According to data from the motorcycle specialist website Motorcycles Data, Vietnam’s two-wheeled vehicle market experienced robust growth in 2025. Sales consistently maintained a positive trend, with a remarkable 17.4% increase in August alone. Cumulatively, over the first eight months, motorcycle sales in Vietnam reached 2.08 million units, marking a 15.2% rise compared to the same period in 2024.

Motorcycles Data highlights that the demand for motorcycles in Vietnam has surged across all segments. Specifically, scooter sales grew by 14.8%, while manual transmission motorcycles saw a significant 65.6% increase. Notably, the electric motorcycle sector experienced a breakthrough, with the L1 category (equivalent to under 50cc bikes) soaring by 89%.

Compact electric motorcycles designed for students are among the fastest-growing segments in Vietnam.

Alongside the L1 segment, electric motorcycles in the L3 category (equivalent to over 50cc bikes) also achieved a 197% growth. These figures underscore the increasing popularity and acceptance of electric motorcycles in the Vietnamese market.

Motorcycles Data attributes this explosive growth to strong consumer demand and the shift towards low-emission vehicles. The website previously reported that Vietnam ranks as the third-largest consumer of electric motorcycles globally, with sales surging by over 99% in the first half of 2025.

The domestic electric motorcycle market gained further momentum after major cities like Hanoi and Ho Chi Minh City announced plans to restrict and eventually ban fossil fuel-powered motorcycles. Additionally, manufacturer incentives and promotions have played a pivotal role in encouraging consumers to transition from gasoline-powered bikes to electric alternatives.

Among electric motorcycle brands in Vietnam, VinFast leads the way in implementing demand-stimulating policies and supporting users in switching to electric vehicles. Recently, the company has launched several new models, including those equipped with dual batteries, and has expanded its battery-swapping stations to cater to diverse consumer needs.

VinFast Feliz model with dual battery configuration.

Chinese brand Yadea supports customers transitioning from gasoline to electric motorcycles through trade-in programs and direct discounts, particularly for student-oriented models during the back-to-school season.

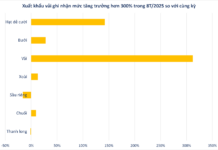

These efforts from manufacturers and dealers have fueled the rapid growth of electric motorcycle sales in Vietnam. According to Motorcycles Data, as of August 2025, VinFast’s motorcycle sales surged by 447%, solidifying its leadership in the fast-growing electric motorcycle segment.

Following VinFast, Yadea achieved a 41.5% growth, while Dibao and Pega also reported positive sales results. These figures highlight the vibrant development of Vietnam’s electric motorcycle market.

Conversely, established motorcycle brands like Honda and Yamaha, traditionally strong in internal combustion engine bikes, are showing signs of slowing down. Data from Motorcycles Data reveals that Honda’s sales in Vietnam grew by 6.3%, while Yamaha’s declined by 8.6%.

Among members of the Vietnam Association of Motorcycle Manufacturers (VAMM), only Honda discloses detailed monthly sales figures. In its latest August 2025 report, the company announced sales of 154,599 motorcycles across all categories.

This figure represents a 21.66% drop compared to July and a 13.4% decrease year-over-year, reflecting the rapid shift in consumer preferences following announcements about restrictions on gasoline-powered motorcycles.

Currently, Honda Vietnam offers two electric motorcycle models: the Icon e: and the CUV e:. The Icon e: targets students and young consumers, while the CUV e: is positioned as a premium option, available exclusively through a rental program at approximately 1.5 million VND per month, including free battery swaps at authorized dealerships.

Honda plans to expand its electric motorcycle lineup in Vietnam starting from the 2026 fiscal year, aiming to sustain sales growth in the domestic market.

Vingroup Invests $900 Million in Electric Vehicle Component Manufacturing Plant

Vietnamese authorities have approved Vingroup’s $810 million (21.4 trillion VND) investment plan to develop an industrial complex dedicated to manufacturing materials, components, and parts for electric vehicles.