The latest data from the Vietnam Banks Association’s Membership Information Consolidated Report for May 2025 reveals insights into the country’s top banks.

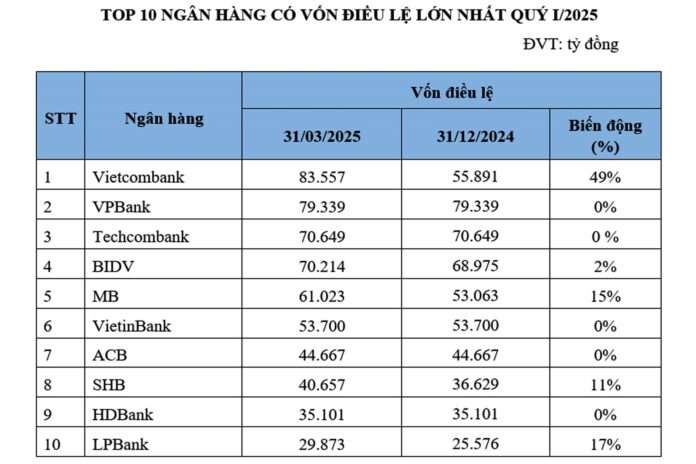

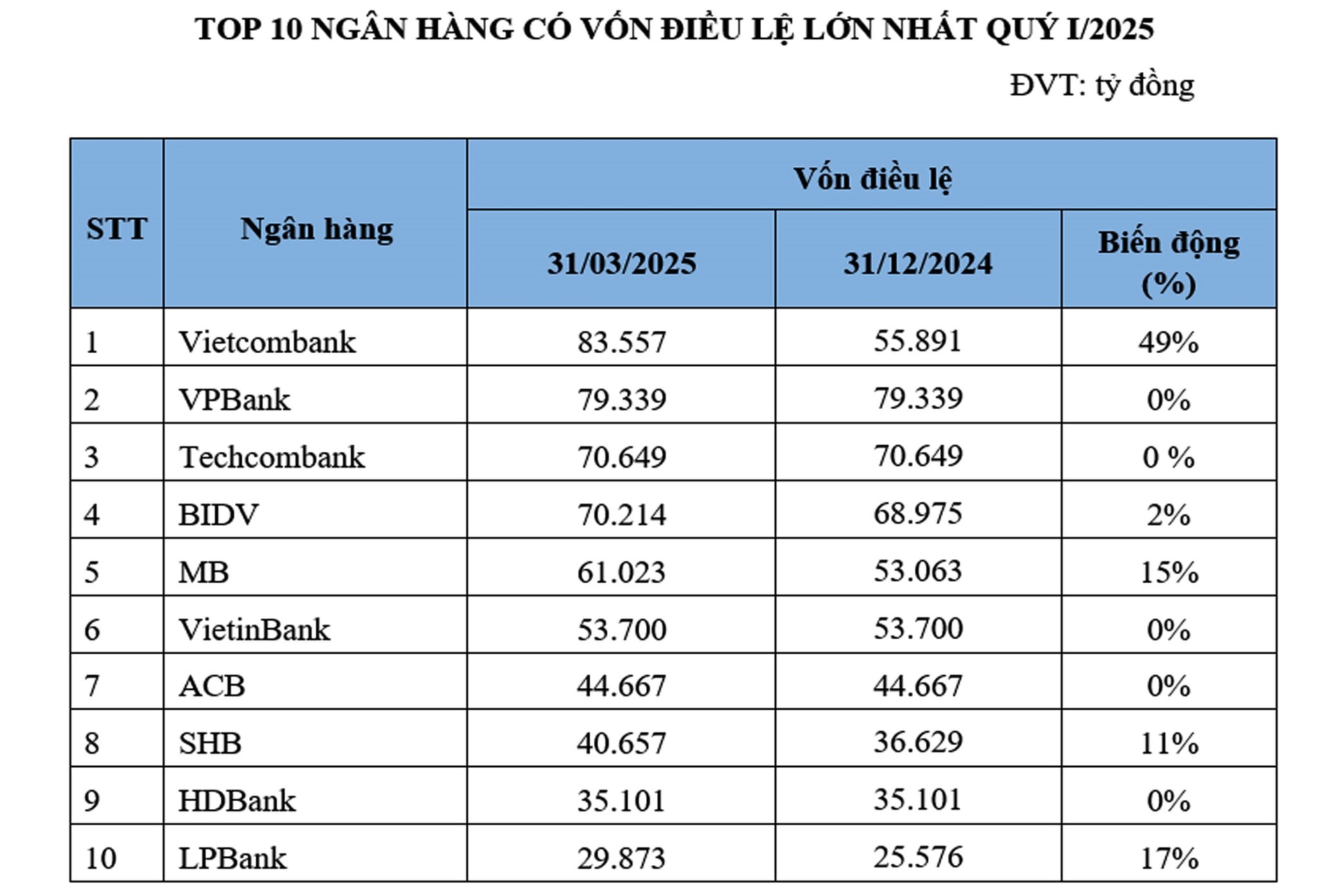

As of Q1 2024, the Top 10 banks with the largest chartered capital included Vietcombank, VPBank, Techcombank, BIDV, MB, VietinBank, ACB, SHB, HDBank, and LPBank. Here are the details:

Vietcombank topped the list with a chartered capital of VND 83,557 billion as of March 31, 2025, marking a 49% increase compared to the end of 2024. This growth resulted from a stock dividend payout to existing shareholders at a ratio of 49.5%, leading to a rise in chartered capital.

VPBank maintained its second position with VND 79,339 billion in chartered capital, unchanged from the previous year. Techcombank and BIDV followed closely, with chartered capital of VND 70,649 billion and VND 70,214 billion, respectively, the latter witnessing a 2% increase.

MB ranked fifth after issuing nearly 796 million shares as stock dividends, boosting its chartered capital to over VND 61,022 billion, a 15% jump from 2024.

The remaining spots in the Top 10 were occupied by VietinBank, ACB, SHB, HDBank, and LPBank. Both SHB and LPBank witnessed capital adjustments, with increases of 11% and 17%, respectively, reaching VND 40,657 billion and VND 29,873 billion.

Market observations indicate that beyond the Top 10, other banks are also actively pursuing capital increases in 2025. Notably, the State Bank of Vietnam recently approved NCB’s proposal to boost its chartered capital by VND 7,500 billion through a private placement to professional securities investors. This move will elevate NCB’s chartered capital from the current VND 11,780 billion to VND 19,280 billion.

Similarly, the State Bank has approved a capital increase of up to nearly VND 4,249 billion for VIB through share issuances to existing shareholders and an ESOP program. Upon completion, VIB’s chartered capital will rise from over VND 29,791 billion to over VND 34,040 billion, representing a 14.26% increase.

Riding the wave of capital increases in the banking sector, OCB’s Board of Directors announced a resolution on May 21, 2025, to implement a plan to boost its chartered capital in 2025 by issuing shares from owner equity. Specifically, OCB intends to issue nearly 197.3 million shares to increase its capital. This move will result in a VND 1,973 billion addition to its current chartered capital of VND 24,658 billion, bringing it to over VND 26,630 billion.

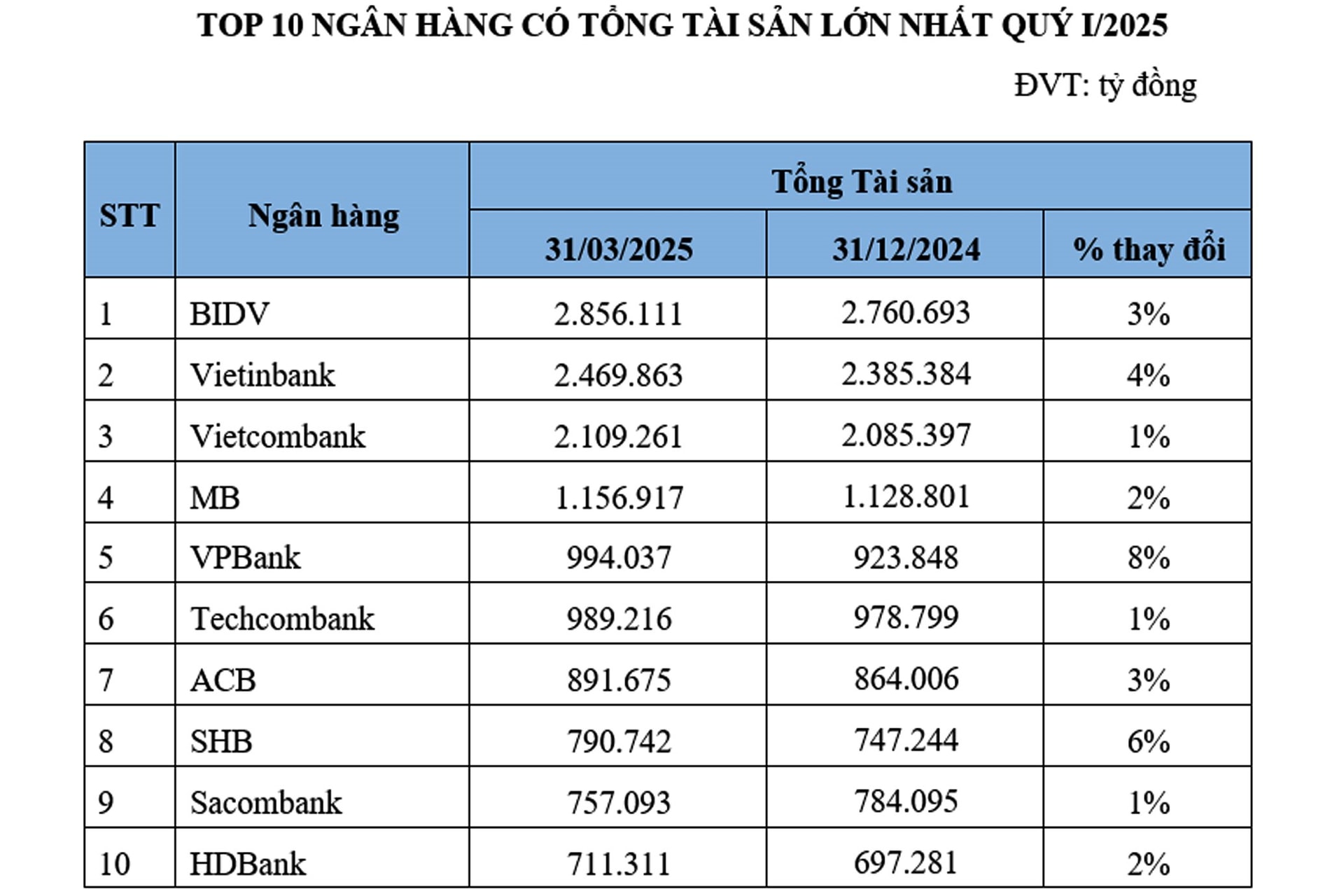

The Top 10 banks with the largest total assets as of Q1 2025 included BIDV, VietinBank, Vietcombank, MB, VPBank, Techcombank, ACB, SHB, Sacombank, and HDBank. Here are the specifics:

BIDV maintained its leading position with total assets of VND 2,856,111 billion as of Q1 2025, reflecting a 3% increase compared to the end of 2024.

VietinBank ranked second with total assets of VND 2,498,630 billion, up by 4%, while Vietcombank took the third spot with VND 2,109,261 billion, a 1% increase from the previous year.

MB came in fourth with total assets of VND 1,156,917 billion, a 2% rise from 2024.

VPBank stood out with an impressive 8% growth in total assets compared to the previous year, reaching VND 994,037 billion as of Q1 2024. This performance propelled it to fifth place among the Top 10 banks with the largest total assets as of Q1 2025, surpassing Techcombank.

Techcombank ranked sixth with total assets of VND 989,216 billion, a 1% increase from the end of 2024.

The remaining positions were held by ACB (VND 891,675 billion, up by 3%), SHB (VND 790,742 billion, up by 6%), Sacombank (VND 757,093 billion, up by 1%), and HDBank (VND 711,311 billion, up by 2%).

What Are the Best High-Yield Savings Accounts of 2025?

The once-plummeting deposit interest rates have now stabilized. As of the beginning of this month, only Bac A Bank, HDBank, and Vikki Bank offer interest rates above 6% per year, mainly for deposits of over 13 months and large amounts.

Upcoming emergence of a joint stock bank with trillion-dong assets after the Big 4 group

If it maintains the growth rate like last year, by early 2024, this will be the first joint stock bank after the Big 4 group to record a total asset scale of over 1 quadrillion VND.