The past trading week was marked by a sense of calm and subdued activity, a stark contrast to the previous period’s volatility. The VN-Index kicked off the week with a 17.64-point gain, sparking hopes of reclaiming the 1,700-point milestone. However, the market quickly reversed, enduring four consecutive days of decline, ultimately closing the week at 1,658 points, a 0.5% dip from the prior week.

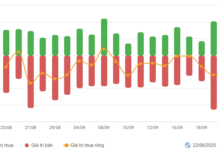

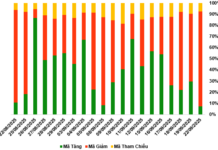

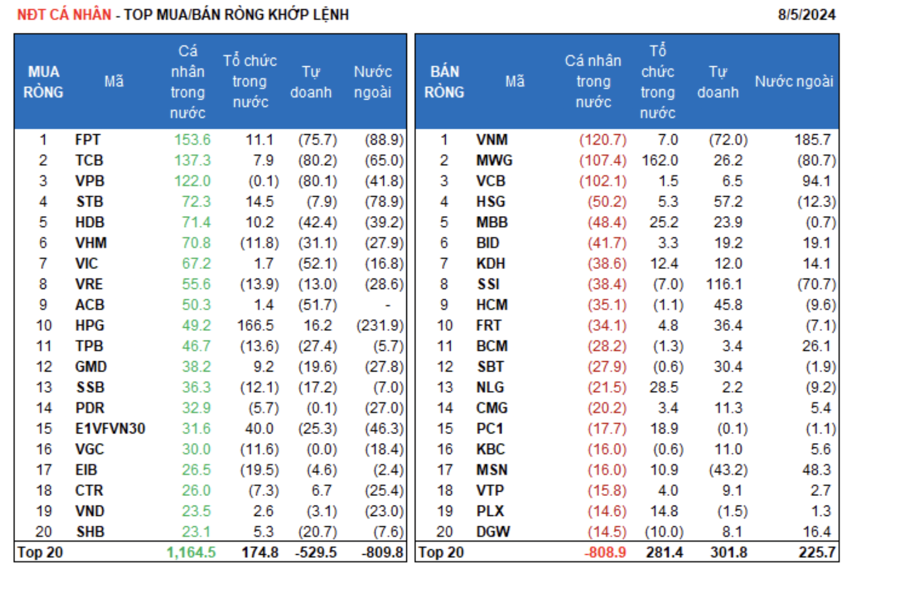

Market dynamics were largely mixed, leaning towards correction. Sectors such as securities, real estate, steel, industrial zones, banking, construction, and retail faced selling pressure, while fisheries, technology, ports, and textiles managed to stay in the green.

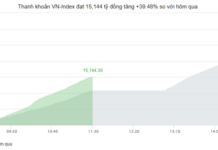

Liquidity saw a significant drop, with the average trading volume on HoSE reaching 1.01 billion shares per session, down 12-13% from the previous week and well below the August average. This marked the lowest liquidity since early July.

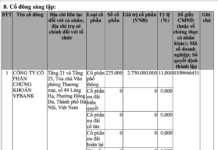

Foreign investors continued their selling streak for the ninth consecutive week, offloading VND 5,715 billion on HOSE, bringing the year-to-date net sell value to VND 89,167 billion—nearly matching the entire 2024 figure. Foreign ownership now stands at approximately 15.7%, a rare low since 2012, suggesting that selling pressure may gradually ease.

The stock market experienced its least active week since early July.

Looking ahead, Saigon-Hanoi Securities (SHS) predicts that the VN-Index is in a natural adjustment and accumulation phase following its strong rally beyond the 2022 peak. In the short term, the index may oscillate around the 1,665-point resistance level (aligned with the 20-session moving average) and could potentially retest the psychological support zone of 1,600 points. Similarly, the VN30 has entered an accumulation phase around 1,850 points after failing to surpass its August-September high.

SHS believes the market is establishing a new price floor with low liquidity, awaiting clearer growth catalysts from Q3 earnings reports and macroeconomic factors. Only when these fundamentals improve can the VN-Index break free from its sideways movement and embrace a more positive trend by year-end.

A notable event for investors last week was the U.S. Federal Reserve’s first rate cut of 2025. The Fed lowered the lending rate by 25 basis points to 4.0-4.25% and signaled two more cuts this year. However, the stock market reacted mildly, as this move was already priced in.

According to VNDirect Securities, post-Fed policy action, attention will shift to October 7th, when FTSE announces whether Vietnam’s stock market will be upgraded from Frontier to Secondary Emerging status.

Meanwhile, the Q3 earnings season is set to begin, offering clearer insights into listed companies’ profit outlooks. These two factors are expected to serve as significant catalysts, potentially shaping the VN-Index’s Q4 trajectory. However, investors should exercise caution in the 1-2 quarters following an upgrade, as the market may experience heightened volatility.

VNDirect forecasts that ahead of these pivotal events, the VN-Index may face short-term correction pressure. Profit-taking is likely to concentrate on large-cap stocks, particularly in banking and securities—sectors that have led the market recently.

Additional risks stem from exchange rate fluctuations and prolonged foreign selling. In a cautious scenario, the VN-Index could retreat to test the 1,600-point region (±20 points) to absorb low-price supply before potentially challenging the 1,700-point resistance in Q4.

Given this context, VNDirect advises investors to maintain exposure to fundamentally strong stocks with growth potential. Risk management should be prioritized through portfolio rebalancing and strict financial leverage control.

Regarding capital flows, if FTSE upgrades Vietnam to Secondary Emerging status, the market could attract $1.0-1.5 billion from open-end funds and ETFs tracking FTSE indices. Stocks poised to benefit from foreign demand include VIC, VHM, HPG, VCB, MSN, VNM, VRE, SSI, and VND.

An MSCI upgrade to Emerging Market status could bring in approximately $3 billion. If both FTSE and MSCI upgrades occur, total foreign inflows could reach $4.5 billion, providing a strong boost to the stock market.

Market Pulse 22/09: Weak Demand Fuels Widespread Sell-Off

Amidst a lack of buying momentum, the market deepened its decline into the red, following unsuccessful recovery attempts near the 1,640-point threshold. By the end of the morning session, the VN-Index closed at 1,635.84 points, down 1.37%, while the HNX-Index fell 0.69% to 274.34 points. Selling pressure dominated, with 466 decliners outpacing 208 gainers. Foreign investors continued their net selling streak, offloading 1.4 trillion VND across all three exchanges.

Vietstock Weekly 22-26/09/2025: Prolonged Market Volatility

The VN-Index retraced following profit-taking pressure near the 1,700 resistance zone, coupled with trading volume dipping below its 20-week average. Volatility is likely to persist as the Stochastic Oscillator weakens further after signaling overbought conditions.