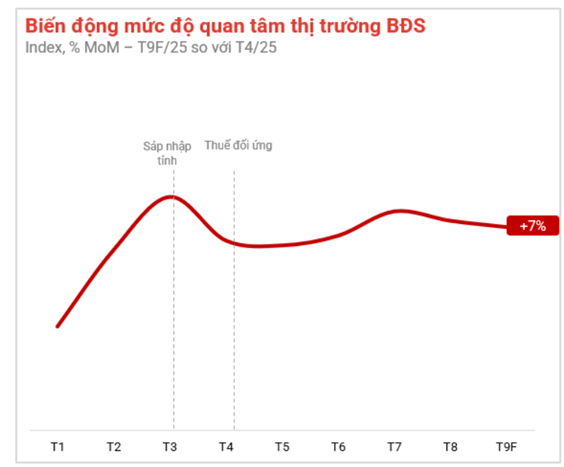

According to data released by Batdongsan.com.vn, Vietnam’s real estate market demonstrated a strong rebound in Q3 following macroeconomic fluctuations in April. After a period of cautious observation, awaiting developments regarding U.S. countervailing duties on other countries, interest in real estate has gradually recovered. Batdongsan.com.vn’s data predicts a 7% increase in real estate interest in September 2025 compared to April 2025.

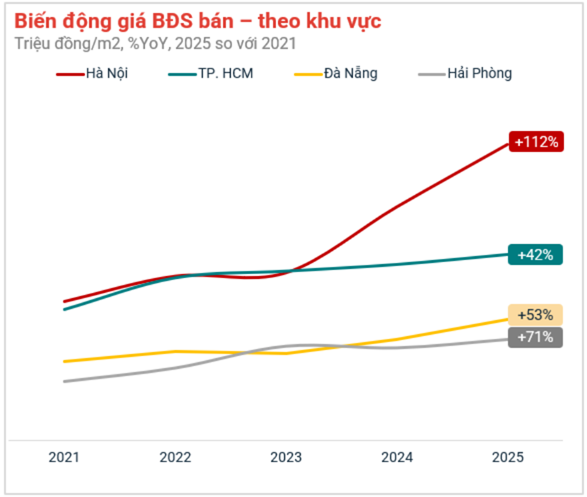

Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, noted that Vietnam’s real estate market has shown remarkable resilience and adaptability amidst macroeconomic shifts, particularly in key urban centers. Major economic and real estate hubs like Hanoi, Ho Chi Minh City, Hai Phong, and Da Nang have exhibited exceptional growth, with impressive property price increases over the past five years.

Specifically, Hanoi leads in property price growth from 2021-2025, with a 112% increase, followed by Hai Phong at 71%. Da Nang, representing Central Vietnam, saw a 53% rise, while Ho Chi Minh City, the Southern economic powerhouse, recorded a 42% increase over the same period.

The Vietnam Association of Realtors (VARS) highlights three standout real estate markets: Hai Phong in the North, Da Nang in the Central region, and Ho Chi Minh City in the South.

According to VARS, Hai Phong is emerging as a new real estate hotspot in Northern Vietnam, especially after its merger with Hai Duong province. This merger not only expands its development space but also creates a mega urban-industrial-port region, ranking among the top three in terms of GRDP nationwide. The 36 planned industrial zones by 2030 are driving significant growth in industry, logistics, and residential and commercial real estate.

Hai Phong is the only locality with all five strategic transportation connections: deep-sea ports, international airports, cross-border railways, highways, and inland waterways. This reduces logistics costs by 20–30% compared to Hanoi, offering a competitive edge in attracting investment in industrial, warehousing, and residential real estate.

Hai Phong boasts all five strategic transportation connections.

Hai Phong’s real estate market is also bolstered by major developers such as Vingroup, BRG Group, Hoang Huy, Van Phu Invest, Masterise Homes, BĐS HP, N.H.O (South Korea), and DOJILand. Well-planned megacities like Vinhomes Royal Island (Thuy Nguyen), Vinhomes Golden City (Duong Kinh), Hoang Huy Green River, and apartment projects like The Zenith Hai Phong, Gem Park, and Golden Crown Hai Phong are transforming the city and attracting investors and buyers.

VARS predicts that Hai Phong will solidify its position as a key real estate hub in Northern Vietnam from 2025 to 2030, driven by its unique advantages and growth potential.

In Da Nang, VARS reports a surge in real estate supply over the past year. Newly launched projects continue to see strong absorption rates, with high-end condominiums leading the market. Prices are rebounding, nearing 2019 peak levels with a 15–20% increase. Additionally, villa stays, boutique hotels, and rental apartments have seen rental prices rise by 30–40%, fueled by recovering tourism and investment demand.

In the South, the new Ho Chi Minh City, following its merger with Binh Duong and Ba Ria-Vung Tau, has become a megacity. With an area of over 6,772 km² and a population exceeding 14 million (projected to reach 18 million by 2030), it is one of Vietnam’s largest economic hubs.

The combined GRDP of Ho Chi Minh City, Binh Duong, and Ba Ria-Vung Tau contributes approximately 25% of the national GDP, 33% of total budget revenue, and over 20% of total import-export turnover. The merger enhances the region’s maritime economy, tourism, and industrial infrastructure, positioning it as a global technology, finance, commerce, and tourism hub.

VARS anticipates that Ho Chi Minh City’s real estate market will benefit from this integration, with areas like the Northeast region, known for strong infrastructure and economic foundations, leading the growth.

Da Nang: The Emerging Hotspot for Real Estate Investment

Da Nang is rapidly emerging as the epicenter of real estate investment. With its strategic location, booming tourism, and world-class projects like Capital Square, this city promises golden opportunities for savvy investors.

Unveiling the Secrets Behind $100 Million per Square Meter Condo Prices

The current prices of condominiums have skyrocketed beyond the reach of not only low-income earners but also those in the upper-middle-income bracket. This staggering reality stems from developers grappling with exorbitant costs: soaring interest payments on loans, escalating soft costs, prolonged legal procedures for project approvals, hefty land-use fees, surging construction material prices, and debt moratorium policies.

Dr. Can Van Luc: Vietnamese Public Servants Need Nearly 26 Years of Work to Afford an Apartment, Compared to Global Average of 15 Years

Dr. Can Van Luc asserts that the real estate market is grappling with significant volatility, as housing prices are rising faster than incomes, making it increasingly difficult for people to afford homes. He urges businesses to restructure, manage risks, and accelerate digital and green transformations. Additionally, he calls on the government to implement measures aimed at reducing overall price levels.