SSI’s Extraordinary General Meeting in 2025 Held on September 25th

|

Capital Increase to Meet the Demands of a Booming Market

During the meeting, SSI Securities Corporation proposed a plan to issue 415.6 million shares to existing shareholders at a ratio of 5:1 (for every 5 shares held, shareholders receive 1 purchase right). The offering price is set at VND 15,000 per share, with the issuance scheduled for 2025-2026 or as decided by the Board of Directors upon approval from the State Securities Commission.

Upon successful issuance, the company expects to raise approximately VND 6,234 billion, increasing its charter capital to VND 24,963.5 billion. The proceeds will be allocated to supplement capital for margin lending and investments in bonds, deposit certificates, and other securities as determined by the Board of Directors.

Previously, SSI issued over 104 million shares to professional investors, representing 5.28% of the total outstanding shares. At a price of VND 31,300 per share, SSI raised more than VND 3,256.5 billion, increasing its charter capital from VND 19,739 billion to VND 20,779 billion (as of August 30, 2025). SSI plans to use 50% of the proceeds to invest in deposit certificates and the remaining 50% for margin lending activities.

SSI Chairman Nguyen Duy Hung Discusses the Company’s Direction

|

In response to shareholder inquiries about the company’s direction and the rationale behind the issuance, SSI Chairman Nguyen Duy Hung emphasized sustainable development and capital scale as key priorities. SSI meets both criteria, achieving steady growth while maintaining the largest capital scale in the market. With market demand surging, margin lending needs are at an all-time high. “The market’s growth potential is immense, and this capital increase aims to strengthen existing shareholders’ ownership and meet current demands, without predicting the next 3-5 years,” Chairman Hung explained.

In October, FTSE may upgrade Vietnam’s stock market. Interest in Vietnam is the highest in the region, and SSI is confident in the market’s potential, preparing for future growth.

94% of Annual Target Achieved in 9 Months

At the meeting, SSI’s leadership shared a 9-month business forecast. Ms. Nguyen Thi Thanh Ha – SSI’s CFO revealed that the company has achieved 94% of its annual target. If market conditions remain favorable, SSI could exceed its target by at least 15%, possibly even 20%, by year-end.

Ms. Nguyen Thi Thanh Ha, SSI’s CFO, Discusses Business Results

|

Regarding business strategy, Chairman Nguyen Duy Hung stated that SSI will continue to develop across all segments. Given the market’s unpredictability, preparedness is crucial. For margin lending, SSI aims to meet all market demands. If demand persists, further capital increases are possible. With record-high debt levels, SSI can handle a 30-40% increase in margin lending, but a 200% surge would require reevaluation, Mr. Hung noted.

SSI’s leadership aims for 15-20% annual growth. With this year’s results surpassing 20%, the 2026 target will be set at 15-20%.

New initiatives like “Digital Sale” aim to expand SSI’s online presence. Brokerage market share is growing steadily, approaching 12% this year. SSI is also exploring global expansion, leveraging digital platforms to overcome geographical barriers. The company’s strategists are focusing on this goal for the next five years.

– 14:19 26/09/2025

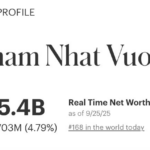

Vingroup Surpasses Vietcombank, Setting Unprecedented Record Under Billionaire Pham Nhat Vuong’s Leadership

Since the beginning of the year, Vingroup’s stock has surged by nearly 290%, adding approximately VND 450 trillion to its market capitalization.

Becamex IDC to Exercise Purchase Rights for Over 125 Million IJC Shares

Becamex IDC has recently registered to exercise its purchase rights for over 125.3 million IJC shares during the offering of more than 251.8 million shares by Becamex IJC.

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.