Illustrative image

According to preliminary data from the General Department of Customs, in August 2025, Vietnam’s fertilizer exports reached over 204 thousand tons, valued at more than 93 million USD, marking a 13.6% increase in volume and a 15.1% rise in value compared to the previous month. In the first eight months of 2025, Vietnam’s fertilizer exports totaled over 1.5 million tons, earning more than 624 million USD, reflecting a 29% growth in volume and a 30.4% increase in value compared to the same period in 2024.

The average export price stood at 415 USD/ton, a 1.1% increase compared to the same period in 2024.

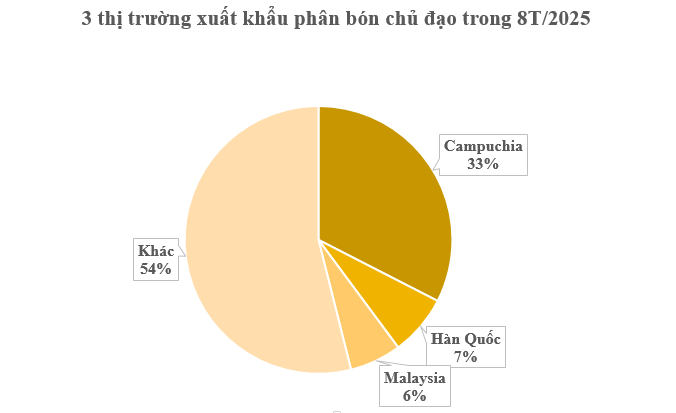

Cambodia was the largest market for Vietnam’s fertilizer exports, accounting for 32.5% in volume and 31.3% in value of the country’s total fertilizer exports. From the beginning of the year, Vietnam exported nearly 500 thousand tons to Cambodia, worth over 195 million USD, representing a 33% increase in volume and a 28% rise in value compared to the same period last year. The average price was 399 USD/ton, a 4% decrease compared to the same period.

South Korea ranked second with over 109 thousand tons, valued at more than 45 million USD, a decrease of 11% in volume and 12% in value compared to the same period in 2024. The average price was 411 USD/ton, consistent with the previous year.

Malaysia was the third-largest market for Vietnam’s fertilizer exports, with over 93 thousand tons, valued at nearly 40 million USD, marking an 11% increase in volume and a 21% rise in value. The price increased by 10% compared to the same period, reaching 420 USD/ton.

For Vietnam’s fertilizer industry, Cambodia has been the largest customer for many years. In 2024, Cambodia imported 592,121 tons of fertilizer from Vietnam, a 1.4% increase compared to 2023. The export value reached 240.82 million USD, with an average price of 406.7 USD/ton, a 3.6% decrease compared to 2023.

In the Cambodian market, fertilizers from various companies are available, including major players such as Binh Dien Fertilizer Joint Stock Company, Five-Star International Fertilizer Company, Phu My Fertilizer Company, and An Giang Plant Protection Company.

Cambodia is a key export market for Dam Ca Mau due to its continuously growing fertilizer demand. According to An Binh Securities, Cambodia’s annual urea consumption ranges from 380,000 to 410,000 tons, DAP consumption from 250,000 to 280,000 tons, and NPK consumption from 260,000 to 300,000 tons.

90% of Cambodia’s urea demand is for prilled urea, concentrated in key agricultural areas such as the Tonle Sap region and surrounding provinces. Dam Ca Mau is currently the only Vietnamese fertilizer company producing this type of urea.

Vietnam’s fertilizer production capacity is approximately 8 million tons annually, while domestic demand exceeds 11 million tons, including both inorganic and organic fertilizers. Vietnam faces an imbalance in production structure, leading to surpluses in some fertilizer types and shortages in others.

Recently, Vietnam’s urea exports have faced intense competition from urea supplies from countries like Indonesia, Malaysia, and Brunei, where producers do not incur a 5% export tax as in Vietnam.

The current 5% export tax rate has diminished business opportunities and reduced the operational efficiency of domestic producers, while also weakening the competitiveness of Vietnamese urea producers in the regional and global markets.

The Vietnam Fertilizer Association suggests that the Ministry of Finance consider proposing to the Government a 0% export tax rate for urea fertilizers to address these policy inconsistencies, thereby supporting both producers and farmers.