I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON SEPTEMBER 22, 2025

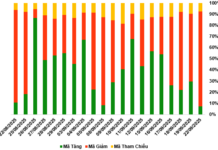

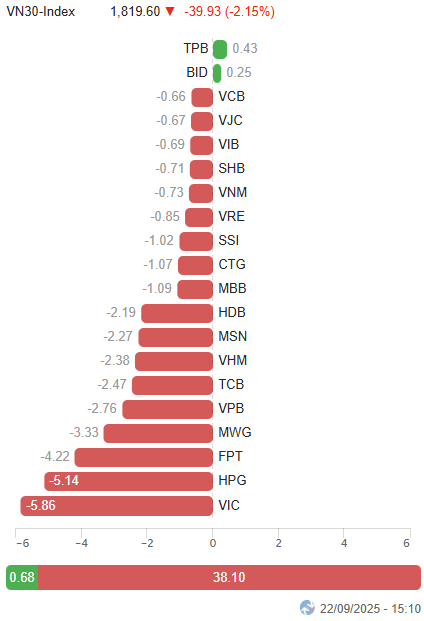

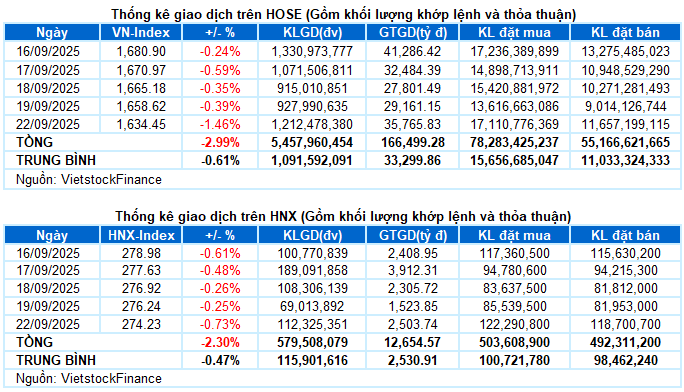

– Major indices continued to decline in the September 22 trading session. The VN-Index fell by 1.46%, closing at 1,634.45 points, while the HNX-Index dropped by 0.73%, settling at 274.23 points.

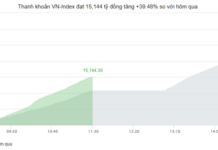

– Trading volume on the HOSE increased by 31.8%, surpassing 1.1 billion units. The HNX also recorded nearly 106 million matched units, a significant 57.2% rise compared to the previous session’s low.

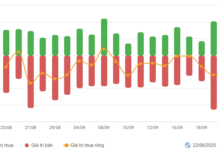

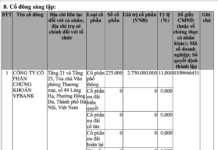

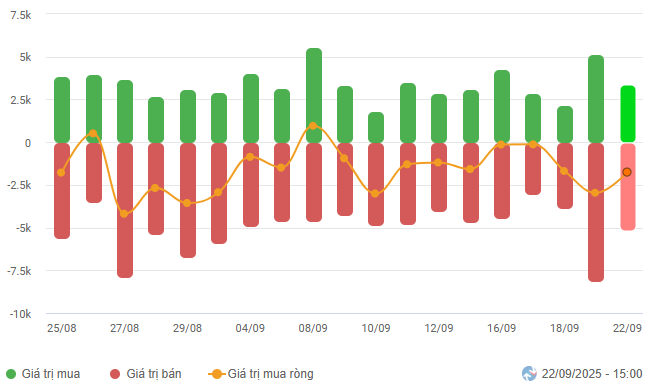

– Foreign investors continued to net sell, with a value of VND 1.7 trillion on the HOSE and over VND 18 billion on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

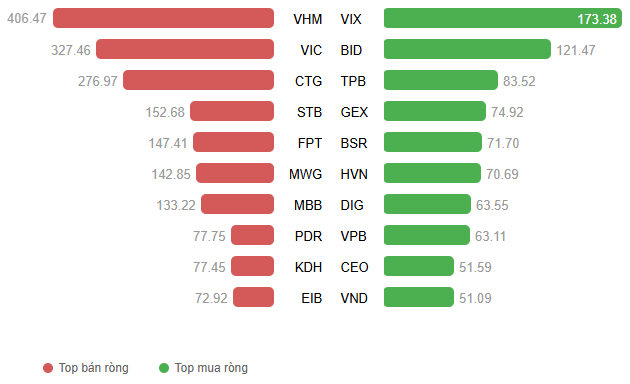

Net Trading Value by Stock Code. Unit: Billion VND

– The stock market kicked off a turbulent week as major indices continued their downward spiral. Selling pressure dominated from the opening bell, sending the VN-Index into a freefall. Lacking support from blue-chip stocks, the already weak buying demand was further overshadowed by overwhelming supply. The index lost the 1,640-point mark by the end of the morning session. In the afternoon, the decline intensified, with the VN-Index dropping nearly 42 points before a recovery in some major stocks helped narrow the losses. The VN-Index closed at 1,634.45 points, down 24.17 points from the previous session.

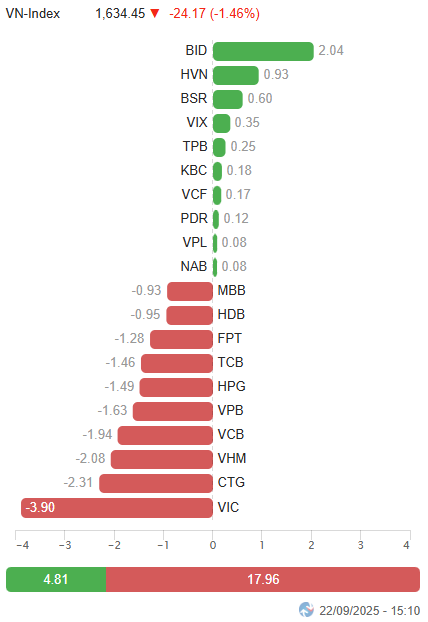

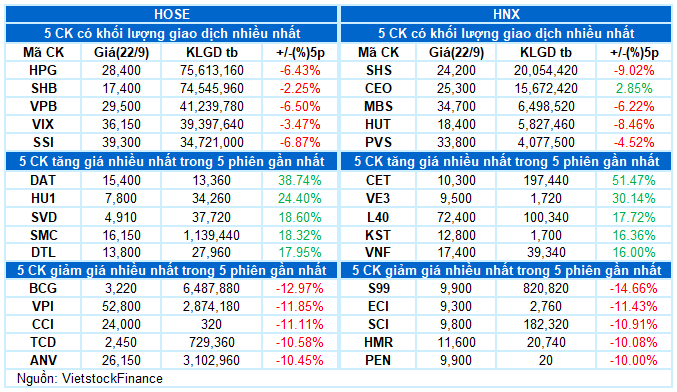

– In terms of impact, the top 10 negatively influencing stocks collectively deducted 18 points from the VN-Index, led by VIC, CTG, and VHM. Conversely, BID, HVN, and BSR were the standout performers, contributing 2.6 points to the index.

Top Stocks Impacting the Index. Unit: Points

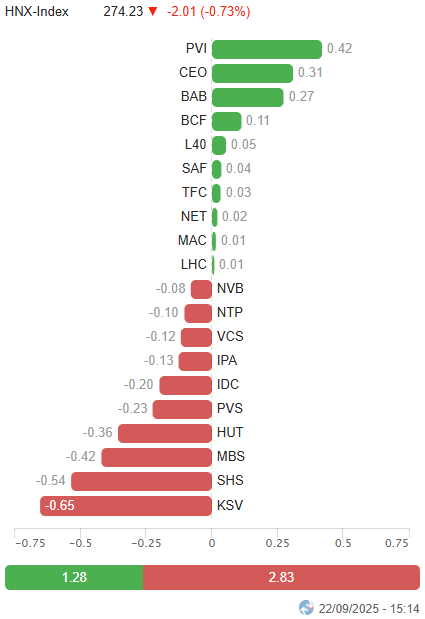

– The VN30-Index plummeted by 2.15%, closing at 1,819.6 points. Sellers dominated with 27 declining stocks, only 2 advancing, and 1 unchanged. HDB, CTG, FPT, and VPB faced heavy selling pressure, falling by 3-4%. In contrast, BID and TPB unexpectedly reversed course in the final session, becoming the only two bright spots against the trend.

Red dominated most sectors. Information technology was the worst performer as leading stocks like FPT (-3.2%), CMG (-3.07%), and ELC (-1.26%) saw deep corrections.

Financial, real estate, communication services, and materials sectors all declined by over 1.5% as red prevailed broadly. Only a few stocks bucked the trend, notably VIX (+2.7%), BID (+3.02%), TPB (+2.15%); DIG (+1.22%), CEO (+3.27%), PDR (+2.13%), KBC (+2.22%); YEG (+2.86%), VNZ (+2.94%); DPR (+1.04%), and DHA (+1.35%).

Energy was the only sector in the green, primarily driven by the leading stock BSR (+3.08%). The rest of the sector performed poorly, with PVS (-2.03%), PVD (-3.08%), PLX (-1.41%), and PVC (-1.69%) all declining.

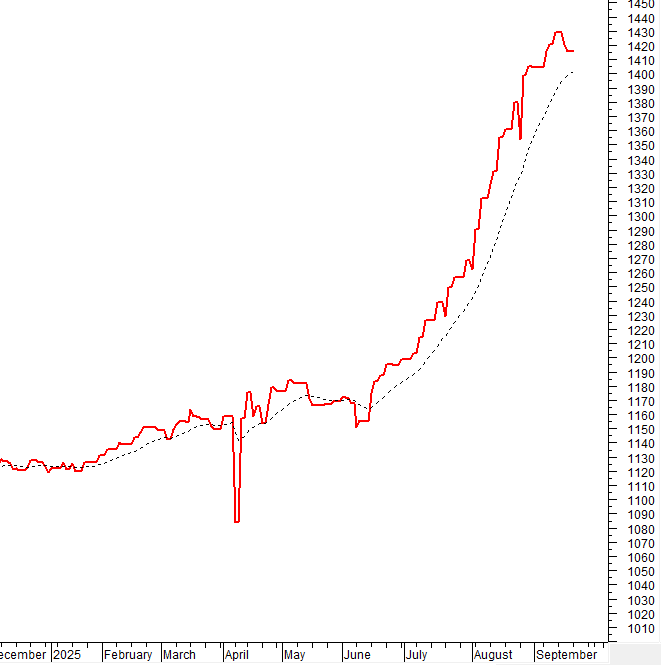

The VN-Index plunged, extending its losing streak to five consecutive sessions. The index broke below its short-term trendline (equivalent to the 1,645-1,660 point range). Meanwhile, the Stochastic Oscillator and MACD indicators continued their downward trajectory after issuing sell signals.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Breaking Below the Short-Term Trendline

The VN-Index plunged, extending its losing streak to five consecutive sessions.

The index broke below its short-term trendline (equivalent to the 1,645-1,660 point range). Meanwhile, the Stochastic Oscillator and MACD indicators continued their downward trajectory after issuing sell signals.

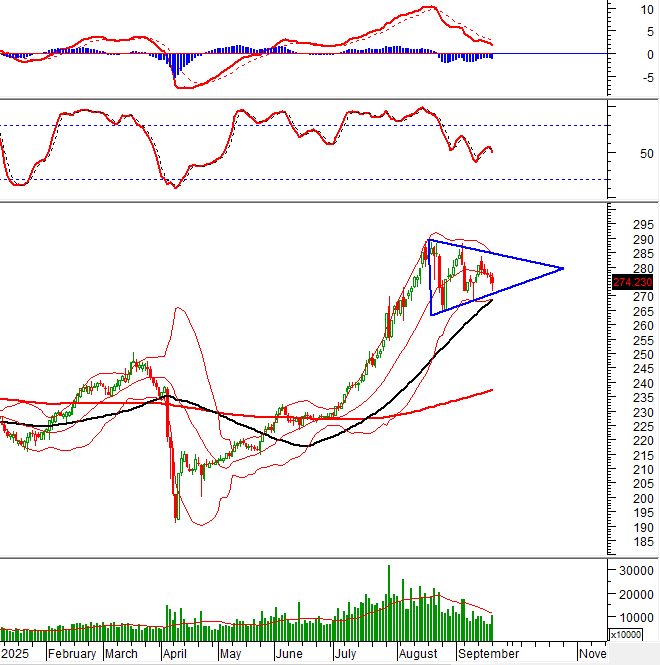

HNX-Index – Stochastic Oscillator Issuing Sell Signal

The HNX-Index continued to decline after falling below the Middle Bollinger Band.

The index is likely to retest the lower boundary of the Triangle pattern (equivalent to the 269-272 point range) as the Stochastic Oscillator has issued a sell signal.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downward thrust will be mitigated.

Foreign Investor Flow: Foreign investors continued to net sell in the September 22 session. If foreign investors maintain this action in upcoming sessions, the outlook will become even more pessimistic.

III. MARKET STATISTICS ON SEPTEMBER 22, 2025

Economic & Market Strategy Analysis Department, Vietstock Consulting Division

– 17:35 September 22, 2025

Awaiting the Next Big Catalyst: Will Stock Markets Remain in Limbo?

The stock market just concluded its quietest trading week since early July, with the VN-Index closing at 1,658 points. Broad-based selling pressure emerged amid sharply declining liquidity and persistent net selling by foreign investors. Analysts anticipate that next week, the market will likely remain in an accumulation phase, awaiting catalysts from third-quarter earnings reports and, notably, the FTSE’s upcoming review for a potential upgrade.

Market Pulse 22/09: Weak Demand Fuels Widespread Sell-Off

Amidst a lack of buying momentum, the market deepened its decline into the red, following unsuccessful recovery attempts near the 1,640-point threshold. By the end of the morning session, the VN-Index closed at 1,635.84 points, down 1.37%, while the HNX-Index fell 0.69% to 274.34 points. Selling pressure dominated, with 466 decliners outpacing 208 gainers. Foreign investors continued their net selling streak, offloading 1.4 trillion VND across all three exchanges.