For years, Vietnam’s Mergers and Acquisitions (M&A) market was dominated by foreign giants acquiring promising local brands.

Household names like Unicharm (Japan) acquiring Diana, ThaiBev taking over Sabeco, and Mondelēz International acquiring Kinh Đô fueled concerns about Vietnamese businesses becoming “prey” in their own backyard.

However, a tide is turning. In recent years, Vietnamese enterprises, armed with newfound strength and vision, are proactively venturing abroad. They’re acquiring international brands to expand their ecosystems and amplify their global influence.

This trend signifies the maturation of Vietnam’s private sector. It demonstrates their ability not only to defend but also to actively “attack” on the global stage.

VTI Group, founded by David Thai, recently welcomed Paris Baguette, a renowned South Korean bakery brand owned by SPC Group, into its portfolio. This acquisition strengthens VTI Group’s market presence across diverse segments.

Vietnam’s M&A landscape has witnessed several notable deals by domestic companies.

Dalat Hasfarm’s parent company invested over $200 million to acquire Lynch Group (Australia), a strategic move positioning Vietnamese flowers within the global premium retail chain.

In the tech sector, FPT Software actively pursues acquisitions in Japan, the US, and Europe to rapidly acquire core technologies and top-tier talent.

In 2023, FPT acquired 80% of AOSIS, a French technology consulting firm, transforming it into a strategic arm to enhance FPT’s solution delivery and digital transformation capabilities for European and global clients.

Prior to AOSIS, FPT invested in Landing AI, a US-based computer vision and AI software company (October 2023), acquired Cardinal Peak, a North American technology services company (December 2023), and recently purchased a 10% stake in Daythree Digital Berhad (Daythree), a leading Malaysian business process outsourcing and systems management provider.

Masan Group has also made bold moves, acquiring H.C. Starck’s tungsten business (Germany), establishing a presence in Europe, North America, and China.

Vinamilk’s acquisition of Driftwood (USA) opens doors for increased dairy product exports to the US market.

Even Trung Nguyen Legend, though yet to finalize any deals, has repeatedly expressed ambitions to acquire coffee brands in the US and Europe.

Vietnamese businesses are not only making international acquisitions but also actively taking over key operations of foreign corporations within Vietnam.

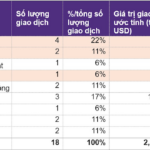

Notable examples include Saigon Co.op’s acquisition of Auchan’s 18 supermarkets (France) in Vietnam (2019), VinFast’s takeover of General Motors’ factory and dealership network (USA) (2018), THACO’s acquisition of E-Mart (South Korea) and its ongoing expansion (2021), Bamboo Capital (BCG)’s purchase of AAA Insurance from IAG (Australia) (2021), TH Milk’s acquisition of Tate & Lyle’s sugar factory (UK) in Nghe An, and Thanh Cong Textile’s acquisition of SY Vina dyeing factory (Dong Nai).

Coteccons Construction JSC acquired 100% of two foreign-invested companies: Sinh Nam Metal Vietnam Co., Ltd. and UG M&E Vietnam Co., Ltd.

This reverse M&A trend is fueled by several factors.

Firstly, Vietnamese businesses have strengthened their financial capabilities through years of accumulation, listings, and diversified funding channels.

Secondly, intensifying domestic competition necessitates expansion into new markets to sustain growth.

Most importantly, a new generation of Vietnamese entrepreneurs harbors global aspirations. They aim not only to export products but also to own foreign brands and technologies, accelerating their global reach.

However, conquering international markets is no easy feat. The post-M&A phase presents complex challenges, demanding exceptional management expertise and experience.

Why Haven’t Coteccons Shares Surged Yet? Chairman of the Board Responds to Shareholder Inquiry

In response to shareholder concerns about Coteccons’ stock not experiencing a sudden surge, Chairman Bolat Duisenov emphasized that the company’s primary focus is on delivering consistent business performance to ensure long-term stock growth, rather than pursuing short-term market fluctuations.

Young Entrepreneurs Host Event to Support Fledgling Vietnamese Startups in the UK

The GVB Festival 2025, a landmark event for the Vietnamese startup community in the UK, was a resounding success. With a focus on innovation and global connectivity, the festival, organized by Hamy Academy and HUB Network UK, provided a dynamic and specialized platform for young Vietnamese entrepreneurs to connect and thrive.

Savills: Dalat’s Potential as a Haven for the Ultra-Wealthy

“With its breathtaking natural heritage and ever-improving transport links, Dalat stands at the precipice of explosive growth. The city has the potential to become a haven for the ultra-wealthy, akin to renowned mountain resorts such as Aspen in the United States or Davos in Switzerland.”