DIC Corporation (DIC Corp, stock code: DIG, HoSE) announces a public offering of shares under the Certificate of Registration for Public Offering No. 330/GCN-UBCK, issued by the State Securities Commission on September 22, 2025.

Accordingly, DIC Corp is offering 150 million shares to existing shareholders. The rights issue ratio is 1,000:232, meaning shareholders holding 1,000 shares will receive an additional 232 new shares. The issued shares are freely transferable.

The registration period for purchases runs from October 20 to November 14, 2025. The transfer of purchase rights is allowed from October 20 to 31, 2025.

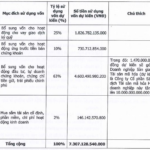

The issuance price is set at 12,000 VND per share, aiming to raise a maximum of 1.8 trillion VND. Of this, DIG plans to allocate 600 billion VND to supplement capital for the Cap Saint Jacques Complex (CSJ) – Phase 3 (Block C4) project.

The CSJ Tower Vung Tau tourism apartment complex is now operational.

An additional 600 billion VND will be used to supplement capital for the Vi Thanh Commercial Residential Area project, and the remaining 600 billion VND will be allocated to repay the DIG12301 bond. Disbursement is scheduled from Q4/2025 to 2026.

This offering replaces the previous plan to issue 200 million shares to the public under Certificate No. 231/GCN-UBCK dated December 12, 2024, issued by the State Securities Commission.

In other developments, DIC Corp recently announced the completion of the transfer of the Lam Ha Center Point Housing Project in Lam Ha Ward, Phu Ly City, Ha Nam Province (now Ha Nam 1 Ward, Ninh Binh Province).

The transfer value exceeds 1.327 trillion VND (excluding VAT). According to the plan, this project will be recorded in the Q3/2025 business results.

The Lam Ha Center Point Project, launched in 2019, spans 13.6 hectares with a total investment of 2.115 trillion VND. It is one of DIC’s key projects for the 2021–2025 period.

As per the plan, the project will offer 106 shophouses, 32 villas, 90 townhouses, and three commercial centers combined with high-rise apartments ranging from 15 to 20 floors. It is expected to accommodate approximately 2,400 residents.

Hai Phong Securities Poised to Join the Trillion-Dong Capital Club

On September 25th, the Board of Directors of Hai Phong Securities Corporation (Haseco, UPCoM: HAC) passed a resolution to issue 100 million shares in a private placement. This move aims to raise VND 1,000 billion, increasing the company’s charter capital from nearly VND 292 billion to approximately VND 1,292 billion, a remarkable 4.4-fold increase.

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

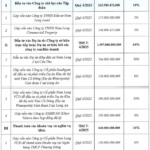

Nam Long Plans Capital Increase for Subsidiary Companies

Nam Long has revised its detailed plan for utilizing the VND 2.5 trillion raised from the issuance of over 100 million shares. The company intends to allocate these funds primarily for investment and capital contributions to its subsidiaries.

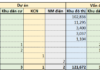

Leading Securities Firm to Invest Nearly $60 Million in Establishing a Crypto Asset Trading Platform

This leading securities firm is set to offer 365 million shares at an initial price of VND 20,000 per share, significantly boosting its chartered capital from VND 1,460 billion to over VND 5,100 billion. A key allocation of the raised capital will be directed toward establishing a cryptocurrency asset trading platform.