With 8 garment factories, Hachiba manufactures over 15 million garments annually and provides stable employment for over 2,500 workers.

|

According to the resolutions of the 2025 Annual General Meeting of Shareholders, Hachiba will initiate the process of canceling its public company status due to failing to meet the minimum requirements for the proportion of free-float shares as stipulated by the current Securities Law. Specifically, despite having a charter capital of nearly VND 52 billion, more than 3.5 times higher than at the time of equitization in 2007, and owner’s equity exceeding VND 151.5 billion as of the end of 2024, the percentage of voting shares held by minority shareholders stands at only 9.73%, falling short of the 10% threshold mandated by law.

Currently, Dệt may 29/3 has a total of 192 shareholders, but the majority of the shares are held by insiders and the management’s families. Nine major shareholders hold 90.27% of the voting shares. Such shareholder structure renders HCB ineligible to remain a public company.

On May 27, the State Securities Commission of Vietnam (SSC) officially approved the cancellation of Hachiba’s public company status and requested the company to disclose relevant information and complete the necessary procedures. Following the disclosure, the Hanoi Stock Exchange (HNX) will delist HCB shares, and the Vietnam Securities Depository (VSD) will terminate the registration of these securities.

A Journey of Nearly Half a Century and the Mark of a Nonagenarian Captain

|

Behind this quiet delisting decision lies a company with a special history. HCB, or Hachiba, was established in 1976 as the 29/3 Garment and Textile Corporation, a name commemorating the liberation of Da Nang. The company was equitized in 2007. Mr. Huynh Van Chinh, the long-serving Chairman of the Board of Directors, has dedicated his life to this enterprise. Affectionately known as “Mr. Chinh of Two Nine Three” in the investment community, he is one of the rare nonagenarian entrepreneurs still active in Vietnam’s stock market.

Headquartered in Da Nang, Hachiba specializes in manufacturing garments, weaving towels, producing packaging, and supplying raw materials for the textile and garment industry. As of the end of 2024, the company employed 2,596 workers, a decrease of 416 from the previous year and a reduction of 1,695 compared to the end of 2018.

Consistent Profitability and High Dividend Payouts

Looking back at the past decade, Hachiba presents a stable financial picture. Annual revenue consistently surpasses VND 600 billion, even reaching a peak of over VND 1,000 billion in 2018 and 2019, before slightly declining to nearly VND 800 billion in recent years. Profits also fluctuate cyclically, remaining stable at VND 24-27 billion during 2015-2019, dipping to VND 10-12 billion during the COVID-19 pandemic, and then recovering to around VND 20 billion since 2022, with VND 23 billion achieved in 2024, nearly matching pre-pandemic levels.

| Hachiba’s Financial Performance over the Past Decade |

|

|

Another distinctive feature of HCB is its consistent cash dividend payouts. After the first dividend distribution in 2012 at a rate of 15%, the company temporarily halted dividends before resuming them consistently since its listing on UPCoM in 2019. In recent years, the dividend ratio has ranged from 10% to 35%, with a maintained level of 20% for the past three years (2022-2024). The dividend plan for 2025 is expected to increase to 25-35%.

Active Insider Trading and Shareholder Changes

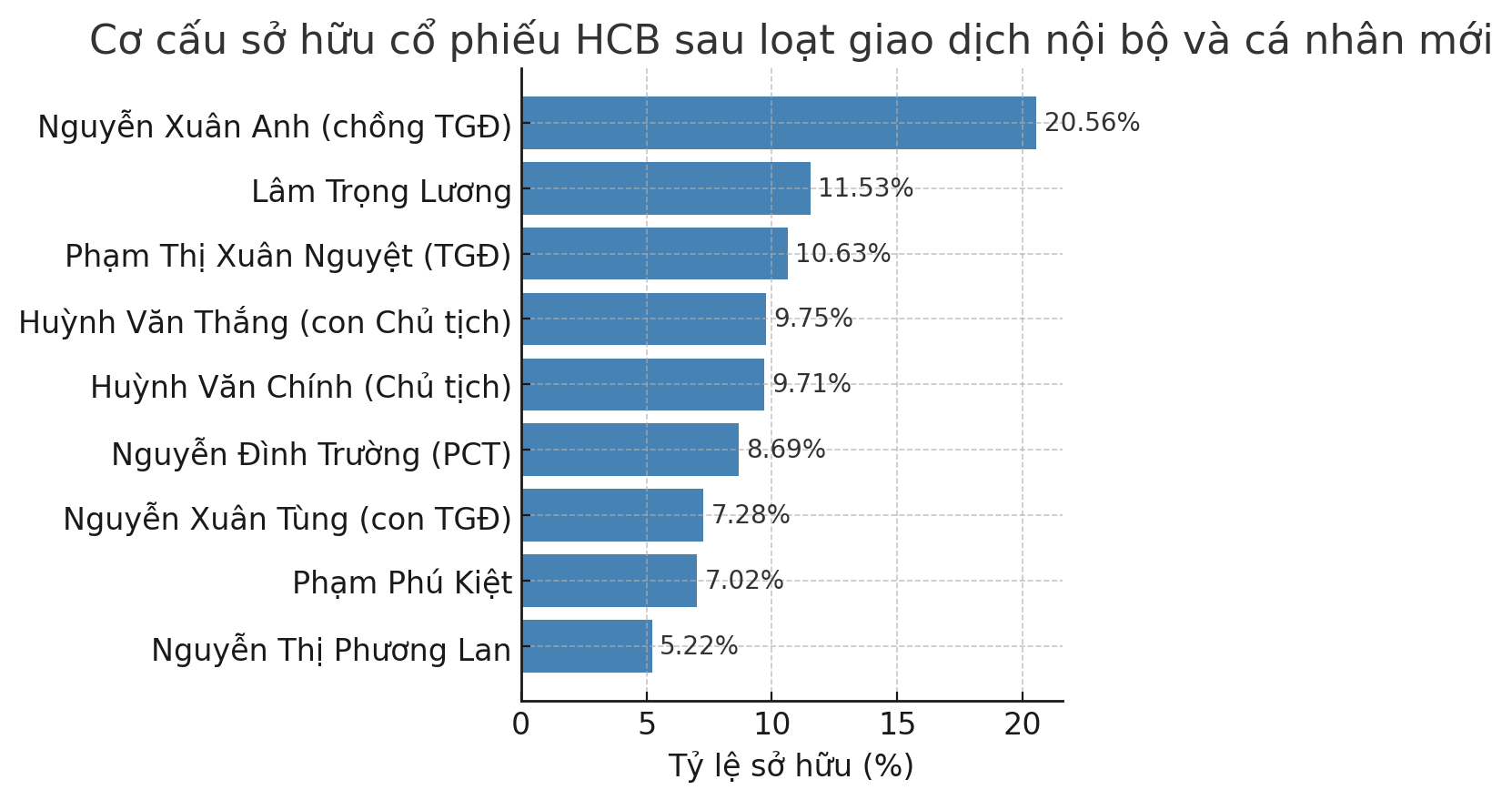

However, behind these numbers lies a different story. Since the beginning of 2025, HCB has witnessed a series of insider transactions among members of the management’s families, resulting in a concentration of shares among major shareholders. Simultaneously, a few individual shareholders have emerged, such as Ms. Nguyen Thi Phuong Lan and Mr. Pham Phu Kiet, but their holdings remain around the 5-7% threshold, and they are not affiliated with the insider group.

|

Changes in Major Shareholders at HCB following Insider Transactions (February-March 2025) – Source: Author’s Compilation

|

Currently, the nine major shareholders of HCB hold 90.27% of the voting shares. Chairman Huynh Van Chinh owns 9.71%, his son Huynh Van Thang holds 9.75%, and Board member Lam Trong Luong possesses 11.53%. The family of General Director Pham Thi Xuan Nguyet also wields significant influence, with Ms. Nguyet holding 10.63%, her husband, Mr. Nguyen Xuan Anh, owning 20.56%, and their son, Nguyen Xuan Tung, controlling 7.28%.

Notably, during the period when these transactions took place, HCB shares remained stagnant at around VND 19,500 per share and exhibited low liquidity, with some sessions recording no transactions. Meanwhile, the insider transactions were conducted through negotiated deals at an average price of approximately VND 16,600 per share, representing a 15% discount to the market price at that time.

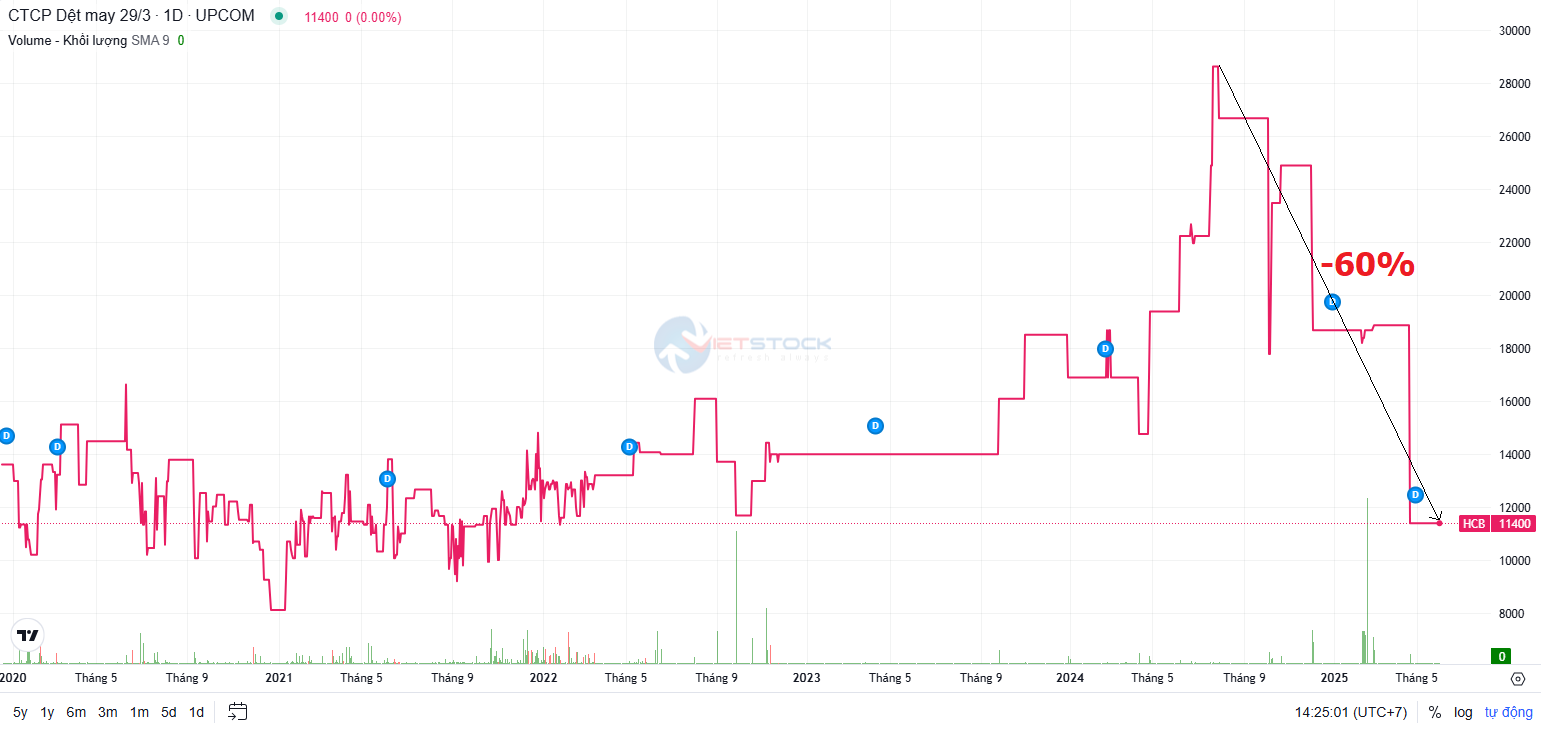

Following this period of active insider trading and improved liquidity, HCB shares once again entered a phase of “paralyzed” liquidity, with minimal trading activity. Since the end of April 2025, the share price of HCB has plummeted to a low of VND 11,400 per share, the lowest level since the end of January 2022, representing a 60% decline from its all-time high of nearly VND 29,000 per share reached in July 2024.

Price Movement of HCB Shares on the Stock Exchange – Source: VietstockFinance

|

– 15:28 03/06/2025

The SGR Chairman Seeks to Sell 9.8 Million Shares

Introducing our upcoming transaction, commencing on June 9, 2025, and concluding on July 7, 2025. This transaction will be facilitated through negotiated and matched orders on the exchange floor. Mark your calendars and prepare for an exciting opportunity!

The Ultimate Guide to the Perfect Cup of Tea: A Journey through the Historic Mỹ Trà Resort

After more than 12 years on UPCoM, My Tra Tourist will delist from the exchange at the end of June. The MTC stock price has plummeted to just VND 1,900, with no liquidity for months. The company has consistently made losses, experienced a significant decline in personnel, and halted dividend payments since 2019.