During the National Assembly Standing Committee’s meeting on September 22, Mr. Phan Văn Mãi, Chairman of the Economic and Financial Committee, expressed his opinion on the draft Law on Thrift and Waste Prevention. His remarks highlighted the need for more proactive measures to combat waste.

The government’s draft law identifies nine categories of wasteful behavior and nine types of violations related to waste prevention. It aims to establish detailed regulations and penalties for individuals and leaders responsible for such actions.

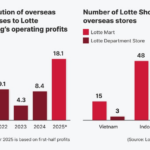

Mr. Mãi raised concerns about the draft law’s lack of flexibility in empowering accountable individuals within organizations. He cited the recent case of Lotte returning the Thủ Thiêm Eco Smart City project as an example.

As the Chairman of the Economic and Financial Committee explained, the project’s land valuation and fees were determined long ago. However, due to delays, the developer incurred additional charges of trillions of VND. Lotte argued that these delays were not their fault and decided to return the project.

According to Mr. Mãi, this situation not only leaves the land unused for years but also negatively impacts the business environment and investor confidence. He urged the draft law to include stronger measures to empower authorities and hold leaders accountable.

Chairman of the Economic and Financial Committee Phan Văn Mãi presents the preliminary review report. Photo: National Assembly Press Center |

The Thủ Thiêm Eco Smart City project, located in functional area 2A (now An Khánh Ward, Ho Chi Minh City), was proposed in 1997 with an investment of over 20.1 trillion VND. The complex was planned to include a financial center, services, and a multi-functional residential area.

In July 2017, Lotte signed an agreement with the Ho Chi Minh City People’s Committee and held a groundbreaking ceremony in September 2022. The project, spanning over 7.4 hectares, featured 11 towers, each 50 stories high, and was considered a key development in Thủ Thiêm. Despite being a billion-dollar project, it faced delays due to financial obligations and legal procedures. In June, the land value was approved at over 16.19 trillion VND. Lotte had repeatedly requested the city to resolve these issues but was unsuccessful. The South Korean conglomerate cited prolonged land appraisal processes and policy changes as reasons for increased costs, making the project unfeasible, leading to their decision to terminate the contract.

Deputy Chairman of the National Assembly Vũ Hồng Thanh emphasized the thin line between thrift and waste. He mentioned that some highways were built with only two lanes and lacked emergency stops, leading to frequent accidents and subsequent costly repairs.

“This approach is more expensive than investing properly from the start,” he noted, advocating for clear distinctions in the draft law.

He also suggested differentiating between wasteful acts due to negligence or legal violations and objective risks during policy implementation, such as pilot programs.

“While the principles are correct, specific regulations are needed for practicality,” Mr. Thanh added.

The Economic and Financial Committee’s review also recommended distinguishing between negligence-based waste and objective risks in policy implementation. They proposed disciplinary actions, including removal or resignation for severe waste cases, and mechanisms for public consultation and oversight.

The draft Law on Thrift and Waste Prevention is scheduled for National Assembly review in October.

Contributors to the Lotte Eco Smart City Complex in Thủ Thiêm

Lotte’s Termination of the Thủ Thiêm Eco Smart City Project

Phương Dung

– 16:15 22/09/2025