Vietnam’s stock market witnessed a remarkable upswing in 2025, with the VN-Index consistently reaching new highs, nearing the 1,700-point milestone. Trading volumes repeatedly set records, with multiple sessions hitting 70 to 80 trillion VND. In sync with the market’s pulse, most securities firms painted a bright picture in their first-half 2025 performance. For the latter half of the year, several have unveiled even more ambitious plans.

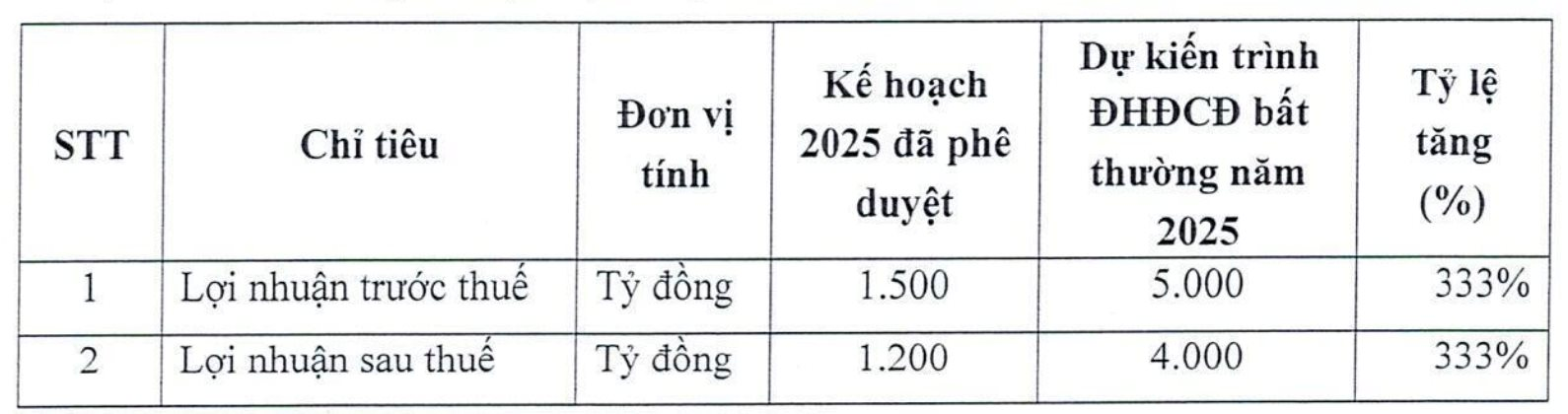

VIX Securities recently announced a Board Resolution to present an extraordinary General Meeting of Shareholders (GMS) in 2025, proposing an upward revision of its 2025 profit targets.

Specifically, VIX aims to increase its pre-tax profit target for 2025 by 333%, from 1.5 trillion VND to 5 trillion VND. Similarly, its post-tax profit target is projected to rise by 333%, from 1.2 trillion VND to 4 trillion VND.

VIX will finalize its shareholder list for the meeting on October 9, 2025. The meeting’s specifics—time, venue, and agenda—will be communicated to shareholders via formal invitations.

This move follows a robust first half for VIX. In the first six months of 2025, the firm reported 2,956 billion VND in operating revenue and 2,068 billion VND in pre-tax profit, marking a sixfold and fourfold increase, respectively, compared to the same period in 2024. These figures represent VIX’s highest-ever semi-annual results and rank second in the entire securities industry.

If VIX achieves its new targets, it could add nearly 3 trillion VND in pre-tax profit in the second half of the year.

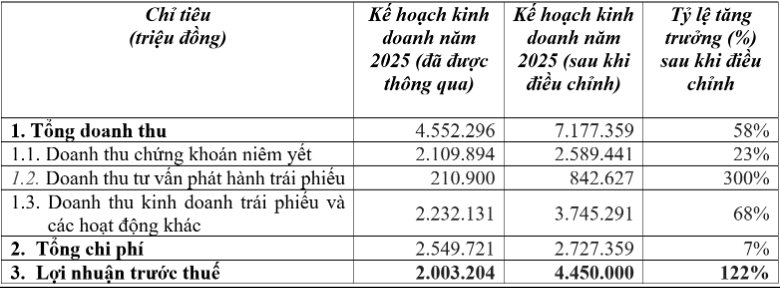

VIX isn’t the only securities firm eyeing higher targets for 2025. Earlier in September, VPBank Securities (VPBankS) raised its total revenue goal by 58%, from 4,552 billion VND to 7,117 billion VND. This includes a 23% increase in listed securities revenue to 2,589 billion VND, a fourfold surge in bond issuance advisory revenue to nearly 843 billion VND, and a 68% rise in revenue from bond trading and other activities to 3,745 billion VND.

Its pre-tax profit target for 2025 jumped 122%, from 2,003 billion VND to 4,450 billion VND—approximately four times the 2024 results.

Despite being a relatively new player in the securities sector, VPBankS has demonstrated robust growth in just three years. In the first half of 2025, it reported a record pre-tax profit of nearly 900 billion VND, an 80% year-on-year increase, securing a spot in the industry’s top five. This implies VPBankS could generate over 3,500 billion VND in pre-tax profit in the second half.

Beyond their strong first-half performances, both VIX and VPBankS have ventured into the digital asset arena. VIX Securities invested 150 billion VND to establish VIX Crypto Asset Exchange Co., Ltd. (VIXEX). According to the business registration certificate issued by Hanoi’s Business Registration Office on August 26, VIXEX boasts a charter capital of 1 trillion VND and is headquartered in Hanoi’s Hai Ba Trung District.

VIXEX’s founding shareholders include three entities: VIX Securities (15 million shares, 15% stake), FTG Vietnam JSC (64.5 million shares, 64.5% stake), and 3C Computing-Communication-Control JSC (20.5 million shares, 20.5% stake).

On September 19, Vietnam Prosperity Crypto Asset Exchange JSC (CAEX) was established with an initial charter capital of 25 billion VND. The company is located on the 4th floor of 5 Dien Bien Phu, Ba Dinh District, Hanoi.

CAEX specializes in crypto asset-related services. VPBankS holds an 11% stake (2.75 billion VND), while LynkiD JSC and Future Land Investment LLC hold 50% and 39% stakes, respectively. Previously, VPBank announced it was finalizing procedures to pilot a crypto asset exchange.

September 24th Session: Foreign Investors Continue Net Selling Spree, Offloading Nearly VND 1.6 Trillion – Which Stocks Took the Biggest Hit?

In the afternoon session, CII emerged as the most heavily net-bought stock across the entire market, with a remarkable value of 121 billion VND.

Streamline Account Opening for Foreign Investors

The State Bank of Vietnam has issued a directive to commercial banks, mandating compliance with regulations regarding the opening of accounts for foreign investors engaging in indirect investment activities within Vietnam.