State Bank of Vietnam Increases Agricultural Credit Limit to VND 185 Trillion

The State Bank of Vietnam (SBV) has officially issued Document No. 8333/NHNN-TD, raising the credit limit for the agricultural, forestry, and fisheries sectors to VND 185 trillion. This move aims to further support production and business projects in these sectors, fostering sustainable agricultural development.

As directed, the credit program for agricultural, forestry, and fisheries products is implemented in accordance with Official Dispatch No. 5631/NHNN-TD dated July 14, 2023, and Official Dispatch No. 2756/NHNN-TD dated April 15, 2025. Lending will continue until the total disbursement reaches VND 185 trillion, based on the registered participation of commercial banks. All other related provisions remain as previously guided by the SBV.

Participating banks include: Agribank, BIDV, VietinBank, Vietcombank, Loc Phat Bank, Sacombank, MB, ACB, Nam A Bank, OCB, Eximbank, Ban Viet Bank, SHB, Vietbank, HDBank, TPBank, KienlongBank, and Bac A Bank. These banks are responsible for monitoring and reporting program outcomes, ensuring loans are disbursed to eligible recipients at the committed interest rates. Additionally, the SBV encourages other commercial banks to join the program as per the guidelines.

Notably, the eligibility criteria for borrowers have been expanded under Official Dispatch 5631/NHNN-TD. This includes customers with projects or plans serving production and business activities in agriculture, forestry, and fisheries. This expansion is crucial in enabling more enterprises, cooperatives, and producers to access preferential capital.

Regarding interest rates, the SBV mandates that loans in Vietnamese Dong must be at least 1-2% lower than the average lending rate for the same term offered by the lending bank. This measure is expected to reduce capital costs for borrowers, enhance production efficiency, and support the sustainable growth of the agricultural, forestry, and fisheries sectors.

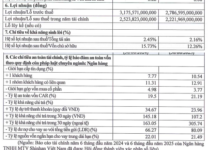

Commercial Real Estate Loans with a 200% Risk Weighting

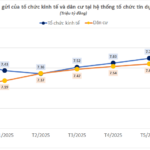

As of July 31, 2025, Vietnam’s real estate credit outstanding balance reached VND 4,080 trillion, marking a 16.95% increase compared to the end of 2024, outpacing the overall credit growth rate, according to the State Bank of Vietnam. In line with the government’s directives, the central bank has implemented various credit measures to support the real estate market, facilitate access to capital for individuals and businesses, and ensure the safety and stability of banking operations.

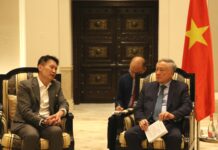

VPBank CEO: Real Estate Market Booms, Interest Rates at Historic Lows

According to Mr. Nguyen Duc Vinh, CEO of VPBank, the real estate market has become significantly more vibrant compared to a year ago. This indicates that we have successfully navigated through the most challenging phase.