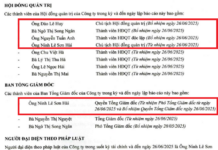

On September 25, 2025, PetroVietnam Power Corporation (PV Power, stock code: POW) held an Extraordinary General Meeting of Shareholders. Shareholders approved a plan to increase the company’s chartered capital from VND 23,418 billion to VND 30,678 billion, with an additional VND 7,259 billion in chartered capital.

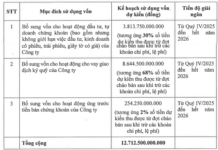

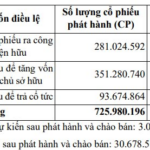

According to the plan, PV Power aims to raise its chartered capital through three methods. First, the company will offer an additional 281 million shares to existing shareholders at a 12% ratio (shareholders owning 100 shares are entitled to purchase 12 new shares). The offering price is VND 10,000 per share, equivalent to VND 2,810 billion in expected proceeds. These funds will be allocated to the Nhon Trach 3 and Nhon Trach 4 Power Plant projects, specifically for payments to contractors and partners.

The second method involves POW issuing bonus shares to increase equity capital from the owner’s equity at a 15% ratio (shareholders owning 100 shares will receive 15 new shares), equivalent to over 351 million shares. The capital source is from the Development Investment Fund in the audited financial statements for 2024.

Third, POW plans to issue dividend shares at a 4% ratio (shareholders owning 100 shares will receive 4 new shares). The source of issuance is from the undistributed after-tax profit in the audited financial statements for 2024.

The issuance rounds are expected to be implemented in 2025 and Q1/2026, following approval from the State Securities Commission. The proceeds from the offering to existing shareholders (expected to be VND 2,810 billion) will be used to finance the owner’s equity for the Nhon Trach 3 and Nhon Trach 4 Power Plant projects, specifically for payments to contractors and partners. The disbursement is expected to occur in Q4/2025 and Q1/2026.

The two power plants are designed with a total capacity of 1,624 MW and an investment capital of VND 32,486 billion (30% owner’s equity and 70% loan capital). This is Vietnam’s first LNG-fueled thermal power project, which, upon operation, will add approximately 9 billion kWh of electricity annually to the national grid and contribute to the government’s commitment to achieving net-zero emissions by 2050, as pledged at COP26.

PV Power (POW) completed its equitization in 2018 after selling all 468 million shares in its IPO at an average price of VND 14,938 per share. The corporation held its first General Meeting of Shareholders in June 2018 and subsequently listed its shares on the HOSE from January 14, 2019. Since its equitization, PV Power has not conducted any share issuances to increase its chartered capital. PetroVietnam remains the parent company, holding 79.94% of the enterprise’s shares.

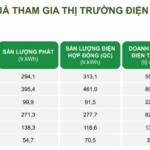

Regarding business performance, PV Power’s cumulative electricity sales revenue for the first eight months is estimated at nearly VND 23,079 billion. The company updated the investment progress of the Nhon Trach 3 and 4 Power Plant projects, stating that it expects to commence commercial operation of Nhon Trach 3 Power Plant in November 2025.

In September, the company plans to achieve a total electricity output of 1,570 million kWh across its power plants, with a revenue target of VND 3,252 billion.

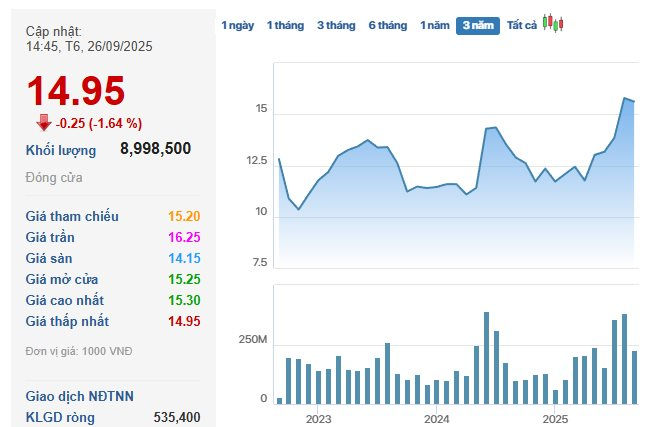

In the market, POW shares closed the session on September 26 at VND 14,950 per share.

‘Powering the Nation: A Giant’s Bold Move’

The upcoming conference will feature a notable agenda item: the approval of a share offering/issuance scheme to boost PV Power’s charter capital from 23.418 trillion VND to 30.678 trillion VND, representing an increase of 7.259 trillion VND in charter capital.