Illustrative Image

The latest data from Vietnam Customs reveals that in August 2025, pangasius fish exports reached $200 million, a 5% increase compared to August 2024. Cumulatively, in the first eight months of the year, this sector has earned over $1.4 billion, marking a 10% rise year-on-year.

In terms of product structure, frozen pangasius fillets remain the flagship product, generating over $1.1 billion. Exports of dried and other frozen pangasius products (under HS code 03, excluding HS0304) reached $246 million, a 2% increase from last year. Notably, deeply processed products under HS code 16—though representing a smaller share—recorded a significant surge in August. By the end of August 2025, value-added pangasius exports totaled $36 million, up 32% year-on-year.

Regarding markets, in the first eight months, exports to the U.S. reached $234 million, a 3.7% increase year-on-year, and are considered stable. Despite modest growth, the U.S. remains a critical market due to its high value, stringent requirements, and global influence. Maintaining growth amid complex tariffs and technical barriers highlights Vietnam’s pangasius industry’s strengthening position in the mid-to-high-end segment.

Exports to CPTPP member countries totaled $242 million in the first eight months, a 36% increase compared to 2024. Japan, Canada, and Mexico are key markets within this bloc, with diverse demand ranging from frozen fillets to processed products. The tax benefits from the FTA, coupled with shifting consumer preferences toward convenience and safety, are unlocking significant opportunities. Thus, CPTPP is not just a short-term highlight but a long-term strategic region for the pangasius industry.

Within ASEAN, Thailand imported $52 million worth of pangasius, a 31% increase year-on-year, while the Philippines reached $26 million, up 31%. Malaysia and Singapore also maintained steady growth. With geographic proximity, lower logistics costs, and similar tastes, ASEAN is becoming a “safety belt” that reduces the industry’s reliance on distant, technically challenging markets.

Exports to Europe reached $120 million in the first eight months, a 6% increase year-on-year. Although growth remains moderate, the EU is a high-value market with strong brand influence. Stable demand for high-standard pangasius fillets, particularly in Germany, the Netherlands, and Spain, underscores long-term consolidation potential.

Vietnam is the world’s largest producer and exporter of pangasius, accounting for 52% of global production and 90% of international trade, with products favored across multiple markets for their flavor and competitive pricing. The fish is widely sold as “dory” in most Southeast Asian countries. In Malaysia, locals call it “ikan patin,” commonly consumed whole, steamed, or cooked with fermented durian in a spicy broth.

U.S. Tax Challenges: A Critical Litmus Test for Businesses

The 20% reciprocal tax imposed by the U.S. on imports from Vietnam presents a significant challenge, yet it also serves as a critical test for businesses to restructure their market strategies and enhance competitiveness. With thorough preparation and support from local authorities, companies can not only retain their market share but also explore opportunities for expansion.

Seafood Exports Surpass $10 Billion: Unveiling the 2 Star Products

The seafood industry has witnessed impressive growth in exports, inching closer to the significant milestone of $10 billion annually. This remarkable journey can be largely attributed to the stellar performance of two key players: shrimp and catfish. As the industry surges ahead, these two aquatic powerhouses have emerged as the primary contributors to its success, solidifying their status as the backbone of this thriving sector.

Seafood Exports on Track to Hit $10 Billion Landmark

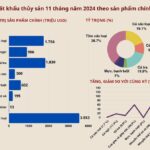

With the current growth trajectory, Vietnam’s seafood industry is on track to achieve its target of $10 billion for the full year 2024, marking an impressive 11.5% increase from 2023. Shrimp and catfish will remain the key drivers, with projections of reaching $4 billion and $2 billion, respectively.

Seafood Exports for the First Ten Months Reached $8.3 Billion, with Key Products Showing Strong Growth

The seafood industry is swimming towards success, with October’s achievements pushing the 10-month tally to a remarkable $8.33 billion in export turnover. This impressive figure marks a 12% increase compared to the same period last year, showcasing the sector’s resilience and growth. Key products such as shrimp, pangasius, and tuna have all witnessed positive growth trajectories, contributing to the industry’s overall triumph.