Following a robust recovery session, the market sustained its positive momentum on September 25th. The benchmark index experienced minor fluctuations throughout the session. At the close, the VN-Index rose by 8.63 points (+0.52%), reaching 1,666.09 points. Foreign trading activity was a notable downside, with a significant net sell-off valued at 2.2 trillion VND across the market.

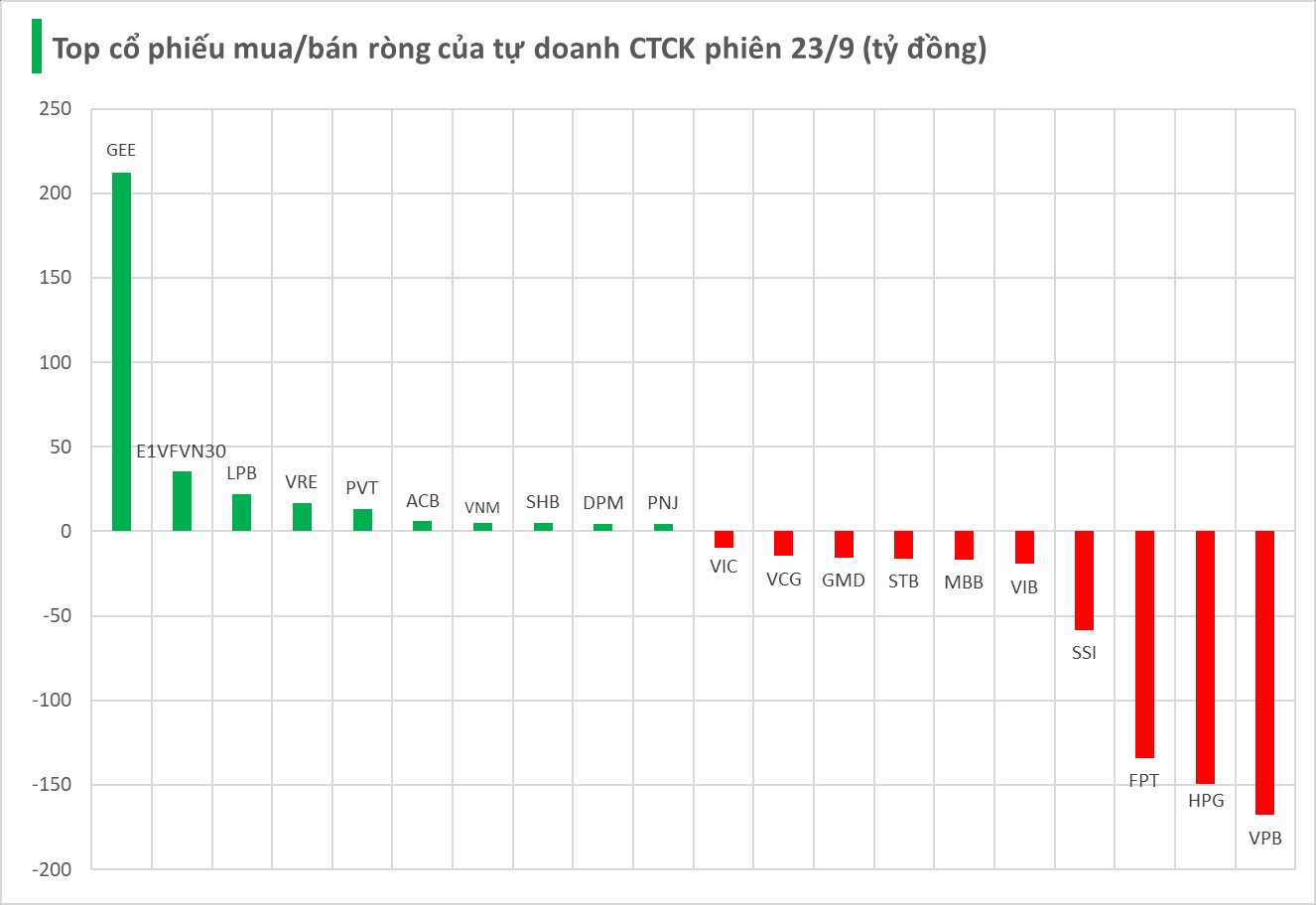

Securities firms’ proprietary trading desks recorded a net sell of 336 billion VND on the HoSE.

Specifically, securities firms were net sellers in VPB with a value of -168 billion VND, followed by HPG (-149 billion), FPT (-134 billion), SSI (-58 billion), and VIB (-19 billion VND). Other stocks also saw notable net selling pressure, including MBB (-17 billion), STB (-16 billion), GMD (-15 billion), VCG (-15 billion), and VIC (-10 billion VND).

Conversely, GEE shares were net bought for 212 billion VND. E1VFVN30 ranked second in net purchases by securities firms’ proprietary desks with 35 billion VND, followed by LPB (22 billion), VRE (17 billion), PVT (13 billion), ACB (6 billion), VNM (5 billion), SHB (5 billion), DPM (5 billion), and PNJ (4 billion VND).

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.

Technical Analysis for the Afternoon Session of September 25: Holding Strong Above Key Support Levels

The VN-Index is currently fluctuating as it retests the middle band of the Bollinger Bands. However, the index has found stability after successfully testing the previous August 2025 low (around the 1,600-1,630 point range). Meanwhile, the HNX-Index shows even stronger momentum, with the Stochastic Oscillator generating a clear buy signal.

Surge in Brokerage Firm’s Proprietary Trading: One Stock Witnessed Unexpected Net Buying Spike on September 23rd

Proprietary trading firms recorded a net purchase of VND 61 billion on the Ho Chi Minh City Stock Exchange (HOSE), signaling a significant shift in market dynamics. This substantial investment underscores growing confidence in the bourse’s potential, as traders capitalize on emerging opportunities within Vietnam’s vibrant financial landscape.