On September 24th, the stock market witnessed a remarkable surge in HDBank (HDB) shares. After a sideways movement in the morning session, the stock price unexpectedly skyrocketed in the afternoon, peaking at a 6% increase and surpassing the 30,000 VND per share mark.

By the close of trading, HDB hit the upper limit with a 7% gain, ending at 30,700 VND per share. Trading volume surged to nearly 23 million shares, with a total value of approximately 700 billion VND.

HDB’s impressive performance was fueled by a series of positive developments. Notably, the bank reported stellar financial results for the first half of 2025, with net interest income reaching 17,227 billion VND, a 15.8% increase year-over-year. Non-interest income from payment services, digital banking, and foreign exchange surged by over 210%, driving total operating income up 30% to 20,840 billion VND.

With these results, HDBank maintained its industry-leading operational efficiency, boasting a return on equity (ROE) of 26.5%. As of June 30, 2025, HDBank’s total assets exceeded 784 trillion VND, up 12.4% since the beginning of the year. Deposits grew by 7% to 664 trillion VND, while outstanding loans surpassed 517 trillion VND, a 18.2% increase and nearly double the industry average growth rate of 9.9%.

Recently, billionaire Nguyen Thi Phuong Thao, Vice Chairwoman of HDBank’s Board of Directors, visited the New York Stock Exchange (NYSE), the world’s largest and oldest financial hub. During her visit, Mrs. Thao met with Lynn Martin, the second female Chairman in NYSE’s 300-year history.

In their discussion, Mrs. Thao highlighted the growth of Vietnam’s capital market over the past 30 years, citing leading companies like Vietjet (VJC) and HDBank (HDB) listed on the Ho Chi Minh Stock Exchange (HOSE). She expressed her ambition to bring Vietnamese enterprises to global platforms like NYSE, expanding international capital raising channels and solidifying Vietnam’s position on the global financial map.

A highlight of her NYSE visit was participating in the closing bell ceremony at 4:00 PM. The U.S. stock market closed with a 48-point gain, marking a memorable day.

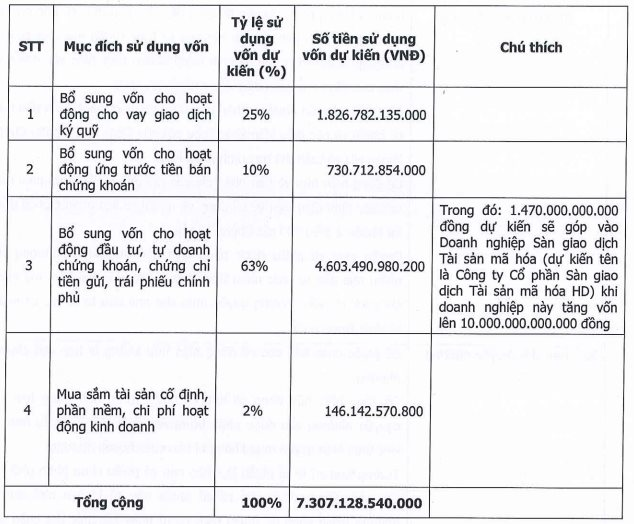

Meanwhile, HD Securities (HDS), in which HDBank holds a 30% stake, has sought shareholder approval for a rights issue to increase its charter capital. The company plans to issue 365 million shares at 20,000 VND each, raising its charter capital from 1,460 billion VND to over 5,100 billion VND. Shareholders will be offered 5 new shares for every 2 held, with total proceeds expected to exceed 7,300 billion VND.

Notably, HD Securities intends to invest 1,470 billion VND in a cryptocurrency asset trading platform, as the platform increases its charter capital to 10,000 billion VND. This move marks another securities firm’s entry into the cryptocurrency asset trading space.

Projected 20%+ Annual Profit Growth Over Next 5 Years

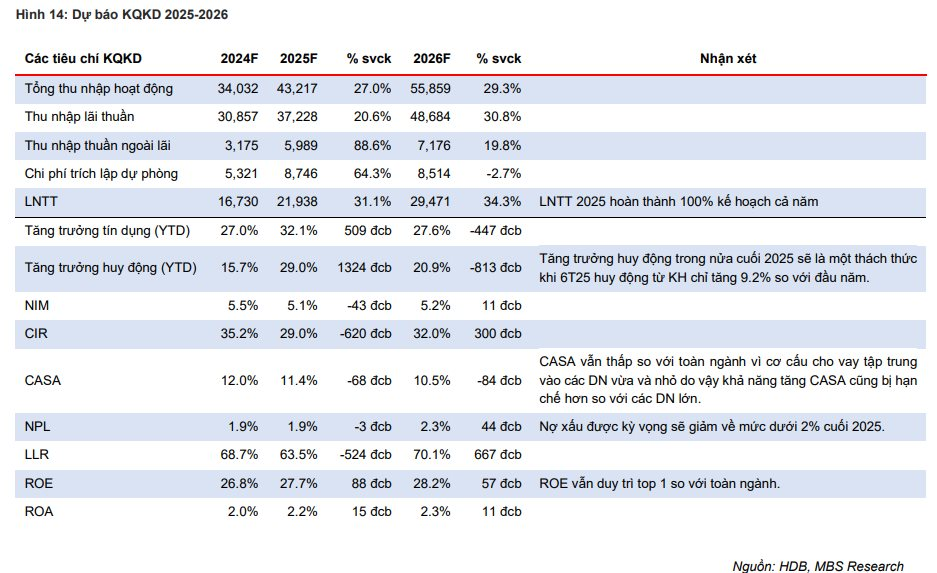

In its latest report, MBS Securities highlights HDBank’s focus on lending to small and medium-sized enterprises and urban/rural retail customers, which has secured a significant market share. Tailored products for these segments have been a key driver of growth.

Strong credit demand in the second half of the year, particularly post-tariff announcements, is expected to boost lending. Low mortgage interest rates will continue to drive housing loans, with MBS projecting HDBank to achieve its 32% credit growth target for 2025.

MBS forecasts HDBank’s 2025 after-tax profit at 17,420 billion VND, exceeding the annual target by 103.6%. Over the next five years, profit growth is expected to remain above 20% annually, driven by a net interest margin (NIM) above 5% and credit growth exceeding 25%.

Unraveling the Surge: Decoding Vingroup’s Stock Market Heatwave

VIC shares are taking center stage in the stock market, having reached new highs four times in just two weeks, peaking at 153,200 VND per share. Following unfounded rumors about its financial health, the Group’s decisive legal action on September 8, 2025, not only restored confidence but also delivered a significant boost to the stock price.

MBS Forecasts 20%+ Annual Profit Growth for a Bank Over the Next 5 Years

MBS has recently released an updated report on HDBank (HDB), offering a highly positive outlook on the bank’s business prospects.

Vietstock Daily 24/09/2025: Liquidity Hits Record Low

The VN-Index formed a Doji candlestick pattern, accompanied by a sharp decline in trading volume below the 20-session average, indicating persistent market caution. With both the Stochastic Oscillator and MACD continuing to weaken following sell signals, the August 2025 low (around 1,600-1,630 points) is expected to serve as short-term support for the index.

Stock Market Plunges Over 40 Points Before Rebounding: Investors Face Losses Amid Sudden Sell-Off

Technically speaking, experts note that key indicators have collectively breached the support zone of the 20-day moving average, signaling a clear short-term correction.