The stock market’s recovery has propelled shares of ThuDuc House Development Joint Stock Company (ThuDuc House, stock code: TDH) to a significant surge. TDH’s stock price hit its ceiling, with no sellers in sight, reaching 5,120 VND per share—its highest level in over a month. Trading volume was robust, with over 770,000 shares matched.

This bullish momentum in TDH’s stock price follows the company’s recent legal victory.

On September 23, 2025, the Supreme People’s Court in Ho Chi Minh City heard the administrative appeal case between ThuDuc House Development JSC and Tax Department Zone II (formerly the Ho Chi Minh City Tax Department).

The appellate panel rejected the appeal filed by Tax Department Zone II and its Director, upholding the original judgment No. 133/2025/HCST dated April 24, 2025.

The court annulled the tax authority’s administrative decisions regarding the 365 billion VND VAT refund and 74.7 billion VND in late payment interest (as of December 25, 2020). Additionally, all derivative decisions stemming from these administrative actions, including the suspension of invoice usage and customs clearance for imports/exports, were also nullified.

The case originated from the 2017-2020 period when former TDH executives colluded with external parties to fraudulently claim VAT refunds, embezzling 365.5 billion VND from the state. In the criminal case, the court ordered TDH to repay this amount to the Tax Department while also holding 18 defendants jointly liable to compensate TDH over 340 billion VND.

ThuDuc House argued that the late payment penalty on the 365 billion VND resulted from criminal actions by the defendants and thus should not be the company’s responsibility.

Consequently, on May 27, 2024, ThuDuc House filed an administrative lawsuit with the Ho Chi Minh City People’s Court, seeking to annul all administrative decisions by the Ho Chi Minh City Tax Department related to the late payment penalty and enforcement measures against the company.

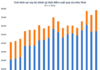

In Q2/2025, ThuDuc House reported an after-tax profit of 13.2 billion VND, a significant improvement from the 26 billion VND loss in the same period last year. This marks the second consecutive profitable quarter following the company’s comprehensive restructuring. In Q1/2025, ThuDuc House recorded an after-tax profit of 5.7 billion VND.

For the first six months of 2025, ThuDuc House achieved consolidated revenue of nearly 26 billion VND and after-tax profit of 19 billion VND.

For 2025, TDH targets consolidated revenue of over 235 billion VND (2.7 times higher than the previous year) and net profit of over 66 billion VND. Meeting this target would prevent the company from facing mandatory delisting due to consecutive losses in 2023-2024.

Unraveling the ‘Outperformance’ Secret of Vietnam’s Oldest Open-Ended Fund

DCDS, one of Vietnam’s oldest open-ended funds, is making waves with its exceptional performance, outpacing the VN-Index benchmark.