Illustrative image

|

A Major Investment Following a Familiar Philosophy

Kraft Heinz was formed in 2015 through a merger orchestrated by Warren Buffett, Chairman of Berkshire Hathaway, and the Brazilian private equity firm 3G Capital. By combining two giants in the packaged food industry—Kraft Foods Group and H.J. Heinz Company—Buffett aimed to create a mega-enterprise controlling numerous American household brands.

Buffett’s involvement began in 2013 when Berkshire Hathaway partnered with 3G Capital to acquire Heinz for $23 billion. Berkshire contributed half of the amount, equivalent to $11.5 billion.

In 2015, Buffett pushed for the merger of Heinz with Kraft, forming Kraft Heinz. Berkshire and 3G paid a special dividend of $10 billion to Kraft shareholders to secure their approval for the merger. Berkshire Hathaway contributed half of this dividend, amounting to $5 billion. In total, Berkshire Hathaway invested $16.5 billion.

Following the merger in July 2015, Berkshire Hathaway owned 26.7% of Kraft Heinz. At first glance, the deal seemed to align with Buffett’s investment philosophy of focusing on well-known consumer brands, such as Apple, Coca-Cola, and Dairy Queen. However, the key difference here was that while those investments were highly profitable, Kraft Heinz turned out to be a colossal failure.

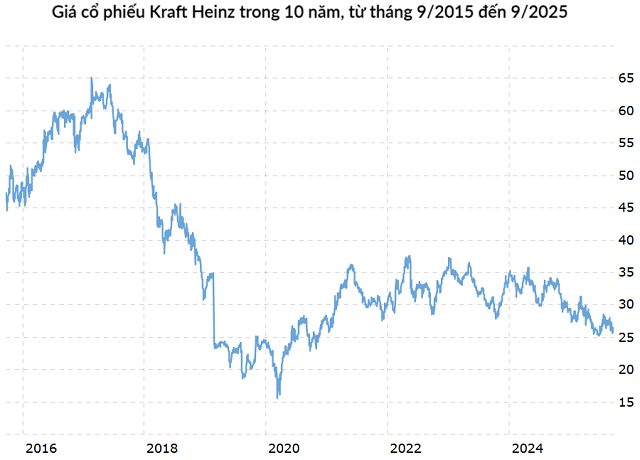

Source: Macrotrends.net

|

Cost-Cutting to the Bone

3G Capital’s philosophy was to maximize profits by minimizing costs through “zero-based budgeting.” This approach requires each department’s annual budget to start from zero, rather than being based on the previous year’s figures. Department heads must justify every expense, no matter how small, with no assumptions carried over from prior years.

With Buffett’s approval, a massive cost-cutting campaign began immediately after the merger. Over 2,500 employees were laid off, and numerous offices were closed. Kraft Heinz turned a $266 million loss in 2015 into a $3.4 billion profit in 2016. By 2017, profits soared 220% to $10.9 billion, thrilling investors. However, these short-term gains came at the expense of long-term growth.

Under intense pressure from 3G Capital, Kraft Heinz managers resorted to tactics to meet profit targets and justify cost cuts, thereby securing their positions. For example, reducing production lines increased efficiency but left the company inflexible and unable to respond to shifting market demands. Marketing and brand promotion efforts were nearly halted, causing flagship products to lose their appeal.

Accounting fraud and cost concealment became inevitable. Managers proposed long-term supplier contracts that offered deep discounts to reduce short-term input costs, but these contracts led to significantly higher costs in subsequent years.

In 2018, the U.S. Securities and Exchange Commission (SEC) investigated Kraft Heinz’s accounting practices and uncovered $208 million in concealed costs across over 300 transactions. That same year, the company reported a net loss of $10.3 billion, erasing nearly all of the previous year’s profits.

Shifts in Consumer Markets

One of Kraft Heinz’s biggest strategic errors was underestimating market changes. While 3G Capital focused on cost-cutting, it overlooked a critical trend: shifting consumer preferences, particularly among younger generations.

The U.S. cheese market exemplifies this shift. Millennials and Gen Z increasingly favor organic, fresh, and minimally processed products. Consumers are moving away from processed cheeses like American Cheese, a Kraft staple, in search of healthier alternatives. Annual reports show that sales of cheese and other traditional Kraft Heinz products began to stagnate and decline by late 2017.

The company’s failure to invest in research and development (R&D) and product innovation eroded its competitiveness in a dynamic market. While smaller competitors launched new, diverse products, Kraft Heinz relied on decades-old formulas.

Heavy Losses

The combination of misguided cost-cutting and failure to adapt to new consumer preferences led to Kraft Heinz’s decline. The company’s stock plummeted from over $80 in early 2017 to under $30 by early 2019.

In February 2019, Kraft Heinz shocked the market with three announcements: a dividend cut from $2.5 to $1.6 per share, an SEC investigation into its accounting practices, and a $15 billion write-down of the Kraft and Oscar Mayer brands. These revelations showed that the optimistic revenue and profit assumptions made during the 2015 merger were nothing more than wishful thinking.

By September 2025, Kraft Heinz’s stock had fallen to $26. With a 26.7% stake, Berkshire Hathaway suffered its largest investment loss in history.

Berkshire received approximately $6 billion in dividends during its investment period, and the value of its shares in September 2025 was around $8.5 billion, totaling $14.5 billion—$2 billion less than its initial $16.5 billion investment. While a 12% loss may seem small, the opportunity cost was enormous.

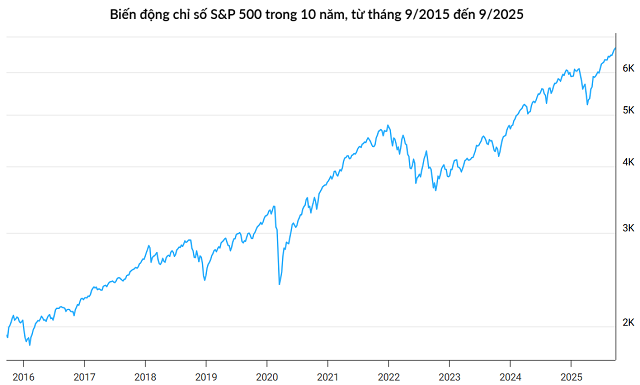

From 2015 to 2025, the S&P 500 grew by 350%. Had Berkshire invested its $16.5 billion in an S&P 500 index fund, it could have grown to $74 billion.

Source: Macrotrends.net

|

“I was wrong. We overpaid for the Kraft merger,” Buffett admitted in 2019.

Lessons from a Failed Merger

After years of struggle, on September 2, 2025, Kraft Heinz announced its split into two independent companies: one focused on sauces and spices, and the other on North American grocery staples.

This split not only closed a sad chapter in the company’s history but also marked the end of Buffett’s most disastrous investment. The failure highlights that in a world of rapidly changing consumer preferences, conservatism and short-term profit focus are unsustainable strategies.

The Kraft Heinz saga serves as a cautionary tale: Even the strongest brands can become obsolete, and even the greatest investors can make mistakes. A company’s value lies not in how much it cuts costs, but in its ability to innovate, adapt, and create products that meet modern consumer needs.

– 11:11 25/09/2025

The Automotive Market in 8 Months: SUVs Dominate, MPVs Surge, Sedans Lag – Are Vietnamese Car Preferences Shifting?

Over the past few years, Vietnam’s automotive market has witnessed a significant shift as the leading brands in vehicle sales continuously change positions.

The Great American Real Estate Paradox: Warren Buffett’s Billion-Dollar Bet

“In a fascinating turn of events, the US housing market is witnessing a unique phenomenon: the cost of new construction homes is dipping below that of previously owned residences. Against this intriguing backdrop, Warren Buffett’s Berkshire Hathaway conglomerate is making waves by investing over $1 billion in residential real estate ventures. This bold move underscores the group’s forward-thinking approach and underscores a potential shift in the industry.”

“The Young Investor’s Guide to Warren Buffett’s Wisdom”

The legendary investor’s early bets reveal three standout qualities: a dedication to research, patience in waiting for the right opportunity, and a bold approach to seizing it.

The Golden Opportunity: A Potential $700 Million Investment Boost for the $5 Billion Petrochemical Complex in Vung Tau

This section is dedicated to constructing an extensive etan repository, a comprehensive resource that will serve as an invaluable asset for all enthusiasts and professionals alike. With a meticulous approach to detail, we aim to create a knowledge base that surpasses all existing resources, setting a new standard for information sharing within this domain.