|

Market Struggles to Break Free Amid Pressure from Key Stocks

Source: VietstockFinance

|

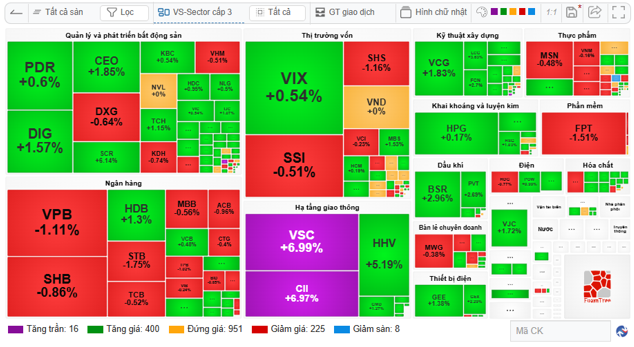

Across all capitalization scales, positive trends were observed, with Large Cap up 0.05%, Mid Cap up 0.5%, Small Cap up 0.34%, and Micro Cap up 0.53%. Market-wide, 416 stocks rose (including 16 at their upper limit), outpacing 233 decliners (8 at their lower limit). Meanwhile, 951 stocks remained unchanged.

Despite the majority of stocks rising, the market’s gains were modest in the morning session due to significant pressure from banking, securities, food, software, and retail sectors.

In banking, notable declines included VPB (-1.11%), STB (-1.75%), and TPB (-1.02%), alongside other red-inked stocks like SHB, TCB, MBB, ACB, and CTG.

In securities, major players like SSI (-0.51%), SHS (-1.16%), and VCI (-0.23%) significantly impacted overall performance. Bright spots included VIX (+0.54%), MBS (+1.53%), and HCM (+0.19%), though these were insufficient to balance the market.

The food sector saw declines in MSN (-0.48%), VNM (-0.16%), VHC (-0.99%), and KDC (-0.39%). Software stocks like FPT fell 1.51%, while retail stocks such as MWG (-0.38%), PNJ (-1.26%), and FRT (-1.97%) also contributed to market pressure. Real estate giant VHM dropped 0.51%.

Conversely, efforts in real estate, construction engineering, mining, metallurgy, oil and gas, electrical equipment, and particularly transportation infrastructure sectors significantly supported the market.

|

Market Map at the End of the Morning Session, September 25

Source: VietstockFinance

|

Liquidity continued to improve compared to recent sessions, reaching over 16 trillion VND for the day.

10:40 AM: Bulls and Bears Battle for Points as Industrial Stocks Surge

The market experienced intense tug-of-war, with clear polarization evident on the map. Notably, industrial sector stocks surged, becoming a positive highlight.

Transportation infrastructure stocks exploded, with CII hitting its upper limit, VSC repeatedly touching its ceiling, and HHV rising 5.19%. In construction engineering, CDC quickly reached its upper limit, followed by VCG (+1.65%), LCG (+2.82%), and FCN (+2.43%).

Green dominated across various sectors, including real estate and oil and gas.

Conversely, banking stocks exerted considerable pressure. Red dominated large areas of the sector map by trading value, with VPB (-0.79%), SHB (-1.44%), STB (-1.4%), and CTG (-0.4%) declining.

Other large-cap stocks also impacted overall performance, including SSI, VND, SHS, VCI in securities; VHM in real estate; and FPT, MWG, MSN, HPG, and VNM, all losing ground.

Liquidity trended higher on the VN-Index, with trading value reaching 10.7 trillion VND, significantly above the recent five-session average.

Opening: Early Session Volatility

After ATO concluded with a 2.24-point gain, the VN-Index experienced continuous volatility and unpredictability.

By 9:30 AM, the VN-Index rose slightly by 1.09 points to 1,658.55, while the HNX-Index and UPCoM-Index also edged up. Liquidity remained subdued, with over 134 million shares traded, totaling nearly 3.6 trillion VND.

Green spread across the market map, with 308 advancing stocks, including 13 at their upper limit. Conversely, 124 stocks declined, with 7 at their lower limit. In key sectors like finance, real estate, and industry, green dominated large areas.

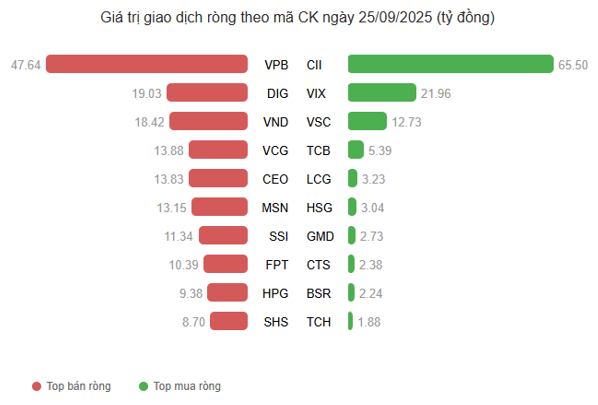

Among the few early gainers, CII stood out, heading for its second consecutive upper-limit session. Trading at 26,100 VND/share, CII saw nearly 19.2 million shares matched and a buy surplus of over 7.2 million shares.

Foreign investors were net buyers of this stock, with purchases totaling nearly 66 billion VND, far outpacing others. Overall foreign trading by 9:30 AM showed continued net selling, totaling nearly 168 billion VND.

Source: VietstockFinance

|

Source: VietstockFinance

|

Globally, Asian markets opened mixed, with Nikkei 225 up 0.23% and All Ordinaries up 0.12%, while Hang Seng fell 0.05%, Shanghai Composite dropped 0.02%, and Singapore Straits Times declined 0.18%.

Wall Street marked its second consecutive decline overnight, with the S&P 500 falling 0.28% to 6,637.97, as AI giants Nvidia and Oracle faced continued pressure. The Nasdaq Composite lost 0.34% to 22,497.86, and the Dow Jones dropped 0.37% to 46,121.28.

– 12:00 PM, September 25, 2025

MBS Forecasts Q3 Earnings for Top Real Estate Firms: Vinhomes Projected to Profit VND 13 Trillion, One Name Expected to Surge Over 500%

MBS forecasts a remarkable 68.7% surge in profits for listed real estate companies under its coverage in Q3 2025.

Revolutionizing Finance & Real Estate: Citics and VPBank Partner to Build a Digital Ecosystem

On September 19, 2025, in Hanoi, Citics Group Joint Stock Company (Citics) and Vietnam Prosperity Joint Stock Commercial Bank (VPBank) officially signed an expanded cooperation agreement, marking a strategic milestone in combining financial and banking strengths with real estate technology expertise.

Mapletree’s Next Move: Unveiling the 13,600m² West Tay Ho Land (Part 1)

In late 2024, Mapletree Investments Pte Ltd (Mapletree) finalized the acquisition of a 13,600m² land plot in the Tay Ho Tay urban area from Taseco Land, paving the way for the development of a Grade A office tower combined with retail space, boasting a total floor area of nearly 92,000m². This marks a rare move by the Singaporean real estate giant in Hanoi, following over a decade of primary focus on Ho Chi Minh City.

TTC Plaza Danang Accelerates Construction, Set to Open in Early 2026

Anticipated to redefine the skyline, this development promises to be a premier commercial, service, hospitality, and office complex in the heart of the coastal city.

Surge in Year-End Investment Floods Bordering Areas of Ho Chi Minh City

Investment trends are increasingly shifting towards the regions bordering Ho Chi Minh City, with real estate in areas like Can Giuoc, Ben Luc, and Duc Hoa in Tay Ninh Province becoming highly sought-after by savvy investors. These locations, strategically positioned near the bustling metropolis, are quietly emerging as prime targets for those looking to capitalize on their proximity and growth potential.