According to the Vietnam Association of Realtors (VARS), the supply of apartments in Hanoi plummeted from over 20,000 units in 2018 to just 10,000 in 2023. However, the market rebounded strongly in 2024, with 30,000 new units launched. The first half of 2025 saw the introduction of 10,000 apartments, and the second half promises a flurry of new projects.

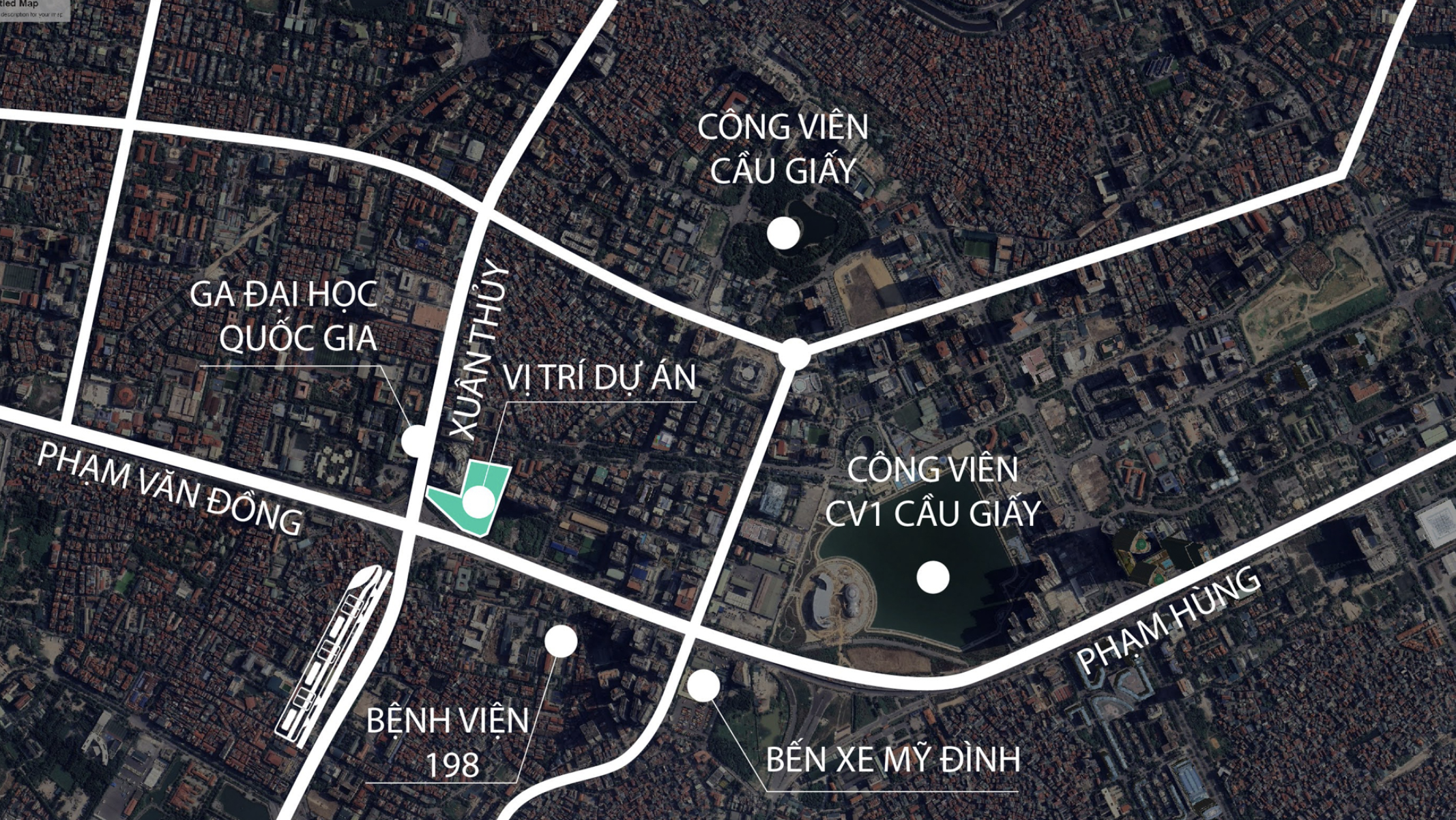

A prime example is the Sun Feliza Suites project by Sun Group, emerging as a focal point in Hanoi. Strategically located on prime land at the intersection of Pham Hung and Xuan Thuy, it comprises five towers ranging from 43 to 45 floors, offering 1,667 apartments. Its low-density design and a 1.1-hectare internal park set it apart.

Beyond its internal amenities, Sun Feliza Suites boasts excellent connectivity. Residents are a 5-minute drive from Cau Giay Park, 15 minutes from Hoan Kiem Lake, and have easy access to Noi Bai Airport and the Nhon-Hanoi metro station. Priced between 140 and 200 million VND per square meter, it ranks among Hanoi’s most luxurious offerings, solidifying Sun Group’s position in the ultra-luxury segment.

In southern Hanoi, The Queen project near Giai Phong Street stands out. With an expected price of around 100 million VND per square meter, it’s one of the area’s most premium developments. Its direct access to bus stations, railway hubs, and the Ring Road 3 makes it a highly anticipated attraction for homebuyers.

Long Bien District has long been hailed as the new real estate hub in eastern Hanoi. Its strategic location, connected to the city center via major bridges like Vinh Tuy, Chuong Duong, and Thanh Tri, coupled with the presence of Aeon Mall Long Bien, international schools, and modern hospitals, makes it a vibrant and attractive destination for both homeowners and investors.

Long Bien Central, priced at approximately 120 million VND per square meter, epitomizes luxury in this area. Its modern design, reasonable construction density, and commitment to high-end interior delivery make it a dual-purpose choice for both living and investment. Amid Hanoi’s surging new supply, Long Bien Central is poised to attract eastern customers.

Adjacent to Vinh Tuy Bridge, Northern Emerald offers just 196 apartments but adheres to luxury standards. With flexible sizes ranging from 80 to 197 square meters, it caters to diverse needs, from young families to multi-generational households. Its 5-star interior delivery ensures a lavish living experience comparable to central projects.

Northern Emerald also boasts diverse amenities, including a year-round pool, gym, sky garden, and communal spaces. Priced around 90 million VND per square meter, it offers luxury at a more accessible rate than inner-city projects, appealing to those seeking affordability without compromising on sophistication.

Also in Long Bien, Khai Son City is progressing into its next phase, priced above 70 million VND per square meter. A standout feature is the large balancing lake in front of the residential towers, offering a rare green oasis in the urban landscape.

Hanoi’s market in late 2025 is clearly polarized. Ultra-luxury projects in the center cater to the elite, while eastern developments offer more affordable options, supported by improving infrastructure, including new bridges over the Red River.

Expanding to Hung Yen, major projects like Vinhomes Ocean Park 2, Vinhomes Ocean Park 3, and Sunshine Legend City are adding thousands of units to the market in the latter half of 2025, further energizing the real estate scene.

The Privé Phase 2: The Ultimate Residential Choice for the Elite

In August 2025, The Privé set a remarkable record with all 1,027 units of its Phase 1 sold out within just 72 hours.

Unlock Your Dream Home: Young Buyers Seize Financial Incentives at The Gió Riverside

Experience unparalleled ownership with our exclusive 36-month 100% interest support policy and a 5-year principal grace period. Seamlessly acquire your dream residence in the East Wind Tower at The Gió Riverside, boasting a breathtaking 270-degree riverfront view and access to 68 premium amenities. Elevate your lifestyle today.

The Queen: A New Icon in the Heart of Hanoi’s Scarce Supply Region

In the heart of Hanoi, where prime land is increasingly scarce and luxury apartment offerings in the urban core are nearly depleted, The Queen 360 Giai Phong emerges as a beacon of opportunity. It not only addresses the growing demand for premium living spaces but also stands as a superior investment and asset accumulation prospect, poised to redefine the capital’s real estate landscape.