This week, global gold prices surged past $3,700 per ounce, nearly doubling from two years ago—and the precious metal is on track to hit record highs this year. Soaring gold prices may leave some investors feeling priced out of the market.

Fortunately, another precious metal has also been on the rise recently—one that’s far more affordable. HSBC precious metals analyst James Steel noted last month, “Gold’s rally is drawing additional silver buying, possibly from investors who missed out on gold’s ascent.”

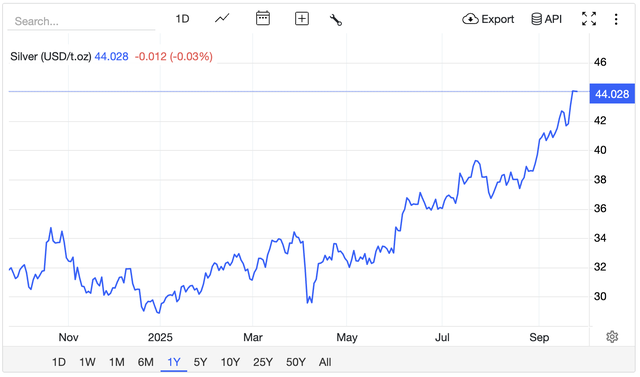

Percentage-wise, silver’s 52% year-to-date gain through September 24th outpaces gold’s 43%. Over two years, both metals’ gains are comparable.

“If gold continues to rise, silver, albeit with a lag, will follow,” said Ed Yardeni, a veteran market strategist and president of Yardeni Research. He predicts gold will hit $4,000 by year-end, echoing forecasts from other Wall Street investors.

Currently around $44 per ounce, silver’s lower price point makes it an accessible entry point for new investors—those unwilling to spend heavily to explore the ups and downs of physical precious metal ownership.

While silver shares similarities with gold, it carries greater risks, largely due to its widespread industrial applications closely tied to the economy.

“Silver is more volatile, both up and down,” said Stefan Gleason, CEO of Money Metals Exchange, a major U.S. precious metals dealer. “For that reason, if you’re investing in silver, it shouldn’t be a short-term play.”

Though silver lacks gold’s advantage as a universally accepted reserve asset, its price has seen significant rallies in recent years, strongly correlating with gold—though typically with a slight delay.

Silver prices have surged since mid-year.

“Silver acts as financial leverage to gold,” Gleason explained. “It rises more when gold rises, especially in the latter half of a bull market, and falls more when gold falls.” Gleason sees significant upside potential for silver, given the current record-high gold-to-silver price ratio.

In Vietnam, silver is also emerging as a popular investment choice, particularly among younger investors. According to Phu Quy Jewelry Corporation, customers buying silver during this period must pay in advance and wait until November for delivery—indicating strong demand outpacing supply.

As of September 25th, Phu Quy 999 silver bars traded at VND 1,689,000 (buy) and VND 1,741,000 (sell) per tael. Over the past week, silver prices rose nearly 6%, and 62.9% year-over-year.

Silver Prices Surge to New Heights

Silver prices today, both domestically and internationally, continue their upward trajectory, maintaining a strong and consistent rise.

Is Gold Expensive or Affordable?

Even as gold achieves its strongest growth since 1979, no analyst is advising investors to slow down.