Oil Prices Reach Multi-Week Highs

Oil prices climbed to multi-week highs as a weaker US dollar and positive sentiment surrounding US-China trade negotiations in London boosted expectations for improved global economic prospects and subsequently, higher oil demand.

Specifically, Brent crude oil rose by 0.57 USD (0.9%) to 67.04 USD per barrel, reaching its highest level since April 28th. US WTI crude oil increased by 0.71 USD (1.1%) to 65.29 USD per barrel, with a peak of 65.38 USD—the highest since April 4th.

The US Dollar Index fell by 0.3%, making oil more affordable for holders of other currencies. Oil prices were also supported by expectations of a potential US-China trade deal, with Brent crude gaining 4% and WTI rising by 6.2% last week.

Any potential impact from increased OPEC+ output next month was overshadowed by the positive trade negotiations. According to a Reuters survey, OPEC pumped 26.75 million barrels per day in May, an increase of 150,000 barrels per day compared to April. Saudi Arabia led the production boost, while Iraq made significant cuts to compensate for previous overproduction.

Gold Prices Edge Higher

Gold prices rose slightly, buoyed by a weaker US dollar and optimism surrounding US-China trade talks in London. Spot gold increased by 0.8% to 3,335.02 USD per ounce, while US gold futures climbed by 0.2% to 3,354.90 USD per ounce. The decline in the US Dollar Index by 0.3% made gold more attractive to investors holding other currencies.

The meeting between officials from both countries follows a temporary pause in trade tensions last month. Analysts suggest that positive outcomes from the negotiations could lead to a slight dip in gold prices, but they remain supported by expectations of interest rate cuts by the Fed, a weak economic outlook, and rising inflationary pressures.

Additionally, tensions in Ukraine have fueled safe-haven demand for gold. The People’s Bank of China continued to increase its gold reserves for the seventh consecutive month.

Other precious metals also saw gains, with platinum rising to 1,212.82 USD per ounce (highest since May 2021), silver reaching 36.71 USD (+2.1%), and palladium climbing to 1,077.64 USD (+nearly 3%).

Copper Prices Rise on US-China Trade Hopes and Declining Inventories

Copper prices on the LME rose by 1% to 9,787 USD per ton, buoyed by optimism surrounding US-China trade negotiations and declining inventories, despite weak export data from China, the world’s top copper consumer.

Copper inventories on the LME fell by 10,000 tons to 122,400 tons, a decline of over 50% since February. Additionally, another 67,800 tons have been scheduled for withdrawal, with most expected to be shipped to the US, where copper prices are significantly higher due to potential import tariffs.

China’s exports in May fell to a three-month low due to US tariffs. The country’s imports of copper and copper products in May decreased by 16.9% year-over-year and 2.5% month-over-month to 427,000 tons. The Yangshan copper premium fell to a three-month low of 41 USD per ton, down from 103 USD at the beginning of May.

Prices of other industrial metals saw slight movements: aluminum rose by 1.2% to 2,480 USD per ton, tin increased by 1.1% to 32,710 USD, lead climbed by 0.3% to 1,989 USD, while zinc and nickel fell by 0.5%. The weaker US dollar also provided some support to commodity prices.

Iron Ore Prices Slip

Iron ore futures declined due to weak economic data from China, which dampened investor sentiment. However, hopes for progress in US-China trade negotiations limited the downside.

The September 2025 iron ore contract on the DCE fell by 0.71% to 703 Chinese yuan per ton (approximately 97.83 USD). On the Singapore Exchange, the July 2025 contract decreased by 0.74% to 94.80 USD per ton.

In May, China’s producer price index (PPI) fell at its fastest pace in nearly two years, while consumer prices continued to decline, reflecting persistent pressures from the real estate crisis and trade tensions.

Additionally, China’s iron ore imports in May fell by 4.9% month-over-month as steel mills exercised caution ahead of the seasonally weak steel demand period. However, falling port inventories and sustained hot metal production—indicative of stable demand—prevented a steeper decline in prices.

Other steelmaking raw materials saw mixed movements: coking coal rose by 0.13%, while coke fell by 1.22%.

On the Shanghai Futures Exchange, steel prices traded within a narrow range: rebar and hot-rolled coil were almost unchanged, wire rod fell by 0.66%, and stainless steel dropped by 0.47%.

Wheat, Corn, and Soybean Prices Decline

US wheat prices fell by approximately 2% due to seasonal harvest pressure as the winter wheat harvest in the Northern Hemisphere commenced. Corn and soybean prices mostly declined due to favorable weather conditions for crops in the US.

As of 17:59 GMT, July 2025 wheat futures on the CBOT fell by 11 cents to 5.43-3/4 USD per bushel, ending a three-day winning streak. July corn decreased by 8.5 cents to 4.34 USD per bushel, while July soybean futures dipped by 0.5 cents to 10.56-3/4 USD per bushel, and November 2025 soybean futures fell by 5 cents to 10.32 USD per bushel.

Investors paused their buying after last week’s short-covering rally. Ahead of the USDA’s weekly crop progress report, analysts expected around 8% of the US winter wheat crop to have been harvested.

In Russia, the world’s top wheat exporter, consulting firm Sovecon raised its 2025 wheat production forecast by 1.8 million tons to 82.8 million tons due to favorable weather.

The USDA reported US corn exports for the week at 1.657 million tons, surpassing expectations. However, Brazil’s second corn crop harvest could limit US corn export prospects.

Japanese Rubber Futures Fall After Three Sessions of Gains as US Dollar Weakens

Japanese rubber futures turned lower after three sessions of gains as the US dollar weakened ahead of trade negotiations between the US and China in London.

On the Osaka Exchange (OSE), the November 2025 rubber contract fell by 4.1 yen, or 1.39%, to 290.2 yen per kg.

On the Shanghai Futures Exchange (SHFE), the September 2025 contract decreased by 35 Chinese yuan (0.26%) to 13,660 yuan per ton. Meanwhile, the July 2025 butadiene rubber contract rose slightly by 25 yuan (0.22%) to 11,275 yuan per ton.

Thai smoked sheet rubber and block rubber prices increased by 1.08% and 6.39% to 73.9 baht and 69.95 baht per kg, respectively.

The US dollar fell by 0.3% against the Japanese yen to 144.39, after strengthening by 0.9% in the previous session. The stronger yen made yen-denominated assets less appealing to foreign buyers.

Natural rubber prices are often influenced by oil prices as they compete with synthetic rubber, a petroleum byproduct. Typically, rubber trees yield lower production from February to May before entering the peak harvest season, which lasts until September.

On the Singapore Exchange (SICOM), the July 2025 rubber contract last traded at 160.6 US cents per kg, a slight decline of 0.2%.

Cocoa Prices Steady After Strong Gains, Coffee and Sugar Prices Rise

Cocoa prices on ICE steadied after a 5% surge last week, as speculators booked profits amid forecasts of rain in West Africa. Coffee and sugar prices climbed, supported by fresh buying and tighter supplies in some regions.

London Cocoa dipped by 0.3% to £6,626 per ton. New York cocoa was almost unchanged at $9,456 per ton. Hedge funds reduced their net long position in New York and London cocoa by 2,303 and 4,066 contracts, respectively, as of June 3rd. Despite the forecast of rain in West Africa this week, agents noted that the soil remains dry, limiting crop growth.

StoneX stated, “Early reports for the 2025/26 crop indicate that Côte d’Ivoire’s production could reach only 1.8 million tons, well below the average of 2.2 million tons, suggesting that the deficit could last for several years.” Cocoa arrivals at Côte d’Ivoire’s ports from the start of the season until June 8th rose by 6.8% year-over-year.

Raw Sugar climbed by 1.1% to 16.67 cents per lb after hitting a four-year low in the previous session. White sugar increased by 1.5% to $472.40 per ton. Improved monsoon rains in India and Thailand boosted crop prospects. In Brazil, the cane harvest accelerated after a dry spell. However, prices faced pressure from Thai mills’ delayed hedging.

Robusta coffee surged by 2.6% to $4,451 per ton after touching a 9.5-month low last week. Arabica coffee rose by 1.1% to $3,594 per lb. The recent recovery was supported by a sharp decline in arabica coffee stocks on the ICE, with 95,000 bags withdrawn in a week. However, ample supplies from Brazil and Vietnam continued to weigh on the market.

Cazarini warned that if the pace of withdrawals continued, the market could face a temporary deficit. Consultant Archer noted that Brazilian farmers were selling robusta to cover harvest costs.

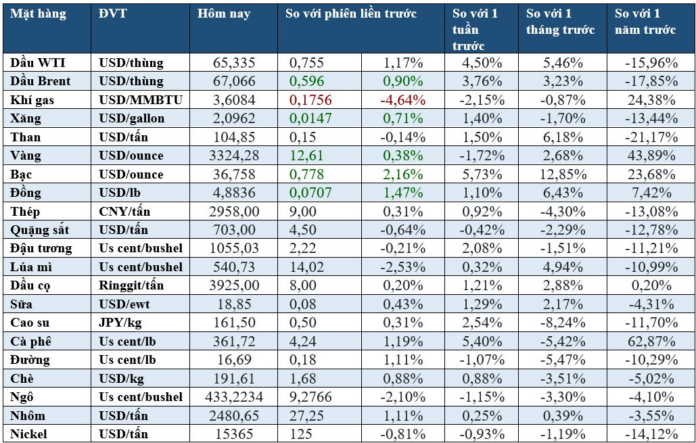

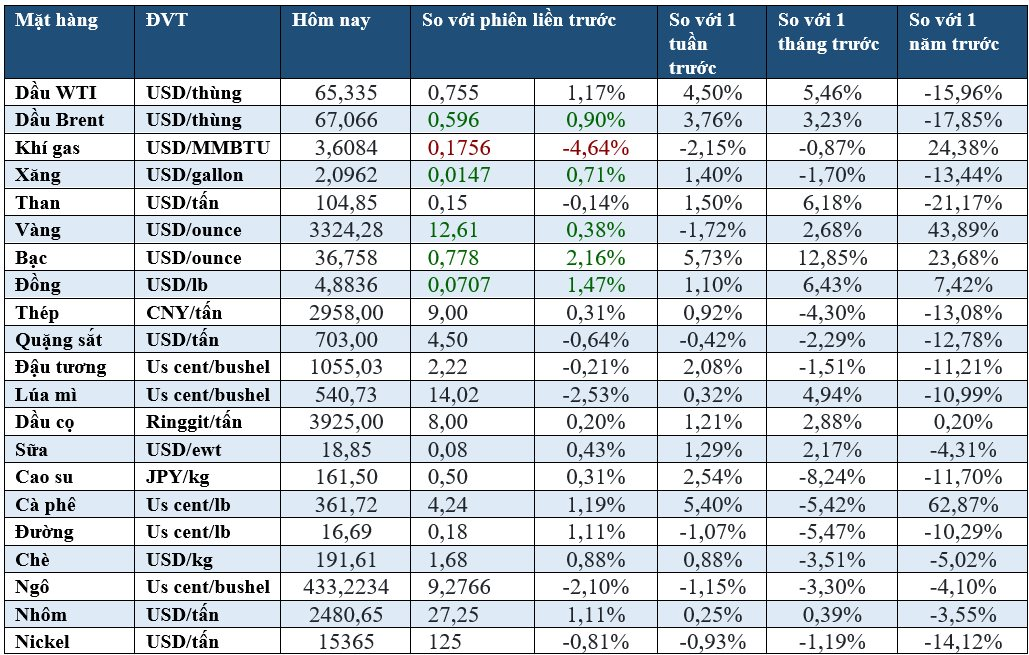

Prices of Key Commodities in the Morning Session Today

The Energy Market on June 7: Oil Prices Continue to Surge, Gold Plunges Over 1%

The energy complex continued its upward trajectory on June 6th, with oil prices extending gains. Silver shone brightly, surging to a 13-year high, while platinum reached a 3-year peak. However, gold suffered a sharp decline, dropping over 1%. Raw sugar prices remained subdued, languishing at a 4-year low.

Gold Prices Plummet Following US Jobs Report, SPDR Gold Trust Sells Off

However, the high demand for risk aversion and the depreciation of the US dollar this week have kept the precious metal prices buoyant, resulting in a weekly gain…

Gold Prices Slip on US-China Trade Talk Hopes

The sentiment among investors turned cautious ahead of the release of the U.S. non-farm payrolls report for May on Friday. With global economic uncertainties looming large, market participants are keenly awaiting insights into the health of the labor market, which could influence the Federal Reserve’s monetary policy trajectory. As the Fed has signaled a commitment to taming inflation, even at the risk of a recession, investors are bracing for a potential shift in their investment strategies.

The End of Easy Profits: Riding the Golden Wave

The Vietnamese gold market witnessed a tumultuous surge in April 2025, with gold prices fluctuating by up to VND 7.5 million per tael per day. This volatility presented a lucrative opportunity for savvy traders and investors to profit from the rapid price movements. However, those days of frenzied gold trading seem to be over, as the current market offers little room for such lucrative waves.