Should Tax Exemptions Be Expanded?

The Ministry of Finance has released a comprehensive summary of opinions, feedback, and explanations regarding the Draft Law on Personal Income Tax (Amended). Among the proposals is the suggestion to include Vietnamese flight attendants working for foreign airlines in the tax exemption category, similar to the policy applied to seafarers (as mentioned in the draft).

According to the feedback, Vietnamese flight attendants employed by foreign airlines have a unique work profile, often residing in aircraft cabins while working across multiple countries, much like seafarers on ships. They must adhere to international standards and spend the majority of their working hours either in foreign territories or international airspace.

In terms of recruitment, flight attendants are typically hired through licensed dispatch companies—a form of labor with foreign elements, akin to labor export in various other sectors.

Regarding income, flight attendants’ salaries are paid in foreign currencies (USD, EUR, JPY, etc.) and are largely remitted back to Vietnam for living expenses, investments, or savings. Exempting them from personal income tax would not only alleviate their financial burden but also encourage the repatriation of foreign currency, contributing to the nation’s foreign exchange reserves.

Proposal to exempt personal income tax for flight attendants working for foreign airlines. Illustrative image.

Thus, exempting seafarers from tax while not applying the same to flight attendants could lead to inconsistencies in tax policy. Both groups share similar characteristics, work for foreign companies, and contribute foreign currency to the country.

In response, the Ministry of Finance noted that Vietnamese seafarers working for foreign shipping companies often receive lower net income compared to their foreign counterparts, even with the same salary, due to Vietnam’s tax regulations. Many other countries either do not impose taxes or offer deductions, making Vietnamese seafarers less attractive to employers. To foster the development of seafarer exports and ensure fairness with international labor, exempting seafarers from personal income tax is essential.

Proposal to Exempt Taxes on Allowances for Overseas Officials

The Ministry of Industry and Trade has requested the drafting agency to clarify the treatment of living expenses, allowances (such as war allowances, dual-location allowances, and gender-specific allowances), subsidies, and other benefits for Vietnamese officials stationed abroad. These should be classified as non-taxable income, as they are not considered salary or wages.

The Ministry of Industry and Trade explained that the current personal income tax law lacks clarity regarding Vietnamese officials working overseas. The Ministry of Finance has not yet provided specific guidance. Meanwhile, living expenses, allowances, subsidies, and other support for officials and their spouses are outlined in Decree 08/2019/NĐ-CP and Decree 51/2024/NĐ-CP, designed to meet both material and spiritual needs for effective diplomatic service under unique conditions.

According to the Ministry of Industry and Trade, living expenses are monthly payments intended to cover essential costs, distinct from domestic salaries. Spouses who do not accompany officials receive 50% of the living expenses—a humane provision, not intended as income.

Additionally, tuition support for officials’ children covers only about 30% of actual costs, while many countries reimburse 50–100% of international school fees to ensure uninterrupted education.

In high-cost regions like Western Europe, North America, Northeast Asia, and Australia, the total income of officials and their families barely meets basic needs. This has led to challenges in daily life and, in some cases, family separation due to difficulties in education and living arrangements for young children.

The Ministry of Industry and Trade emphasizes that tax policy should balance general principles with the unique demands of diplomatic service. They urge the drafting agency to clarify that living expenses, allowances, and subsidies for Vietnamese officials abroad qualify as “tax-exempt income” under Article 4 of the Draft Law on Personal Income Tax.

Vietnam Television also recommends including living expenses, allowances, and subsidies for overseas officials in the tax-exempt income category.

The Ministry of Finance has acknowledged these suggestions and will consider them during the development of implementing regulations.

Gold Transaction Tax: Are Wedding Gold Purchases Subject to Taxation?

Are you wondering if gold rings, classified as jewelry, are subject to taxation? Or perhaps you’re curious whether buying or selling wedding gold falls under taxable transactions?

Revised Title:

Amended Personal Income Tax Law: Does It Lack Support Mechanisms for Freelancers?

Taxpayers have expressed concerns regarding the proposed personal income tax (PIT) regulations, highlighting a lack of support mechanisms for freelancers. The current policy on taxing financial investment income remains unclear and lacks legal framework, posing potential risks for citizens. Additionally, the taxation of cryptocurrency assets continues to raise significant uncertainties.

Personal Income Tax on Gold Transactions: Can It Curb Speculation and Narrow Price Gaps?

After a series of price hikes, with a difference of approximately $1,700 per tael since the beginning of the year, gold has emerged as an attractive investment channel, offering lucrative returns. Experts support the proposal to impose personal income tax (PIT) on gold transactions. However, the implementation of this tax should follow a gradual roadmap, distinguishing between investment and accumulation activities to prevent any shock to the public.

Revamped Personal Income Tax Law: Upcoming Amendments Unveiled

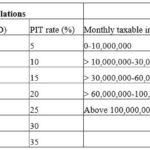

Under the newly proposed Personal Income Tax (PIT) bill by the Ministry of Finance, monthly taxable income will be subject to a progressive tax rate ranging from 5% to 35%.