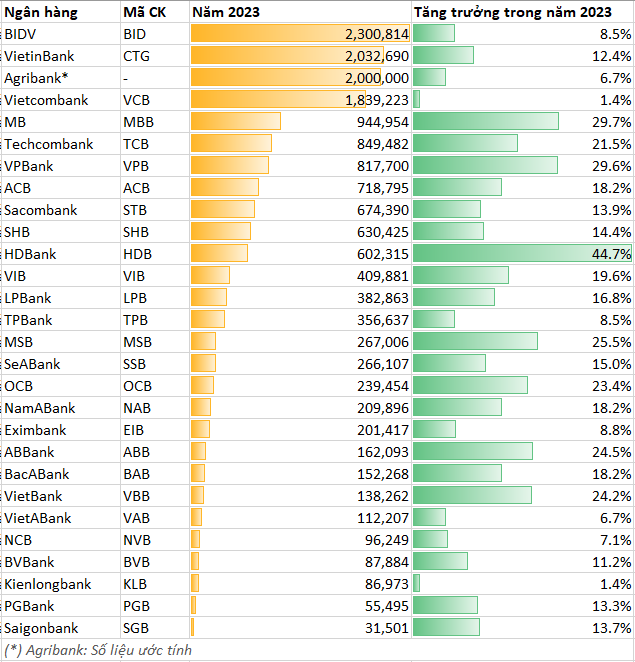

According to new figures released by the State Bank of Vietnam, the total assets of the credit institutions system reached over VND 20,073 trillion by the end of 2023, an increase of 9.83% compared to the end of 2022.

Statistics from the financial reports and business results announcement of 28 banks showed that total assets amounted to over VND 16.6 quadrillion. Of which, 3 banks with total assets above VND 2 quadrillion are BIDV (over VND 2.3 quadrillion), VietinBank (over VND 2 quadrillion) and Agribank (over VND 2 quadrillion). Vietcombank is the fourth largest bank in the system with total assets of over VND 1.8 quadrillion, only increasing by 1.4% compared to the end of 2022.

Thus, the total assets of the Big 4 group account for 50% of the total scale of the credit institutions system in Vietnam.

The next banks entering the Top 10 in terms of total assets are MB (over VND 944 trillion), Techcombank (over VND 849 trillion), VPBank (over VND 817 trillion), ACB (over VND 718 trillion), Sacombank (VND 674 trillion), and SHB (over VND 630 trillion).

HDBank closely followed SHB’s position in the Top 10 with total assets reaching over VND 602 trillion by the end of 2023. This bank recorded the highest growth rate in the system in the past year, reaching a growth rate of 44.7%.

In the Top 10, MB, Techcombank, VPBank all recorded high growth rates in 2023, reaching over 20%, even up to nearly 30% for MB and VPBank. These banks have almost utilized all the credit growth “room” assigned by SBV for 2023, with the majority of the growth in credit for the corporate sector.

If they maintain the growth rate as in the past year, in early 2024, MB will soon become the first joint stock bank after the Big 4 group to exceed VND 1 quadrillion in total assets.

In the past 10 years, with the ability to expand credit scale, Techcombank and VPBank have gradually replaced ACB and Sacombank to become the largest private banks in terms of total assets. From 2013 to now, the total assets of Techcombank have increased 5.3 times, and VPBank has increased 6.7 times. Meanwhile, ACB and Sacombank have only increased more than 4 times.

Ranking of banks’ total assets. Unit: trillion VND