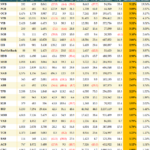

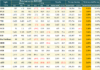

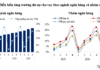

During the first eight months of 2025, Mobile World Investment Corporation (MWG) reported a net revenue of VND 99.801 trillion, marking a 13.5% increase compared to the same period last year. This achievement represents 67% of the company’s annual revenue target of VND 150 trillion for 2025.

The two flagship chains, The Gioi Di Dong (TGDD) and Dien May Xanh (DMX), collectively generated VND 67 trillion in revenue, a 14% year-over-year growth, despite a reduction of over 150 stores. According to the report, this growth is primarily driven by existing stores, which saw a 15% increase in revenue.

Additionally, in August—typically a slow sales month—the two chains still achieved nearly VND 9 trillion in revenue, marking the sixth consecutive month of positive growth. This figure is 19% higher than the same period last year and 3% higher than the previous month. Categories such as laptops and home appliances showed significant improvements compared to July 2025. Notably, starting in August 2025, TGDD, DMX, and Topzone began preparations for the iPhone launch in September, marking the first time the product will be released simultaneously with the U.S. market.

The online segment contributed VND 3.7 trillion in revenue over the first eight months, accounting for 5.5% of total revenue.

Meanwhile, Bach Hoa Xanh (BHX) contributed nearly VND 30.5 trillion in revenue, a 14% year-over-year increase, driven by growth in both fresh food and FMCG categories. Following a period of cost optimization, the chain saw a 4% monthly revenue improvement in July and August. Over the eight months, BHX opened 463 new stores, with half located in the Central region.

Other chains also performed well: An Khang maintained an average monthly revenue of VND 530 million per store, AvaKids achieved double-digit growth with an average monthly revenue of nearly VND 1.8 billion per store, and EraBlue in Indonesia saw over 70% growth, with average monthly revenues of VND 4 billion for Model M stores and VND 2 billion for Model S stores.

Earlier, during the Q2 2025 investor meeting, MWG Chairman Nguyen Duc Tai reflected on the company’s 20-year journey, highlighting strategic shifts across different phases. The initial phase (2004–2014) focused on rapid growth, followed by network expansion from 2015 to 2021. Since 2022–2023, the company has undergone significant restructuring, streamlining stores and personnel to prioritize quality. Starting in 2024, MWG aims to enter a new growth cycle centered on “quality” over “quantity.” According to Mr. Tai, The Gioi Di Dong’s growth will be driven by enhanced service quality and customer experience.

Thúy Hạnh