.S. saw the highest growth.

Specifically, Vietnamese businesses exported 3,051 tons of coffee to the U.S., valued at 15.473 million USD, representing an 84.1% increase in volume and a 45% rise in value compared to July 2025.

Domestic coffee prices hold up better than exchange rates

This indicates that Vietnamese coffee has effectively capitalized on the opportunity created by the 50% countervailing duty imposed on Brazilian coffee imports to the U.S.

For the first eight months of 2025, coffee exports to the U.S. totaled 65,306 tons, worth 359.44 million USD, marking a 5.1% increase in volume and a 60.8% rise in value compared to the same period last year.

The U.S. is currently Vietnam’s sixth-largest coffee import market, accounting for 5.7% of the market share, while Germany leads with 14.4%.

The Coffee Chain Spending Spree: Phúc Long Expands 50% of Stores, Highlands Invests in $21M Plant, Trung Nguyên Legend Builds Southeast Asia’s Largest Coffee Factory

In the first half of 2025, Vietnam’s coffee chain market experienced a robust expansion wave, marked by significant growth in store scale, production infrastructure investment, and a surge in e-commerce and social media presence.