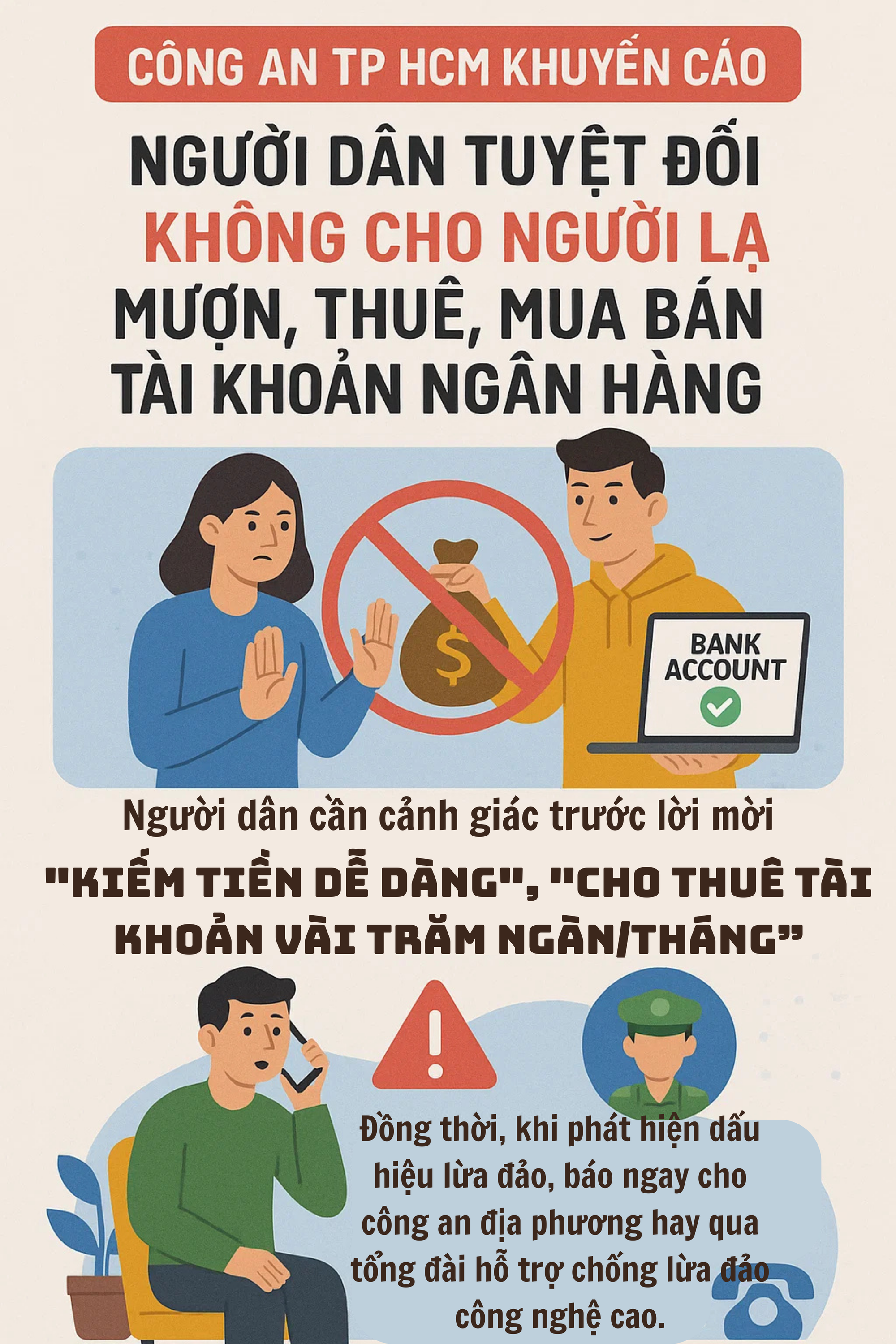

The Ho Chi Minh City Police Department has issued an urgent warning to the public about a fraudulent scheme disguised as renting, lending, or buying bank accounts. This activity carries significant legal risks, potentially turning participants into accomplices in fraud or money laundering cases.

According to the police, numerous individuals are advertising for people to rent, lend, or sell their bank accounts, promising “easy extra income” or “a few hundred thousand dong per month.” In reality, these accounts are often used for money laundering or fraudulent activities, leaving account holders facing severe legal consequences.

Those involved in renting, lending, or selling bank accounts may face:

Administrative penalties: Individuals engaging in these activities will be fined between 10 to 50 million dong, and the associated accounts will be closed or frozen.

Criminal prosecution: Such actions may lead to charges of “Fraudulent Appropriation of Property” or “Money Laundering,” with sentences ranging from 6 months to 20 years in prison, or even life imprisonment, depending on the severity of the offense.

The Ho Chi Minh City Police emphasize:

“Renting out a bank account is tantamount to aiding criminals, and you could become an accomplice.”

The public is advised: Never rent, lend, or sell bank accounts to strangers. Be wary of offers promising “easy money.” If you suspect fraudulent activity, report it immediately to local police or contact the anti-fraud hotline for guidance.

Unveiling the Trial of Accomplices Behind 27 Shell Companies in Mr. Pips Phó Đức Nam’s Fraud Scheme

Misappropriated funds, under the direction of Mr. Pips, were strategically cycled to create an illusion of liquidity, subsequently extracted through various methods including cash withdrawals, gold purchases, and conversion into USDT.

Domestic Money Transfers of 500 Million VND or More Require Reporting

The State Bank of Vietnam (SBV) has recently issued Circular 27/2025/TT-NHNN, providing guidance on the implementation of key provisions within the Anti-Money Laundering Law. This regulatory update introduces several new measures designed to enhance the effectiveness of monitoring and preventing money laundering and terrorist financing activities within the financial sector.

“Trials Begin for the Group Involved in the Phó Đức Nam and Lê Khắc Ngọ-Linked Scam”

“Bui Trung Duc, the mastermind behind a sophisticated and large-scale international stock investment fraud scheme, orchestrated a complex web of deception that ensnared 12 victims and resulted in a staggering loss of over 11 billion VND. This insidious operation had connections to two notorious figures in the underground world: Mr. Pips, aka Pho Duc Nam, and Mr. Hunter, whose real name is Le Khac Ngo. The impact of Duc’s deceitful actions has left a trail of financial ruin and shattered lives in its wake.”

The Scourge of ‘Phantom Bank Account’ Scams

“Phantom bank accounts” continue to haunt the financial system, with some bank employees colluding in fraud, money laundering, and illegal money transfers. This illicit activity severely damages the country’s financial infrastructure and its citizens.

“Da Nang Expands Money Laundering Investigation: Uncovering the Role of Bank Employees in the 30,000 Billion VND Scheme”

In the latest development of the money laundering and counterfeit document scheme, the Da Nang Police have made significant progress by initiating legal proceedings against 20 suspects, including three bank employees, as part of Phase 2 of the operation. The accused bank staff are alleged to have colluded with fake businesses to open accounts, facilitating a massive VND 30,000 billion fraud and money laundering operation.