Viglacera Corporation – JSC (HOSE: VGC) announced that on September 24, 2025, the Hanoi People’s Committee approved a consortium of investors to develop the Tien Duong 1 Social Housing Project in Phuoc Thinh Commune (formerly Tien Duong Commune, Dong Anh District).

The selected consortium includes Viglacera, Hoang Thanh Infrastructure Investment and Development JSC (Hoang Thanh Group), and Central Construction JSC.

The Tien Duong 1 Social Housing Project spans approximately 44.6 hectares, offering around 3,530 units (3,103 social housing units, 427 commercial apartments), and 99 adjacent low-rise houses. The project is designed to accommodate about 12,465 residents.

The total investment exceeds VND 9.3 trillion, including land clearance and compensation costs of nearly VND 617 billion. Investors contribute VND 1.5 trillion (over 16% of the total investment), with Viglacera leading at VND 825 billion (55%), followed by Hoang Thanh Group at VND 450 billion (30%), and Central at VND 225 billion (15%).

The project will be implemented from 2024 to 2030, with a 50-year operational period starting from the date of land allocation, lease, or land-use conversion approval.

In the former Dong Anh District, on February 13, the Hanoi People’s Committee allocated 2.4 hectares of cleared land (Phase 2) in the CT3 area of the new Kim Chung Urban Area, Kim Chung Commune, to a consortium of Handico and VGC for a social housing project.

The approved plan for the CT3 area includes three high-rise residential buildings (CT3A, CT3B, CT3C), each with 12 floors plus a penthouse and elevators. The total construction area is approximately 109,410 m², accommodating 3,902 residents in 1,104 units.

Handico and VGC allocated 2.4ha for social housing in Dong Anh

Who is the VGC consortium partner?

Central, established on June 23, 2017, specializes in railway and road construction. Its initial charter capital was VND 100 billion, with six founding shareholders: Mr. Tran Quang Tuan (Chairman) holding 81%, Mr. Vu Duc Tai 10%, Mr. Pham Huu Phuc 5%, Mr. Nguyen Thien Thuat 2%, Mr. Hoang Anh Tuan 1%, and Mr. Huynh Ngoc Tuan 1%.

Central has completed major projects such as Marriott Hotel, Vinhomes Dream City, The Beverly Solari, Fairmont Hanoi, Vinhomes Ocean Park, and Vinpearl Phu Quoc Aquarium.

Central acquires a bridge and road construction company

Hoang Thanh Group, founded in 2004 by Mr. Hoang Ve Dung and Mrs. Nguyen Thi Bich Ngoc (current Chairwoman), is known for its real estate ventures. Mr. Dung chairs Duc Giang Corporation (UPCoM: MGG) and served on the Board of Hai Phat Investment JSC (HOSE: HPX) from April 2018 to June 2020. Mrs. Nguyen Thi Bich Ngoc was a board member of GELEX Group (HOSE: GEX) from 2010 to 2020.

Headquartered in Hanoi, the company focuses on real estate. Its charter capital increased from VND 27 billion to VND 1,359 billion in 2022.

As of 2024, consolidated assets totaled VND 3,670 billion (up 6% YoY), with 67% (VND 2,440 billion) in short-term financial investments. Liabilities decreased by 40% to VND 719 billion, including VND 172 billion in financial debt (5x higher YoY).

Hoang Thanh Group partnered with CapitaLand (Singapore) on Mulberry Lane and Seasons Avenue in Hanoi. CapitaLand later exited Mulberry Lane.

Current projects include Hoang Thanh Pearl, Hoang Thanh Villas in Hanoi, and the 407-hectare Du Long Industrial Park in former Ninh Thuan.

Hoang Thanh Group owns 65% of Hanoi Transformer and Electrical Material Manufacturing JSC (UPCoM: BTH) and subsidiaries like Tran Hung Dao JSC, Hoang Thanh – Mulberry Lane LLC, Hoang Thanh – Seasons Avenue LLC, Hoang Thanh Du Long Industrial Park JSC, and Hoang Thanh Do Luong Production and Investment JSC.

|

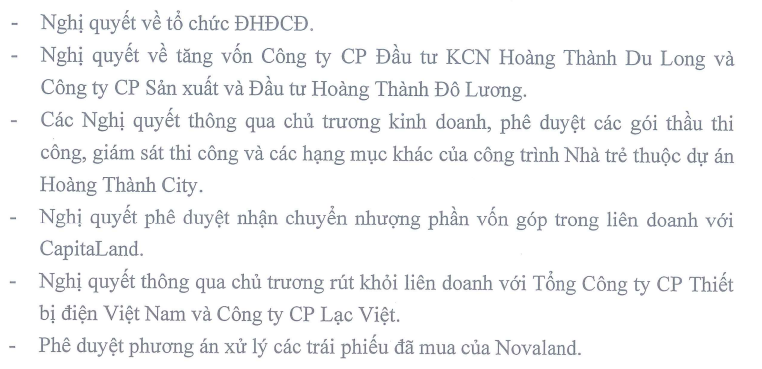

Key Resolutions of Hoang Thanh Group in 2024

Source: Hoang Thanh Group

|

|

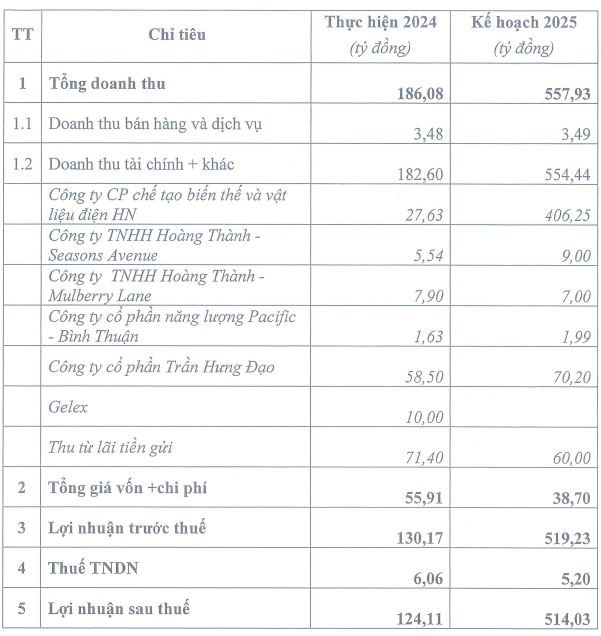

Hoang Thanh Group’s 2025 Business Plan

|

Over VND 1 trillion invested in Du Long Industrial Park

Company pays 250% cash dividend, depleting profits yet confident in reserves

In 2025, Hoang Thanh Group targets VND 558 billion in revenue (3x 2024), primarily from financial and other income (VND 554 billion), with after-tax profit of VND 514 billion (4x YoY).

To achieve this, the company will restructure its portfolio, focusing on industrial real estate, social housing, logistics, and related services. It will also explore commercial and social housing projects in Hanoi.

– 11:31 26/09/2025

Hanoi to Welcome Its Largest Social Housing Project Ever, Accommodating Over 12,400 Residents

The Tiên Dương 1 Social Housing Project, with a projected investment of 8.690 trillion VND, spans 44.6 hectares and is set to deliver approximately 3,103 affordable housing units.

“Prime West West Lake Land to be Transformed into a Green Oasis and Luxurious Villa Community”

The Hanoi authorities have recently allocated over 41,000 square meters of prime land in West West Lake to the Land Development Center. This decision includes plans to develop approximately 36,650 square meters of low-rise residential area.