From the beginning of the year until now, the supply of apartments in Hanoi has been quite abundant, with many new projects launching. As of Q2/2025, Hanoi recorded approximately 8,000 new apartments for sale, according to Savills data. In the first six months, the total new supply reached around 14,900 units, a 121% increase compared to the same period in 2024.

In the latter half of 2025, Savills forecasts that around 11,500 apartments will be launched in Hanoi, primarily in the high-end and mid-range segments.

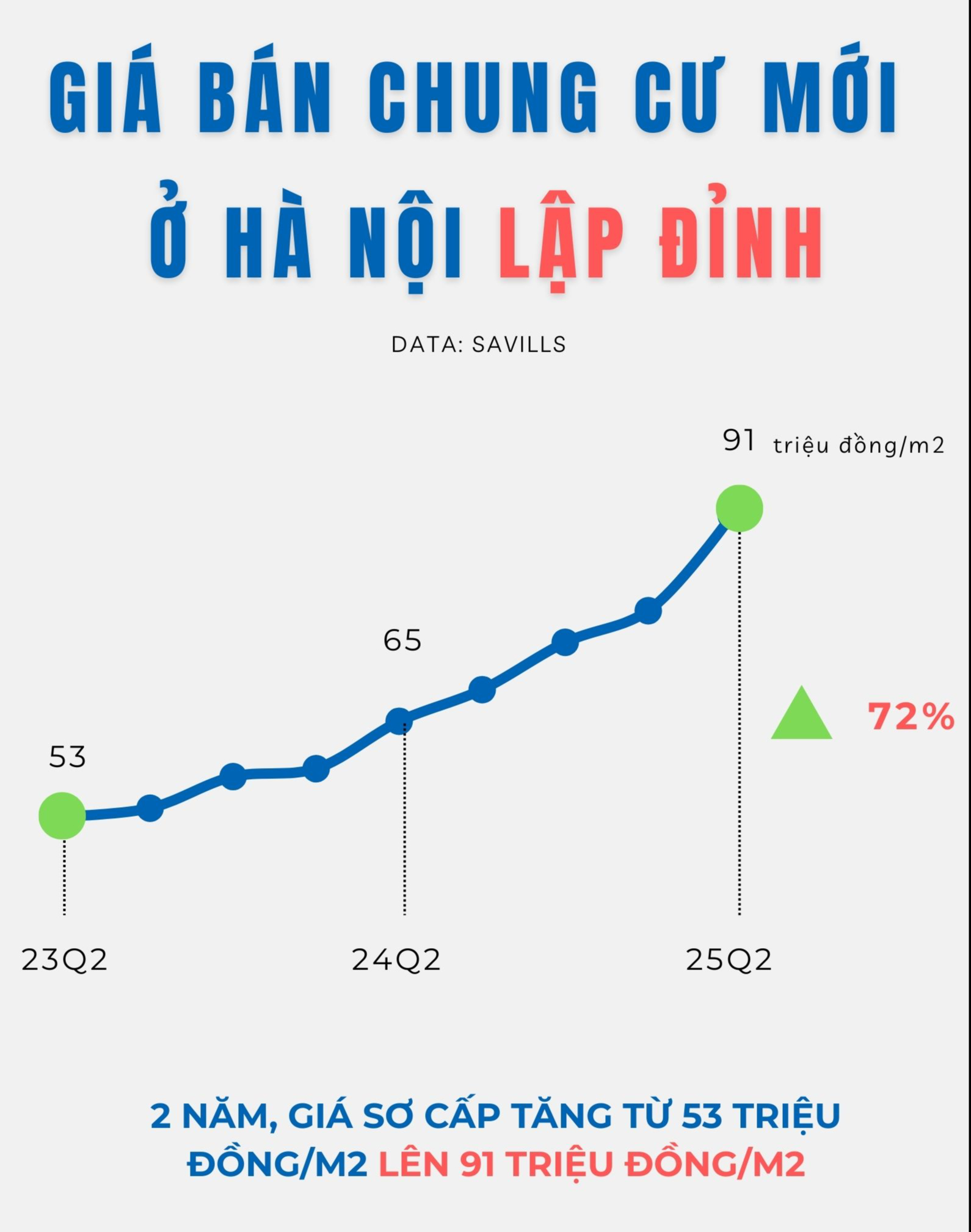

Despite the significant increase in supply, the average primary selling price in Hanoi remains high at 91 million VND/m², a 40% year-on-year increase.

Apartment prices remain high despite the abundant supply. (Photo: Hùng Cường)

In reality, most of the recently launched condominium projects are in the high-end segment, with prices nearing or even exceeding 200 million VND/m². In the new launch basket (comprising around 20 projects), 50% of the units are priced from 100 million VND/m² and above, while the remaining 50% range from 60 to 90 million VND/m².

For instance, some of the high-priced projects on the market include Noble Crystal Tây Hồ, with primary prices ranging from 188 to 330 million VND/m²; Sun Feliza Cầu Giấy, priced between 140 and 200 million VND/m²; Endless Skyline West Lake, ranging from 100 to 180 million VND/m²; and The Nelson Private Residences, priced from 135 to 170 million VND/m².

Explaining why the supply has increased while prices remain high, Ms. Đỗ Thu Hằng, Senior Director of Consulting and Research at Savills Hanoi, stated, “The average primary selling price continues to rise despite the abundant supply because most of the launched projects are in prime locations and positioned in the high-end segment. Additionally, the scarcity of central land and rising development costs have led many developers to focus on maximizing commercial value.”

Not only in Hanoi, but also in Ho Chi Minh City, apartment prices ranging from 60 to over 100 million VND/m² dominate the supply. Meanwhile, prices of 30-40 million VND/m² have been “extinct” for quite some time, and even primary prices of 50-55 million VND/m² are hard to find in this phase.

A survey of property prices in the old Ho Chi Minh City area shows that 80-90% of the new launch basket is priced from 100 million VND/m² and above. Projects like Eaton Park by Gamuda Land, Masteri Grand View (part of Global City Urban Area) by Masteri Homes, The Privé by Đất Xanh Group, Diamond Sky apartments by Vạn Phúc Group, The Beverly, and Lumiere Boulevard (part of Vinhomes Grand Park Urban Area) are all priced between 100 and 150 million VND/m².

A paradox in the apartment market is that despite rising prices, purchasing power remains stable, and liquidity has improved compared to the same period last year. In reality, many projects sell out even before construction begins, reflecting the contradictions and inadequacies in the market.

Regarding the buyer demographics, Ms. Hằng noted, “The current apartment price levels are high, narrowing the demand for actual living. For newly launched projects, there is still a significant distance from the city center or densely populated areas, so buyers primarily expect future value appreciation.

Some buyers also purchase for personal use, targeting the handover period, with flexibility to switch purposes based on market fluctuations. This speculative mindset makes investors the dominant force in total transactions.”

In reality, investor and speculator groups are taking full advantage of developers’ incentives and current interest rates to “flip” apartments.

Mr. Đ.T, a real estate agent specializing in apartments in Hanoi, shared that some regular clients have bought and sold with him across multiple projects. When a project launches, they buy 2-3 units at once. For units in prime locations, they quickly find buyers willing to pay a premium of a few hundred million VND and sell immediately. Some units are held until developer incentives end, while others are kept for long-term investment.

According to Savills observations, investors remain optimistic, especially in prime locations with potential for existing or planned infrastructure development. These factors continue to support prices in advantageous projects and enhance investment value over time.

Alongside the dominant investor group, genuine homebuyers are still present, with significant demand. However, this group is gradually shrinking due to rising launch prices.

Mr. Trần Minh (32, a construction engineer in Hanoi) shared that after years of saving, he and his wife have around 2 billion VND, planning to buy a mid-range apartment. However, surveying current projects, prices range from 60 million to over 100 million VND/m².

“I visited a project in Hoàng Mai. The agent showed a 70m² unit priced at around 5.4 billion VND. With only 2 billion VND, we would need a loan. However, with a combined monthly income of 40 million VND, even with a bank loan, we struggle to afford the monthly payments,” Mr. Minh said.

According to a DKRA survey of over 2,000 transactions, only about 30% of buyers are purchasing for personal use, while 70% are investors. (Photo: Hùng Cường)

According to the Vietnam Real Estate Brokerage Association (VARS), current prices are not only beyond the reach of low-income groups but also unaffordable for upper-middle-income earners.

VARS member brokers report that many young buyers, despite earning 40-50 million VND/month, are unwilling to buy without financial support from their families. The burden of loan repayment, especially with floating interest rates after the promotional period, is a significant psychological barrier for young people who prioritize quality of life and flexibility over long-term debt for a small apartment.

Market data reflects this reality. A DKRA survey of over 2,000 transactions shows that only about 30% of buyers are purchasing for personal use, while 70% are investors. Batdongsan.com.vn reports that 86% of property transactions are resold within a year, indicating that most buyers are flipping rather than buying for long-term use. This abnormal ratio highlights the severe imbalance between actual demand and speculative demand.

When speculation overshadows actual demand, condominiums become investment vehicles rather than homes, driving prices higher. In just two years, Hanoi’s average primary apartment price has risen from 53 to 91 million VND/m² (Savills data). Prices of 40-50 million VND/m² have completely “disappeared” from the primary market.

According to Dr. Cấn Văn Lực, Chief Economist at BIDV and a member of the Prime Minister’s Advisory Council, Vietnam’s real estate market faces a significant and prolonged challenge: prices are too high relative to residents’ incomes.

“A concerning statistic shows that in 2025, a Vietnamese household needs an average of 25.8 years of income to buy an apartment, an increase of 2.1 years from 2024. This places Vietnam 9th out of over 100 countries in terms of housing affordability. From 2019 to 2024, Vietnam’s property prices rose by 59%, a very high increase compared to many regional and global markets,” Dr. Lực shared at the 3rd Vietnam Financial Advisory High-Level Forum 2025, themed “New Era, New Momentum.”

In this context, Dr. Cấn Văn Lực emphasizes that solutions to stabilize housing prices must be carefully considered. He recommends that authorities accelerate the completion of legal frameworks, build land and property databases, and address the factors driving rapid price increases.

Dr. Cấn Văn Lực

“Property prices cannot keep rising like this. Taxing second homes is just one measure; we need comprehensive solutions such as controlling real estate credit, building databases to prevent speculation and price manipulation, diversifying capital sources and products…”

For construction and real estate companies, it is essential to continue restructuring operations, manage cash flow and debt risks, avoid scattered investments, diversify capital and products, bring prices to more reasonable levels, proactively adopt digital and green transformations, contribute to building land and property databases, and standardize processes, products, and personnel in line with new laws (Land Law, Housing Law, Real Estate Business Law, etc.).

The Ministry of Finance and the Ministry of Construction have proposed various tax policies to curb real estate speculation, including taxing second homes, imposing higher taxes on unused properties, and applying progressive taxes on short-term transactions. However, implementation remains challenging due to insufficient data infrastructure.

Mr. Nguyễn Văn Đính, Chairman of VARS, believes that without timely interventions, Hanoi apartment prices will continue to rise. Only when supply improves and state policies and costs are reasonably regulated will prices have a chance to decrease.

Proposed Legislation to Allow Construction on Agricultural Land, Capping Projects at 700m²

The Hanoi People’s Committee has proposed allowing the construction of facilities on agricultural land to support production. Depending on the agricultural production area, specific ratios of farmland will be designated for construction. Notably, in concentrated rice-growing regions spanning 300 hectares or more, the maximum construction area is set at 700 square meters.

“Craving Mooncakes with Green Rice Flakes but Hate the Crowds? Discover These 3 Insider Spots Everyone’s Talking About”

No more early mornings spent queuing up—word on the street is that these three mooncake brands with green rice fillings are not only delicious but also incredibly easy to get your hands on.

Emerging Real Estate Hotspots: Hà Nam, Hưng Yên, Vĩnh Phúc Attract Major Players Like Sun Group, Phú Mỹ Hưng, Bim Group in a Wave of Investment

Amidst Hanoi’s constrained land availability and escalating property prices, neighboring provinces such as Hà Nam, Hưng Yên, and Vĩnh Phúc have emerged as vibrant real estate markets. These satellite regions are witnessing a surge in housing supply, robust buyer demand, and competitive pricing, positioning them as attractive alternatives for both investors and homebuyers.