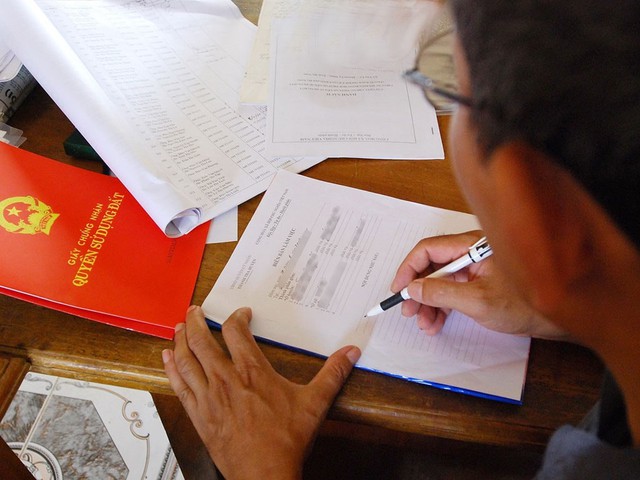

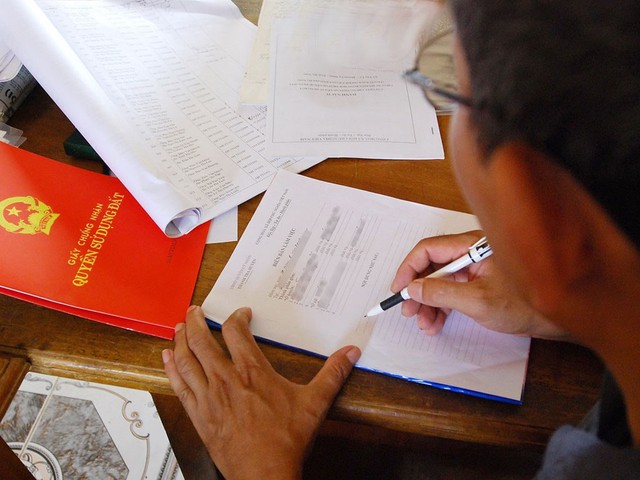

In Vietnam’s credit system, the land-use rights certificate, commonly known as the “red book,” remains the most prevalent collateral asset. It serves not only as a “passport” for individuals and households to access loans but also as a safeguard for banks. Understanding the restrictions is crucial to avoid legal risks and ensure credit accessibility.

Since the Land Law 2024 came into effect, land-use rights pledging has undergone several adjustments:

Failure to Meet General Pledge Conditions

To pledge land-use rights, individuals must satisfy five conditions: possession of a legal certificate; no land disputes; not subject to seizure for judgment enforcement; within the land-use term; and not under temporary emergency measures.

If any of these conditions are unmet, the land-use rights lack the legal validity for pledging. For instance, disputed, encroached, or uncertified land will not be accepted by banks.

Joint Ownership Without Consent

For jointly owned land, all co-owners must consent for any pledging transaction to be valid. Without authorization or signatures from all parties, the pledge agreement is considered null and void, a common risk leading to loan disbursement failures.

For jointly owned land, all co-owners must consent for any pledging transaction to be valid.

Non-Pledgeable Land-Use Rights

Certain land-use rights are prohibited from being used as collateral, including:

Inherited Land: Requires written consent from all heirs before pledging.

Future Assets: Pledging of yet-to-be-formed land-use rights is prohibited to prevent legal risks.

Prohibited Land Types

The Land Law 2024 explicitly bans pledging of the following land types:

Religious and Community Land: Allocated by the state free of charge, thus non-pledgeable.

Annually Leased Land: Only assets attached to the land can be pledged, not the land-use rights.

Natural Forests: Leaseholders of natural production forests cannot pledge, transfer, or contribute these rights.

Defense and Security Land: Even if used for production or economic activities, pledging of land-use rights or attached assets is prohibited.

Minors, incapacitated individuals, or those with limited civil capacity may pledge through legal representatives.

Special Cases

Additional restrictions apply to specific groups:

Minors or Incapacitated Individuals: May pledge through legal representatives.

Ethnic Minorities in Poverty: Land allocated under state support policies cannot be pledged, except for loans from the Policy Bank.

These restrictions aim to enhance transparency in land transactions, protect bank interests, and mitigate legal risks. For individuals and businesses, understanding these regulations facilitates smoother loan applications and prevents contract rejections or invalidation post-signing.

Given the significant role of real estate-backed credit, these new regulations will bolster the safety, transparency, and sustainability of Vietnam’s financial and land markets in the coming years.

The Gateway City in Hung Yen: Now with Individual Land Titles

The real estate market has seen many investors struggle with project delays, poor liquidity, and trapped capital. Amidst these challenges, The Gateway City stands out with its transparent legal framework and efficient land title delivery. Each lot is promptly provided with a red book, offering investors unparalleled peace of mind and confidence in their investments.

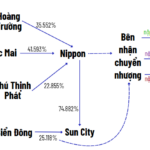

“Distinguishing Between Real Estate Project Transfers and Transfers of Land Use Rights with Built Items to Organizations”

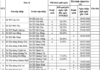

Amidst a dynamic legal and market landscape, the August 28 Real Estate Conference shed light on the nuances of two distinct real estate transaction structures. Luong Van Ly, a senior advisor at Global Vietnam Lawyers, elucidated the differences between transferring real estate projects and assigning the right to use land with existing technical infrastructure to organizations.

Two New ‘Red Book’ Regulations Bring Significant Benefits to Citizens

The new Decree No. 226, effective from August 15, 2025, brings about significant changes to land use certificate (red book) issuance regulations. The decree introduces streamlined administrative procedures and extends the period for land use fee credit. These amendments are designed to simplify the process of obtaining a land use certificate and provide greater flexibility for landowners.

“Withdrawn Applications for Residential Land Use, Yet Tax Debts Still Leave People ‘Hanging’: The Tax Department Explains Why”

The hefty land-use conversion tax has burdened many residents, who, after withdrawing their applications, were still faced with outstanding tax liabilities and late payment penalties by the tax department. This has left them wondering, “Why are we still penalized despite the land registry office’s approval of our withdrawal?”