High-Profile Deals Shake Up the Market

Malaysian real estate firm SkyWorld, through its subsidiary SkyWorld Vietnam, has signed a Memorandum of Understanding (MoU) with Vina An Thuan Phat Co., Ltd. and its representative Le Van Phong. The deal involves SkyWorld acquiring 100% of the Vietnamese company’s equity and associated benefits. The project, spanning 9,443 sqm in Lai Thieu Ward, Ho Chi Minh City, is set to feature a 40-story residential complex with 1,241 units and three basement levels. SkyWorld highlights the project’s alignment with its development strategy and its readiness for launch, as the 1/500 scale plan has already been approved.

SkyWorld acquires two projects in Vietnam.

Previously, the project was listed at VND 900 billion, attracting interest from major players like Ha Do Group, Phu Dong Group, MIK Group, and Khai Hoan Land. However, the price deterred potential buyers.

Earlier, SkyWorld acquired 100% of Thuan Thanh Real Estate Trading and Production JSC’s shares for VND 350 billion. Thuan Thanh holds exclusive rights to a 2,060 sqm plot in Ward 16, District 8, Ho Chi Minh City, currently mortgaged with LienvietPostBank’s HCMC branch. Thuan Thanh is also bidding for two adjacent land plots totaling 4,630 sqm, with plans for a 24-story residential project on a combined 5,206 sqm area.

Amata Vietnam Public Company has approved its subsidiary, Amata Long Thanh Urban Development JSC, to transfer the remaining 51% stake in Amata Long Thanh 1 and Amata Long Thanh 2 service urban companies. The buyer is a consortium of Nova Rivergate (Novaland Group) and Nha Rong Investment and Trading JSC, with the deal valued at USD 46.14 million (VND 1.176 trillion).

Amata Long Thanh 1 Urban Service Area project to be acquired by Novaland.

Previously, Amata Vietnam sold 49% of these companies’ shares. With this latest transfer, Amata Long Thanh 1 and 2 will no longer be Amata Vietnam’s subsidiaries.

Thai Duong Animal Feed Co., Ltd. in Ho Chi Minh City is offering its Thai Duong Social Housing project in Thuan An Ward for VND 220 billion. Approved in January 2025 with a VND 1.123 trillion investment, the project will house 1,400 residents across 20 four-story apartment blocks (900 units).

Him Lam Corporation is selling the Duc Hoa 3 Industrial Park in Duc Hoa Commune, Tay Ninh Province. The sale includes land for factories (Minh Ngan, Song Tan, Long Viet, Muoi Day, Lien Thanh, Long Duc) and logistics services in Long Duc, totaling 7,883,574 sqm.

Him Lam offers Duc Hoa 3 Industrial Park in Tay Ninh Province for sale.

Him Lam is also selling two residential projects within Duc Hoa 3: Slico Urban Area (316,824 sqm, priced at VND 6.68 trillion) and Resco Urban Area (2,149,217 sqm, priced at VND 27 trillion). Both projects were approved in 2023-2024.

Year-End M&A Momentum Surges

According to Savills Vietnam, domestic investors dominate M&A transactions in volume due to their agility and market knowledge. However, foreign investors lead in high-value deals, particularly in luxury housing, urban developments, and industrial real estate. Notable deals include Capitaland’s USD 553 million acquisition in Binh Duong, Sumitomo Forestry’s partnership with Kim Oanh Group for The One World, and Nishi Nippon Railroad’s 25% stake in Nam Long’s Paragon Dai Phuoc project.

Savills forecasts strong M&A growth through 2025, driven by legal reforms, proactive economic diplomacy, and sustainable investment flows. Joint ventures, phased M&A, and partial transfers remain popular for capital optimization.

M&A market heats up with year-end activity.

Administrative mergers at the provincial level will unlock new development opportunities, benefiting strategic locations. Vo Hong Thang, Deputy Director of DKRA Group, notes that mid-sized firms drive M&A activity, seeking development opportunities and long-term strategies. However, high asking prices remain a challenge.

Resolution 171/2024/QH15, allowing commercial housing projects through land-use agreements, is expected to boost activity. Companies can acquire low-cost, well-located land for conversion into real estate projects, enhancing market potential.

Unveiling the Secrets Behind $100 Million per Square Meter Condo Prices

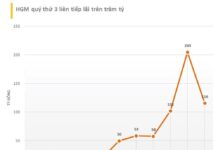

The current prices of condominiums have skyrocketed beyond the reach of not only low-income earners but also those in the upper-middle-income bracket. This staggering reality stems from developers grappling with exorbitant costs: soaring interest payments on loans, escalating soft costs, prolonged legal procedures for project approvals, hefty land-use fees, surging construction material prices, and debt moratorium policies.

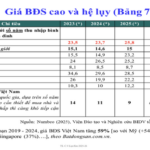

Dr. Can Van Luc: Vietnamese Public Servants Need Nearly 26 Years of Work to Afford an Apartment, Compared to Global Average of 15 Years

Dr. Can Van Luc asserts that the real estate market is grappling with significant volatility, as housing prices are rising faster than incomes, making it increasingly difficult for people to afford homes. He urges businesses to restructure, manage risks, and accelerate digital and green transformations. Additionally, he calls on the government to implement measures aimed at reducing overall price levels.

Young Buyers Fuel Surge in Real Estate Purchases

Despite soaring home prices, young adults are entering the real estate market at higher rates than previous generations, particularly in the apartment segment, according to VARS.

Van Phu Named Among Vietnam’s Top 10 Most Valuable Real Estate Brands of 2025

In the recently released report by Brand Finance, the world’s leading brand valuation and ranking organization, Van Phu has made its debut in the Top 10 most valuable real estate brands in Vietnam. Additionally, for the second consecutive year, Van Phu has secured its position in the Top 100 most valuable brands in Vietnam for 2025.