The Once-in-Two-Years Public Investment Wave

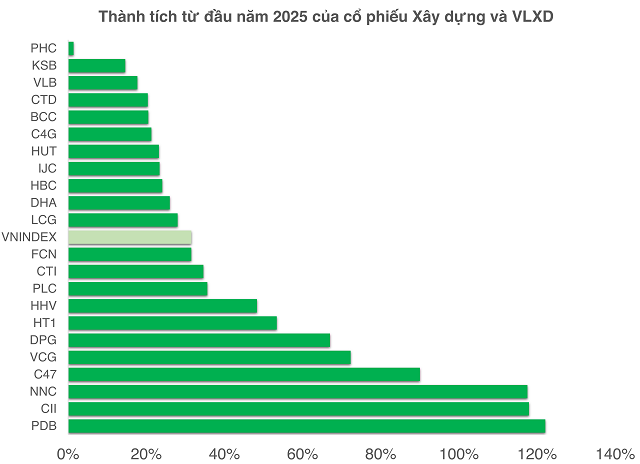

On September 25th, the trading session witnessed a surge in construction stocks, with several hitting their ceiling prices, including CII, LCG, and HHV. Other stocks like C4G, VCG, and KSB also saw gains of over 2%.

This performance has made the group’s year-to-date achievements even more impressive to investors since the beginning of 2025.

Many construction and building materials stocks have outperformed the VN-Index. (As of the close of trading on September 25th.)

|

Specifically, CII has surged by 118%, more than doubling since the start of 2025. VCG is up 72.3%, HHV by 48.3%, and FCN has gained 31.5%.

However, the construction group is actually “lagging” behind the building stone group, as PDB and NNC had already more than doubled by late August and early September.

The entry of construction stocks is likened to the “final confirming piece” of the public investment wave, following the market’s earlier rallies in securities and banking sectors.

As of the close of trading on September 25th, 22 out of 22 stocks in the construction and building materials group are in a long-term uptrend (above MA200), equivalent to 100%.

The status of over 90% of stocks maintaining a long-term uptrend was only recorded from late July 2025, meaning in the last two months.

This is a rare phenomenon, as the last time this group of stocks collectively maintained such a sustainable uptrend was in Q3/2023, linked to expectations of the commencement of 19 infrastructure projects to stimulate the economy post-COVID-19.

Currently, the catalyst comes from the groundbreaking and inauguration of 250 infrastructure projects nationwide, with a total investment of 49 billion USD, which took place on August 19th.

This large-scale event is bolstering investor confidence in the prospects of stocks tied to public investment.

Business Results and Aligned Expectations

Part of the reason the building materials group led the way is due to their strong business results in the first half of 2025.

VICEM Ha Tien (HT1) reported a 6-month profit of 103.2 billion VND, 4.9 times higher than the same period last year. Meanwhile, Da Nui Nho (NNC) achieved a profit of over 50 billion VND in the first half of 2025, double that of the same period last year. PDB also recorded a profit increase of more than 6 times, reaching over 20 billion VND.

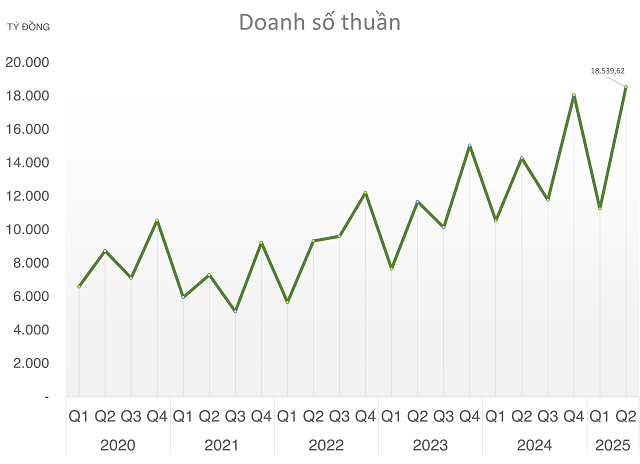

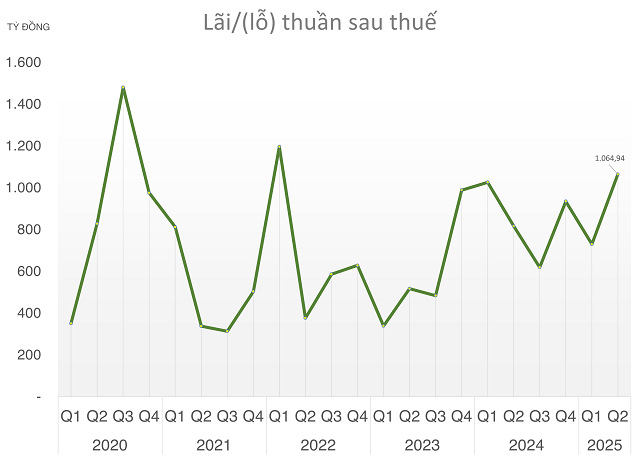

In contrast, the construction group has yet to reflect commensurate performance. Statistics from 8 major companies (C4G, CTD, DPG, FCN, HHV, LCG, VCG, LGC) show that revenue in the first half of 2025 reached nearly 30,000 billion VND, up 20% year-on-year. However, after-tax profit was only around 1,800 billion VND, nearly flat compared to the previous year.

8 companies (C4G, CTD, DPG, FCN, HHV, LCG, VCG, LGC) achieved revenue of nearly 30,000 billion VND in the first half of 2025.

|

However, 6-month profits were only slightly higher than the same period last year.

|

This indicates that the building materials group had a stronger fundamental base in the first half, thus kicking off the wave earlier, while the construction group is now entering its acceleration phase.

Alongside the public investment wave, there have been notable movements in the banking system’s liquidity recently. Mr. Nguyen The Minh, Director of Individual Client Analysis at Yuanta Securities Vietnam, stated: “The banking system experienced liquidity tensions in July and August, despite the State Bank’s regular injections. The main cause was the State Treasury’s significant withdrawal of deposits from the Big4 to fund infrastructure projects. This trend may recur in the final months of the year as disbursement progress accelerates.”

Mr. Minh also noted that closely monitoring Q3/2025 business results and the progress of public investment project disbursements is crucial.

Additionally, market volatility near peak levels could lead to unpredictability in stock performance.

– 14:00 26/09/2025

An Giang Launches 10 Key Projects in Preparation for APEC 2027

On September 24, 2025, the People’s Committee of An Giang Province hosted a groundbreaking ceremony in Phu Quoc Special Economic Zone to launch 10 critical infrastructure projects. These initiatives are designed to support the Asia-Pacific Economic Cooperation (APEC) Forum 2027 and commemorate the 1st Party Congress of An Giang Province for the 2025–2030 term.

Launching and Commencing 10 Key Projects and Initiatives for APEC 2027

Deputy Prime Minister Nguyen Chi Dung emphasized that the projects serving APEC 2027 demonstrate the seamless coordination between the central government and local authorities, as well as between the state and businesses. With the upcoming synchronized infrastructure system, Phu Quoc will not only be the destination for APEC 2027 but also a symbol of an innovative and creative Vietnam, striving towards the goal of becoming a developing country with a modern industrial base by 2030.

Official Groundbreaking: Launching 10 Key Projects and Infrastructure Initiatives for APEC 2027

Deputy Prime Minister Nguyen Chi Dung emphasized that the projects serving APEC 2027 demonstrate the seamless collaboration between the central government and local authorities, as well as between the state and businesses. With the upcoming synchronized infrastructure system, Phu Quoc will not only be the destination for APEC 2027 but also a symbol of an innovative and creative Vietnam, striving towards the goal of becoming a developing country with a modern industrial base by 2030.

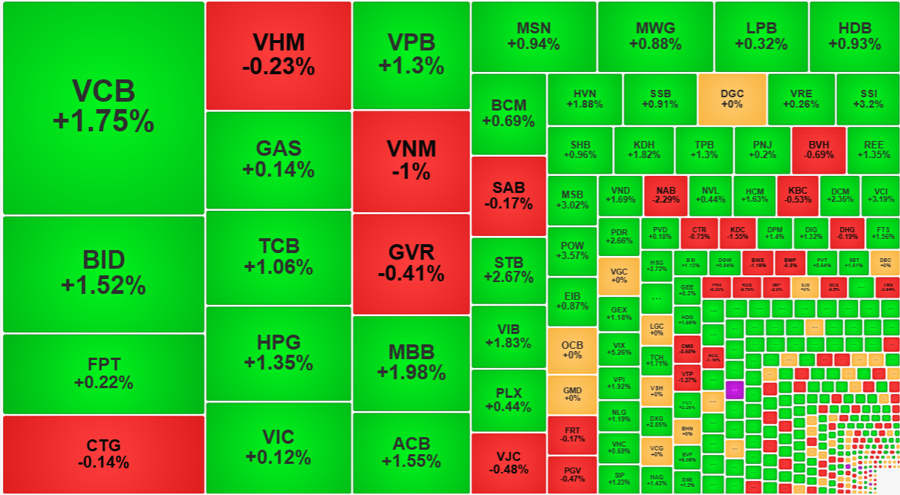

Market Liquidity Weakens as Capital Flows Out of Equity Securities

In recent weeks, cash flow has shown signs of weakening. Despite this trend, certain sectors continue to attract investment. Conversely, the financial sector, particularly stocks, has experienced significant outflows.