On September 26, Deputy Prime Minister Nguyen Chi Dung chaired a meeting to review the implementation of Resolution 68 issued by the Politburo on private sector economic development. During the meeting, the Deputy Prime Minister provided directives on issues related to business households.

According to the Ministry of Finance, ministries, sectors, and localities have promptly developed action plans to implement the Resolution within their respective areas of responsibility. To date, all 34 localities post-merger and 21 ministries, ministry-level agencies, and government-attached agencies have completed the issuance of their plans.

Deputy Prime Minister Nguyen Chi Dung addressing the meeting. Photo: VGP

The Ministry of Finance reports that Resolution 68 has begun to yield positive effects, significantly impacting market entry and business operations. Since its issuance on May 4, 2025, an average of over 19,100 new businesses have been established monthly, marking a nearly 48% increase compared to the first five months of the year.

In the first eight months of 2025, more than 209,240 businesses entered or re-entered the market, surpassing the number of businesses exiting the market by 30%.

Additionally, the number of newly established business households saw remarkable growth, increasing by over 118% compared to the same period in 2024. During the first six months of 2025, nearly 13,700 business households transitioned from lump-sum tax payment to declaration-based tax payment, and approximately 1,480 business households transformed into enterprises. In June alone, 910 households made this transition.

Notably, the positive outcomes in production and business activities have contributed to increased state budget revenue. In the first eight months of 2025, state budget revenue from the private sector in the fields of industry, commerce, and non-state services reached nearly 296 trillion VND, equivalent to 120% of the same period in 2024.

Within this, total revenue from business households and individuals amounted to 17.1 trillion VND, achieving 53.4% of the revenue target and 131% of the same period in 2024. These positive results contributed to the national state budget revenue for the first eight months of 2025, totaling 1.33 million trillion VND, equivalent to 80.7% of the annual estimate and a 31.8% increase compared to the same period last year.

Despite these achievements, the implementation of the Resolution at the local level remains slow and falls short of expectations. The capacity of grassroots officials has yet to meet the required standards.

Concluding the meeting, Deputy Prime Minister Nguyen Chi Dung emphasized the goal of creating an environment and mechanisms to mobilize idle capital within the population and channel it into the economy. This aims to foster a nationwide startup movement and promote private sector business activities.

According to the Deputy Prime Minister, the successful implementation of Resolution 68 will be measured by the confidence it instills in businesses, encouraging them to invest boldly. Alongside the positive results achieved, the Deputy Prime Minister urged ministries, sectors, and localities to intensify the review of projects, programs, and specific plans. Lead agencies must enhance their efforts, fulfill their responsibilities, and provide timely advice.

Regarding administrative procedures, the Deputy Prime Minister tasked the Ministry of Finance and the Ministry of Justice with closely monitoring the issuance of new procedures to prevent the replacement of old procedures with unnecessary new ones.

Furthermore, policies supporting the transition of business households into enterprises should be immediately implemented. It is essential to thoroughly investigate any barriers or hesitations business households may have when making this transition. According to government leaders, a wave of transformation from business households to enterprises must be created.

How Have Four Strategic Resolutions Transformed the Banking Industry?

Vietnam is entering a transformative era marked by the rapid introduction of four pivotal strategic resolutions. Amid this shift, the commercial banking sector, as the economy’s driving force, is proactively unveiling critical plans to align with significant changes set to unfold in the coming year.

From Capital to Management: ACB Empowers Businesses to Elevate Their Enterprise

ACB empowers the transition of businesses from sole proprietorships to corporations with a comprehensive financial solution suite, focusing on capital provision and guarantees. Coupled with government incentives, this foundation enables enterprises to seize integration opportunities and achieve robust growth.

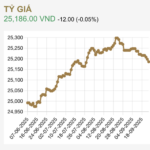

How Will the Fed’s 0.25% Rate Cut Impact Vietnam’s Exchange Rates?

The USD/VND exchange rate is expected to ease as the Federal Reserve initiates its monetary policy loosening cycle, marked by the first interest rate cut of the year.