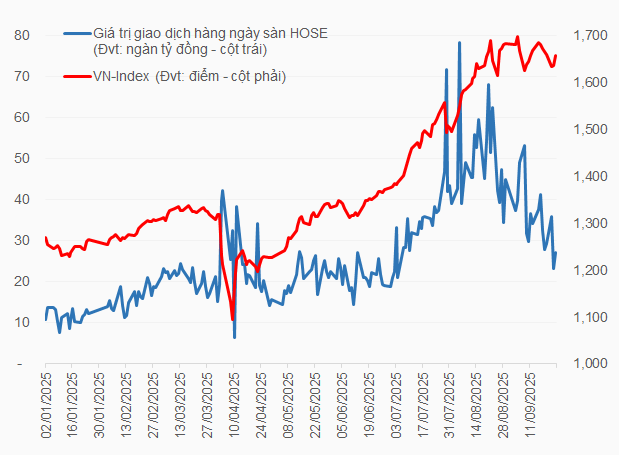

In recent months, the Vietnamese stock market’s fluctuations have made predicting trend reversals extremely challenging.

From its low point in early April 2025, the VN-Index surged over 49%, propelling Vietnam into the ranks of the world’s top-performing stock markets. According to BIDV Securities (BSC), the 2.75% weekly growth during this period even outpaced previous boom cycles, such as the 1.45% weekly increase from 2020-2022 and 1.2% weekly rise from 2016-2018.

Given this rapid ascent, a significant correction seemed inevitable, based on market participants’ historical experience.

Indeed, since mid-August, the VN-Index has halted its upward momentum, with liquidity gradually declining and notable down sessions emerging. However, the market has yet to enter a major correction phase, and the benchmark index remains resilient.

|

Cautious yet Resilient

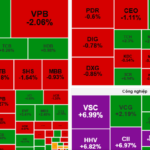

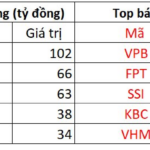

Order-matching liquidity on the HOSE decreased, but the VN-Index remains steady despite fluctuations Data as of the September 24, 2025 trading session. Source: VietstockFinance

|

Old Risks Reemerge, Then Subside

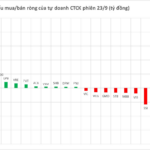

During this volatile phase, a familiar concern for investors in recent years has resurfaced: currency pressure. The State Bank of Vietnam intervened by selling forward foreign exchange to cool the market in late August, while the unofficial USD rate briefly touched 27,000 VND in early September. Simultaneously, as domestic capital weakened, foreign investors resumed net selling at record levels, despite Vietnam’s anticipated FTSE Russell upgrade in October.

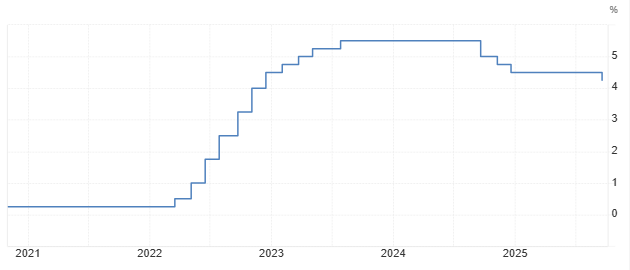

Fortunately for Vietnam, external conditions became more favorable at just the right moment. In mid-September, the US Federal Reserve cut interest rates by 25 basis points for the first time since late 2024. The market now expects two more rate cuts this year.

In response, the US dollar weakened, with the Dollar Index (DXY) falling to its lowest level since early 2022, while US Treasury yields dropped below 4%—a level last seen during the US-China “tariff war” in April 2025. These developments have temporarily eased pressure on Vietnam’s monetary policy.

|

Fed’s First Federal Funds Rate Cut in 2025

The Federal Funds Rate is the interest rate at which banks lend excess reserves to each other overnight at the Fed Source: tradingeconomics.com

|

|

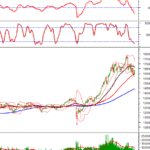

DXY Index and 10-Year US Treasury Yield Trends

Data as of September 24, 2025. Source: tradingeconomics.com

|

Strength Through Support

Amid the current equity market volatility, a key difference from previous years lies in the VN-Index‘s underlying dynamics. The Vin group stocks have emerged as a significant support pillar for the market.

In the past month (August 22 – September 22), the VN-Index fell by 53.55 points, but VIC alone contributed 23.44 positive points, softening the impact of negative sessions.

Over a longer period, from the start of 2025 to September 22, the Vin group stocks (VIC, VHM, VRE, and VPL) accounted for 50% of the VN-Index‘s gains. While reliance on a few large-cap stocks may pose long-term risks, it currently provides short-term market stability.

– 08:00 September 26, 2025

September 25th Session: Foreign Investors Net Sell VND 2.2 Trillion, Which Stocks Were Hit Hardest?

Foreign block transactions stand out as a notable drawback when they exhibit significant net selling across the entire market.

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.