Conference Announcing the Consolidation Decision of the Central Steering Committee on Housing Policy and Real Estate Market. Photo: VGP/Nhật Bắc

|

At the conference announcing the consolidation decision of the Central Steering Committee and its first meeting on the afternoon of September 22, Deputy Governor of the State Bank of Vietnam, Nguyen Ngoc Canh, reported on real estate credit status and the implementation of social housing loan programs.

Positive Growth in Real Estate Credit

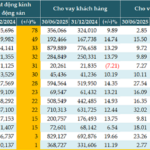

According to the State Bank of Vietnam’s report, as of July 31, 2025, outstanding real estate credit reached over 4.1 trillion VND, a 17% increase compared to the end of 2024, accounting for 23.68% of the total outstanding credit in the economy. Specifically, credit for real estate business reached 1.79 trillion VND (up 23.87%), and credit for real estate-related consumption reached 2.28 trillion VND (up 12.4%).

The bad debt ratio stands at only 2.43%, remaining within controllable limits. Deputy Governor Nguyen Ngoc Canh believes this growth reflects the market’s real demand and demonstrates banks’ disciplined lending practices, balancing credit expansion with systemic safety, contributing to macroeconomic stability.

Strong Support for Social Housing Programs

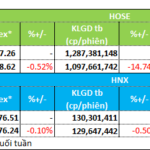

By the end of July 2025, outstanding loans for housing programs as directed by the Government reached approximately 30,000 billion VND. Specifically, the loan program supporting housing under Resolution 02 disbursed 29,679 billion VND, and the social housing loan program under Resolution 100 disbursed 19,226 billion VND.

Mr. Nguyen Ngoc Canh stated that the bad debt ratio is only 2.43%, within controllable limits. Photo: VGP/Nhật Bắc

|

The State Bank is currently implementing a social housing loan package under Resolution 33/NQ-CP, with a scale of 145,000 billion VND until 2030. Notably, under the new mechanism, these loans are not included in the annual credit growth target and prioritize individuals under 35 years old. Interest rates have also been significantly reduced: from 8.7%/year for developers and 8.2%/year for homebuyers, now down to 6.4% and 5.9%/year, respectively, making access easier.

Initial results show that 26 out of 34 provinces and cities have announced approximately 108 participating projects. Banks have committed to providing 8,600 billion VND in credit, with loan disbursements reaching 4,578 billion VND (3,858 billion VND for developers and 720 billion VND for homebuyers).

Deputy Governor Nguyen Ngoc Canh pointed out three major challenges in implementing the social housing program:

Real demand from residents: Many industrial workers prefer renting over buying, while the restriction on reselling within five years creates barriers to demand conversion. Legal entities for disbursement: Banks need a clear legal framework when lending through industrial zone developers to effectively allocate capital to tenants or homebuyers. Clean land funds: Many localities have not prepared land in time for handover to businesses, delaying project progress and hindering safe credit disbursement.

He emphasized that if these three factors are addressed comprehensively, the social housing program will be more effectively promoted, meeting the needs of low-income earners and workers.

Banks Accompany Real Estate: A Bright Signal for the New Journey

Mr. Nguyen Duc Vinh, General Director of Vietnam Prosperity Joint Stock Commercial Bank (VPBank), noted that today’s real estate market is very different from a year ago. Back then, many projects were virtually “frozen,” and banks were in a passive position, only waiting for debts to mature. However, thanks to the Government’s decisive actions, real estate has rebounded, helping the banking system gradually escape bad debt risks and regain confidence in recovery. “Compared to a year ago, the market is much more vibrant. This shows we have passed the most challenging phase,” he emphasized.

According to Mr. Vinh, current real estate prices result from multiple factors, the most important being land prices. Over the years, local budgets have been supplemented by rising land prices, but this has also driven up housing costs. When combined with material and capital costs, the overall picture becomes burdensome. “To reduce prices, a comprehensive and decisive land policy is needed. Only by increasing supply can the market self-adjust,” he analyzed.

Regarding interest rates, Mr. Vinh stated frankly: “I’ve been in banking for 26 years and have never seen rates as low as they are now.” He believes low interest rates are a significant advantage for both businesses and individuals but are not a “magic wand.” The core issue lies in procedures. If a project is implemented within six months, businesses won’t be too concerned about whether the interest rate is 7% or 10%. But if it’s delayed for years, with “interest on interest,” no rate reduction can save it.

Regarding the 120,000 billion VND credit package for social housing, the General Director of VPBank believes that the fourth quarter of this year and 2026 will see strong disbursement. He also agrees with the plan to directly assign reputable real estate businesses to implement social housing at reasonable prices. The State then only needs to control targets and direct benefits, while businesses can act quickly and efficiently. “Social housing is not about making a profit but fulfilling a social responsibility. Businesses are willing to accept losses to compensate in other areas,” he affirmed.

Mr. Le Hoang Chau believes the 145,000 billion VND package will soon be disbursed. Photo: VGP/Nhật Bắc

|

Recovery Signals and Confidence in the Social Housing Market

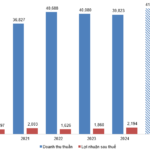

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, emphasized that the real estate market entered a recovery and growth phase from the first quarter of 2024: “This trend is irreversible, so we are confident.”

According to the Ministry of Construction’s report, 692 social housing projects with over 600,000 apartments are currently under construction. Mr. Chau stated: “As VPBank mentioned, there will be a boom in social housing in the coming years.” However, to achieve the target of 1 million social housing units, an additional 300,000 units are needed. Mr. Chau believes this will create a “wave” of supply in the coming years, helping meet the housing needs of middle and low-income groups.

One crucial tool is the 145,000 billion VND credit package from nine commercial banks. Mr. Chau emphasized that this is a voluntary commercial credit package, not a preferential one, with Vietcombank contributing 30,000 billion VND. However, the package has not been disbursed due to legal obstacles in the projects. He expressed confidence that with special resolutions, pilot resolutions, and upcoming legal amendments, “the 145,000 billion VND package will soon be disbursed.”

A notable update is the amendment to Decree 100 on social housing. Mr. Chau mentioned that the Ministry of Construction has proposed adjusting income criteria: 20 million VND/month for individuals, 40 million VND for couples, and 30 million VND for individuals raising children under 18. “We strongly support this proposal,” he affirmed.

Regarding loan interest rates, he suggested reverting to the 4.8%/year rate, previously approved by the Prime Minister from 2021 to July 2024. Currently, the Vietnam Bank for Social Policies applies a rate of 6.6%, higher than the commercial rates offered by some banks like Vietcombank (5.9–6.1%). “We propose the Prime Minister reinstates the 4.8% rate, with Hanoi and Ho Chi Minh City allowed to set higher rates as needed,” he emphasized.

Reducing Housing Prices: Lower Costs and Procedures

Mr. Chau believes that to reduce housing prices, costs must first be lowered: from land use fees, construction costs, input costs like sand, gravel, steel, cement, electricity, and fuel, to compliance costs. “Especially the opportunity costs due to prolonged administrative procedures,” he noted.

Another critical factor is businesses’ profit expectations. He stressed: “We urge the business community to share by reducing profit expectations to a reasonable level.” He also affirmed the role of credit in market regulation, citing China’s example, where lending ratios are adjusted based on market conditions.

Despite challenges, Mr. Chau expressed confidence in the real estate market’s future. “There is a lag between policy implementation and project realization. However, with institutional reforms and reasonable credit policies, the market will recover more strongly,” he concluded.

– 07:38 23/09/2025

From Resilience to Ambition: NCB Continues Its 30-Year Journey of Breakthroughs

From a modest southern bank to a pioneering credit institution in restructuring and innovation, NCB exemplifies the power of resilience and ambition. Its 30-year journey marks not only a milestone of maturity but also the dawn of a brilliant new chapter in development.

VIB at 29: Pioneering Innovation, Elevating Financial Experiences for Millions of Vietnamese Customers

On September 18, 2025, Vietnam International Commercial Joint Stock Bank (HOSE: VIB) celebrates its 29th anniversary—a nearly three-decade journey fueled by the ambition to craft intelligent financial solutions through deep customer understanding, elevating the financial experience for Vietnamese users.

“Monetary, Gold and Stock Market Management: Strategies for Stability and Growth”

The Deputy Prime Minister, Ho Duc Phoc, has signed and issued an urgent dispatch on the 11th of September 2025, addressing the management and governance of the monetary, gold, and securities markets. This dispatch, numbered 161/CD-TTg, underscores the government’s proactive approach to maintaining stability and devising effective solutions for these vital markets.

Is Real Estate Risk-Free When Credit Flows Abound?

The influx of bank credit into the real estate sector is not always indicative of impending doom. The key lies in the quality of individual loans and the allocation of capital. The real estate market is expected to enter a phase of “selective recovery” in the next 6-18 months, offering a nuanced opportunity for discerning investors.