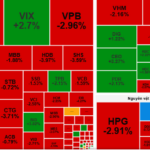

Following a lackluster trading week, the stock market faced continued selling pressure from the opening session on September 22nd. Selling intensified among banking and large-cap stocks. The VN-Index closed down 24.17 points (-1.16%) at 1,634.15 points. Foreign investors were net sellers, offloading a significant 1,757 billion VND during the session.

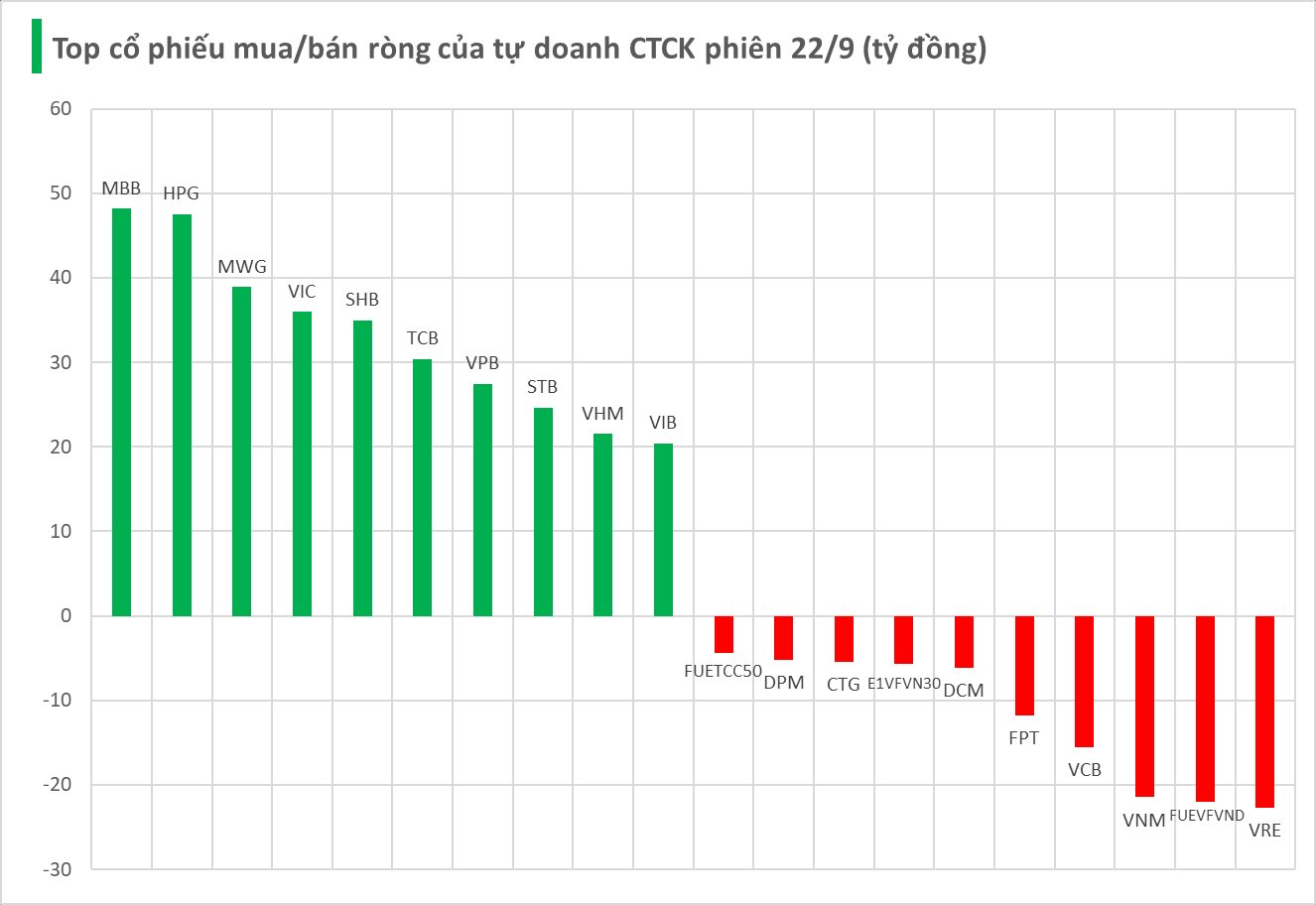

Securities firms recorded net buying of 375 billion VND on the Ho Chi Minh City Stock Exchange (HOSE).

Specifically, MBB and HPG saw net buying of 48 billion VND and 48 billion VND, respectively. They were followed by MWG (39 billion VND), VIC (36 billion VND), SHB (35 billion VND), TCB (30 billion VND), VPB (27 billion VND), STB (25 billion VND), VHM (21 billion VND), and VIB (20 billion VND), all of which were actively purchased by securities firms.

Conversely, securities firms were net sellers of VRE (-23 billion VND), FUEVFVND (-22 billion VND), VNM (-21 billion VND), VCB (-16 billion VND), and FPT (-12 billion VND). Other stocks experiencing notable net selling included DCM (-6 billion VND), E1VFVN30 (-6 billion VND), CTG (-5 billion VND), DPM (-5 billion VND), and FUETCC50 (-4 billion VND).

Market Plunge: Blue-Chip Stocks Retreat, Triggering Sharp Decline in Early-Week Trading

Domestic stocks faced a challenging start to the week, with selling pressure dominating the market and driving the VN-Index down by 24 points. No sector or stock emerged as a strong enough pillar to support the market.

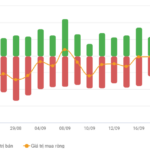

Technical Analysis for the Afternoon Session of September 22: Breaking the Short-Term Trendline

The VN-Index extended its decline, breaching the short-term trendline support at the 1,645-1,660 range. Similarly, the HNX-Index retreated, falling below the Middle Band of the Bollinger Bands indicator.