TCO Real Estate Consulting and Business Joint Stock Company has announced to the Hanoi Stock Exchange (HNX) the results of its early bond repurchase.

Accordingly, TCO Real Estate spent VND 2.5 trillion to fully redeem the TOC32401 bond series ahead of schedule, with a face value of VND 100 million per bond and an actual repurchase value of over VND 107 million per bond on September 25, 2025.

This bond series was issued in late 2024 with a 12-month term, a total value of VND 2.5 trillion, and a maturity date at the end of this year, offering an interest rate of 9.6% per annum.

According to HNX, TCO Real Estate has two other outstanding bond series: TOC12502, valued at VND 5 trillion, issued on June 25, 2025, with an 18-month term, maturing on December 25, 2026, and an interest rate of 9% per annum; and TOC32501, successfully issued on April 9, 2025, valued at VND 3 trillion, with a 12-month term and an issuance interest rate of 8.2% per annum.

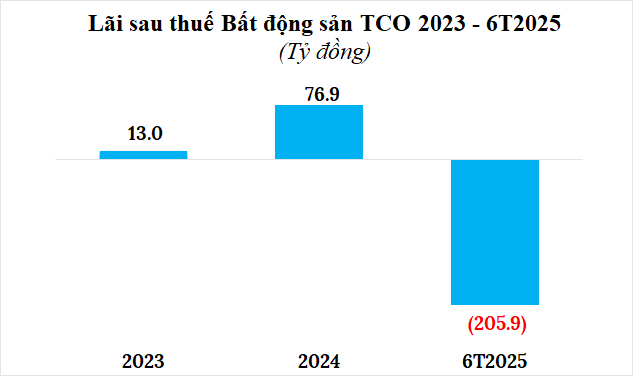

In terms of business operations, TCO Real Estate unexpectedly reported an after-tax loss of nearly VND 206 billion in the first half of 2025, compared to a loss of nearly VND 50 billion in the same period last year.

Source: Author’s compilation

|

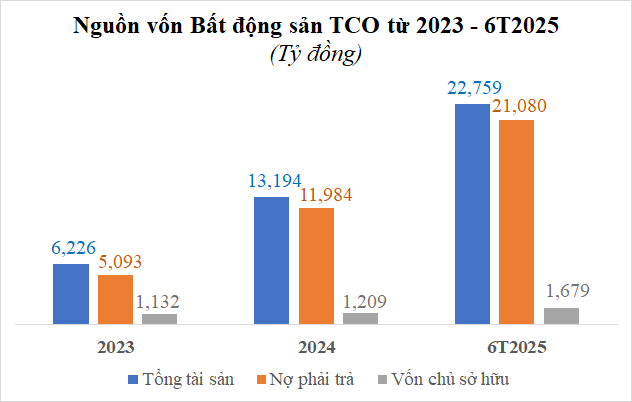

As of the end of June, the company’s equity reached VND 1.679 trillion, a 39% increase from the beginning of the year. Total liabilities surged by 76% to VND 21.08 trillion, with half attributed to bond debt and the remainder to other payables, with no bank debt.

Source: Author’s compilation

|

Established in June 2018 and headquartered in Hanoi, TCO Real Estate operates in the real estate sector. It is known as the developer of the high-rise apartment complex on plots F4-CH02, F4-CH02-CX, and F4-CX02 within the Tay Mo – Dai Mo Urban Area project (also known as Vinhomes Park or Vinhomes Smart City) in Tay Mo Ward, Nam Tu Liem District, Hanoi. The project’s commercial name is LUMIÈRE Evergreen.

The company currently has a chartered capital of VND 1.676 trillion. Its legal representatives are Mr. Ngo Manh Trung, Chairman of the Board of Directors, and Ms. Nguyen Linh Phuong, Chief Executive Officer.

– 08:33 27/09/2025

Insider Sell-Off Sparks Surge: Stock Soars 3X in One Month – Company Responds

Even this stock was moved to the controlled list due to a delay in submitting the audited semi-annual financial report for 2025, exceeding the stipulated deadline by over 30 days.

HBS Stock of Hoa Binh Securities Moves to Controlled Status

HNX has announced that Hoá Bình Securities’ stock (HBS) will be placed under special control starting September 22nd. This decision stems from the company’s failure to submit its audited semi-annual financial report for 2025 within the mandated 30-day timeframe.