In a recent private placement, 25 professional investors acquired over 118.8 million shares offered by TCBS. Notably, Chairman Nguyen Xuan Minh purchased more than 106.1 million shares, accounting for over 89% of the offered shares.

As a result of this transaction, the Chairman of TCBS increased his shareholding from nearly 62.3 million shares (3.18%) to almost 168.4 million shares (8.09%).

Several other executives of TCBS also participated in this private placement, including General Director Nguyen Thi Thu Hien, and Deputy General Directors Bui Thi Thu Hang, Pham Dieu Linh, Tran Thi Thu Trang, Nguyen Tuan Cuong, and Nguyen Dang Minh.

This offering had stringent criteria, including senior leadership positions, membership in the Executive Board, and critical functional roles. The participants have made or are expected to make significant contributions to the company’s strategy execution and have achieved an A2 rating or higher for the eligibility year.

According to TCBS, the issuance aims to express gratitude and retain key management personnel, employees, and important partners of the company.

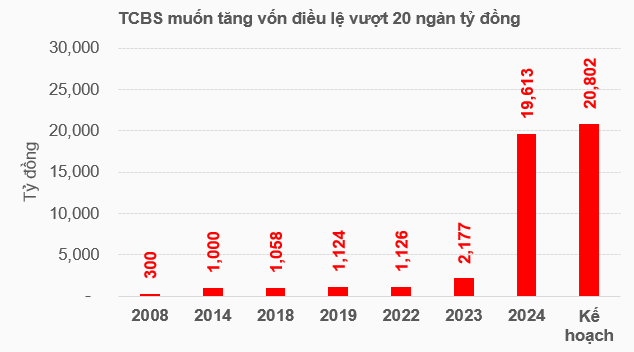

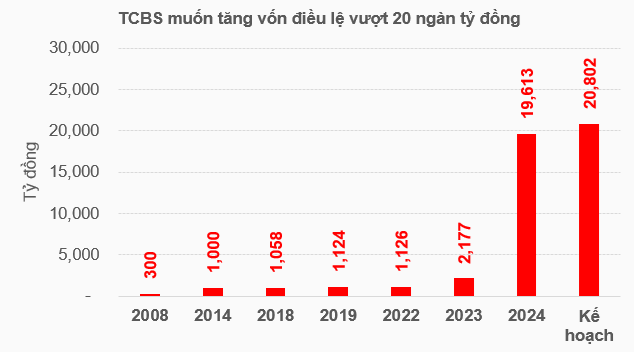

The over 118.8 million shares will be restricted from transfer for one year from the completion of the offering. With this issuance, TCBS has increased its charter capital from over VND 19,600 billion to over VND 20,800 billion, the highest in Vietnam’s securities industry.

Source: VietstockFinance

|

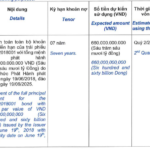

At a price of VND 11,585 per share, TCBS raised nearly VND 1,377 billion to supplement its business activities and diversify its ownership structure. Of this, nearly VND 895 billion will be allocated to proprietary trading (stocks, bonds, etc.) to maintain high returns, especially in the current attractive market conditions. Approximately VND 482 billion will be invested in securities brokerage, margin lending, and other activities.

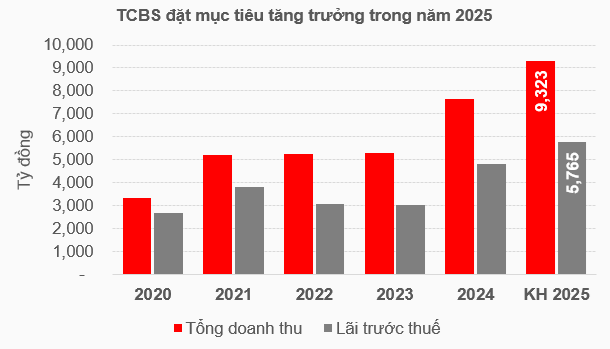

For 2025, TCBS has set ambitious targets, aiming for a total revenue of VND 9,323 billion and a pre-tax profit of VND 5,765 billion, representing a 22% and 20% increase, respectively, compared to the previous year’s performance.

The company emphasizes that abundant financial resources will enable it to expand its business operations, achieve its financial goals, and seize new opportunities as the market moves towards an upgrade. TCBS maintains its vision of sustaining its leading position in profitability and operational efficiency for 2025.

With nearly VND 1,310 billion in pre-tax profit in the first quarter, the company has already achieved 23% of its annual plan.

Source: VietstockFinance

|

– 18:40 10/06/2025

The State Bank of Vietnam Approves Capital Increase for Nam A Bank to Over VND 18,000 Billion

On June 4th, 2025, the State Bank of Vietnam (SBV) approved Nam A Bank’s request to increase its charter capital by a maximum of VND 4,281 billion. This move will see the joint-stock commercial bank, listed as NAB on the Ho Chi Minh City Stock Exchange (HOSE), strengthen its financial position by issuing shares from its owner’s equity and through an employee stock ownership plan (ESOP).