MBS Research has released a comprehensive analysis of the real estate sector, forecasting Q3 earnings for several property companies.

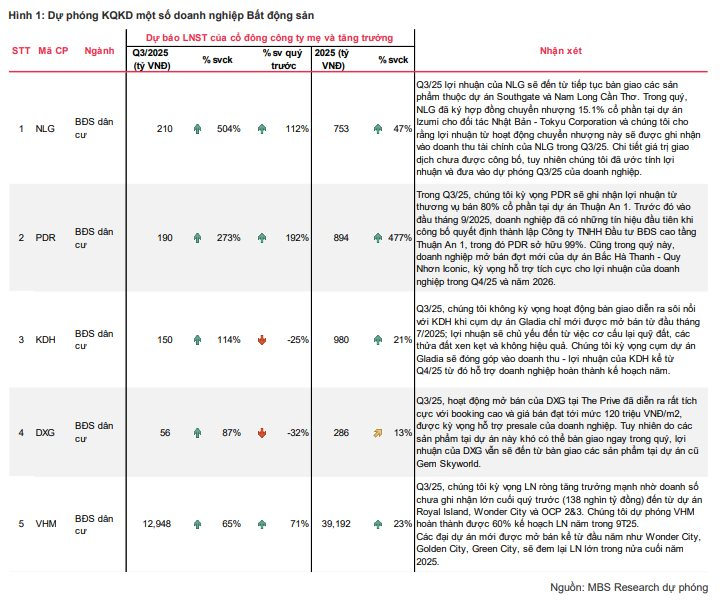

MBS forecasts Nam Long (NLG) to achieve a Q3 net profit of VND 210 billion, a 504% YoY increase, with full-year 2025 profits reaching VND 753 billion, up 47%. This growth is attributed to ongoing handovers in the Southgate and Nam Long Can Tho projects. Notably, NLG’s sale of a 15.1% stake in the Izumi project to Japan’s Tokyu Corporation is expected to boost financial revenue in Q3.

For Phat Dat (PDR), MBS projects a Q3 net profit of VND 190 billion, up 273% YoY. This surge is driven by the sale of an 80% stake in the Thuan An 1 project. Earlier in September 2025, PDR established Thuan An 1 High-Rise Real Estate Investment LLC, holding 99% ownership. Additionally, the launch of the Bac Ha Thanh – Quy Nhon Iconic project is expected to bolster Q4 2025 and 2026 profits.

Khang Dien (KDH) is projected to earn VND 150 billion, a 114% increase. While Q3 handovers are expected to be modest, profits will primarily stem from land restructuring and the sale of underutilized plots. The Gladia project, launched in July 2025, is anticipated to contribute significantly from Q4 2025 onward.

Dat Xanh (DXG) is forecasted to achieve a Q3 profit of VND 56 billion, up 87%. Strong presales at The Prive, with prices reaching VND 120 million/m², are expected to support revenue. However, profits will mainly come from handovers at the Gem Skyworld project.

Vinhomes (VHM) is projected to report a Q3 profit of VND 12,948 billion, a 65% increase. This growth is fueled by unrecorded sales from Q2 2025, totaling VND 138 trillion, from projects like Royal Island, Wonder City, and OCP 2&3. MBS anticipates VHM to achieve 60% of its annual profit target by Q3 2025, with new projects like Wonder City, Golden City, and Green City driving significant profits in H2 2025.

In Q3 2025, numerous new real estate projects were launched, with positive booking activity supported by robust sales strategies, despite seasonal challenges (Ghost Month). In Hanoi, notable launches included Sun Feliza Suites (Sun Group), The Matrix Premium (MIK Group), and Noble Crystal (Sunshine Group). In Ho Chi Minh City, key projects were The Opus One – Vinhomes Grand Park (VHM), The Prive (DXG), Gladia (KDH), The Gio Riverside (AGG), and Lumier Midtown (Masterise).

Outside major cities, projects like Canaria in Izumi City (Dong Nai) and Solaria Rise in Southgate (Tay Ninh) by NLG saw strong booking activity, particularly for DXG and KDH.

While new launches were active, handovers primarily involved existing projects. Significant stake sales, such as NLG’s Izumi City and PDR’s Thuan An 1, are expected to generate substantial financial gains in Q3.

MBS highlights that Q3 2025 profits for listed real estate firms grew 68.7% YoY, driven by recovery from low bases and financial gains from stake sales. New projects launched in Q3 are expected to contribute to earnings from Q4 2025 onward.

MBS Forecasts Q3 Earnings for Top Real Estate Firms: Vinhomes Projected to Profit VND 13 Trillion, One Name Expected to Surge Over 500%

MBS forecasts a remarkable 68.7% surge in profits for listed real estate companies under its coverage in Q3 2025.

Market Pulse 22/09: Weak Demand Fuels Widespread Sell-Off

Amidst a lack of buying momentum, the market deepened its decline into the red, following unsuccessful recovery attempts near the 1,640-point threshold. By the end of the morning session, the VN-Index closed at 1,635.84 points, down 1.37%, while the HNX-Index fell 0.69% to 274.34 points. Selling pressure dominated, with 466 decliners outpacing 208 gainers. Foreign investors continued their net selling streak, offloading 1.4 trillion VND across all three exchanges.