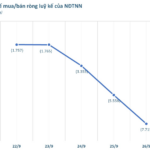

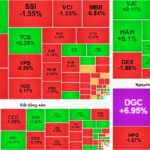

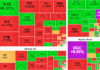

The stock market experienced a relatively volatile trading session on September 26th. The VN-Index fluctuated narrowly around the reference point, with money flow diverging across various sectors. In the final 15 minutes of trading, selling pressure intensified in the banking and securities groups. The VN-Index closed at 1,660.7 points, down 5.39 points, or 0.32%. In terms of foreign trading, foreign investors continued their net selling streak, offloading 2,159 billion VND across the market.

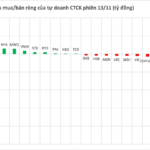

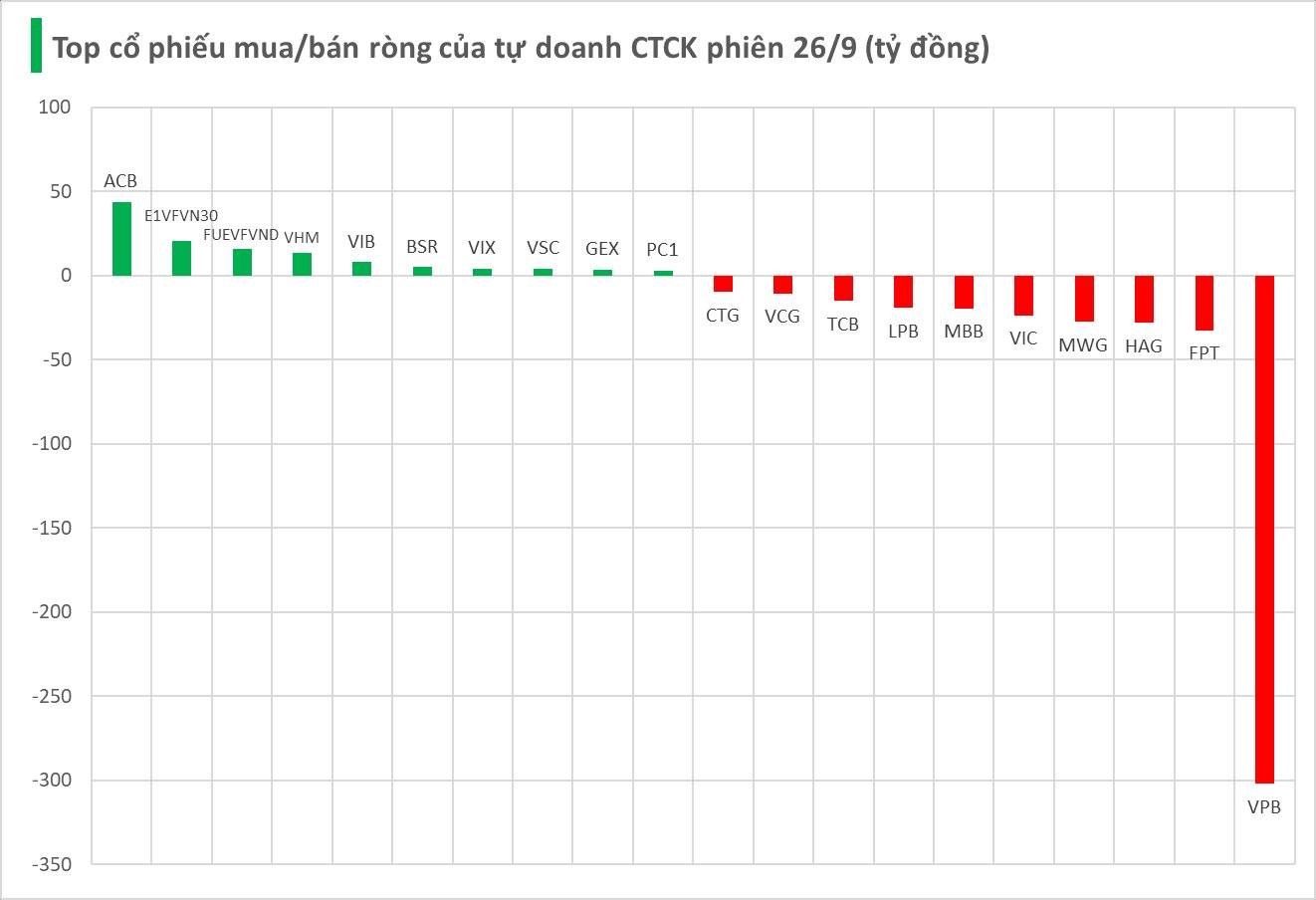

Securities firms extended their net selling to 446 billion VND on the HoSE.

Specifically, securities firms were the heaviest net sellers in VPB, with a value of -302 billion VND, followed by FPT (-32 billion), HAG (-28 billion), MWG (-27 billion), and VIC (-23 billion VND). Other stocks also saw significant net selling, including MBB (-19 billion), LPB (-19 billion), TCB (-15 billion), VCG (-11 billion), and CTG (-10 billion VND).

Conversely, ACB dominated the net buying with 44 billion VND, far surpassing other stocks. E1VFVN30 ranked second with 21 billion VND, followed by FUEVFVND (16 billion), VHM (14 billion), VIB (8 billion), BSR (5 billion), VIX (4 billion), VSC (4 billion), GEX (4 billion), and PC1 (3 billion VND).

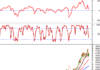

Vietstock Weekly (Sept 29 – Oct 3, 2025): Liquidity Lacks Momentum – Can the Market Break Through?

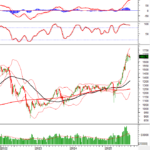

The VN-Index edged higher following a volatile week of trading. While the MACD indicator has maintained a buy signal since May 2025, its divergence from the Signal Line is narrowing. Meanwhile, the Stochastic Oscillator continues to weaken after a sell signal in overbought territory, suggesting short-term volatility remains a risk. Additionally, declining trading volumes in recent weeks indicate a lack of momentum, making a clear breakout unlikely unless liquidity improves soon.