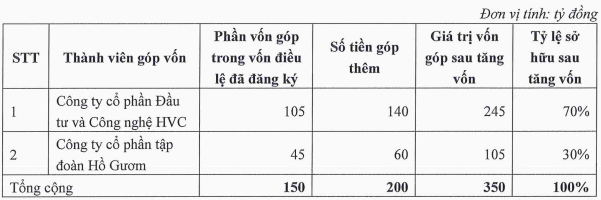

HVC Hoa Binh is a real estate company established in 2023, headquartered in Ky Son Ward, Phu Tho Province (formerly part of Hoa Binh Province). The company currently has a chartered capital of 150 billion VND, contributed by HVH with 105 billion VND (70%) and Ho Guom Group JSC with 45 billion VND (30%).

Mr. Tran Huu Dong, Chairman of the Board of Directors of HVH, also serves as the Chairman of the Members’ Council of HVC Hoa Binh.

According to the plan, HVC Hoa Binh will soon increase its chartered capital from 150 billion VND to 350 billion VND through additional contributions from existing members in proportion. HVH is expected to contribute an additional 140 billion VND, raising its total investment in this subsidiary to 245 billion VND (maintaining its 70% ownership stake).

|

Plan for Additional Capital Contribution to HVC Hoa Binh

Source: HVH

|

The capital increase will enable HVC Hoa Binh to fund its Euro Villas project—a garden villa complex combined with eco-tourism and forestry in Nuoc Hang Village, Mong Hoa Commune, Hoa Binh City, Hoa Binh Province (new administrative address: Nuoc Hang Village, Ky Son Ward, Phu Tho Province). The capital contribution is expected to be completed by June 30, 2026.

The Euro Villas project spans 28.74 hectares and will offer 263 long-term ownership villas. As of December 31, 2024, the project has completed key legal procedures, including 1/500 detailed planning approval, investment policy approval, investor selection via tender, and investor confirmation. It is now in the land clearance phase, progressing toward land allocation and groundbreaking.

Euro Villas Project Rendering. Image: HVH

|

Returning to HVH, the company will raise 140 billion VND through a combination of self-funded capital (40 billion VND) and proceeds from a private placement of 100 billion VND in shares.

As approved at the 2025 Annual General Meeting, HVH plans to issue 20 million shares at 10,000 VND per share to professional securities investors. The offering is scheduled for the second half of 2025, with a one-year transfer restriction on the newly issued shares.

The August 22 Board Resolution revealed that four investors—Ms. Tran Hai Van, Mr. Tran Duc Trung, Ms. Nguyen My Dung, and Mr. Nguyen Dinh An—have committed to purchasing the entire 20 million shares. None of these individuals are related to HVH‘s leadership or hold any prior shares in the company.

With approximately 200 billion VND expected from the offering, HVH will allocate 100 billion VND to repay bank loans and supplier/partner debts, and the remaining 100 billion VND to increase its stake in HVC Hoa Binh.

– 09:13 29/09/2025

What Waves Will Shape the Stock Market Next Week?

Domestic stocks experienced a lackluster trading week, with capital flowing out of banking and securities sectors and shifting towards mid-cap and small-cap stocks. Analysts predict that the market is likely to continue its sideways movement next week unless liquidity improves.

Emerging Real Estate Hotspots: Hà Nam, Hưng Yên, Vĩnh Phúc Attract Major Players Like Sun Group, Phú Mỹ Hưng, Bim Group in a Wave of Investment

Amidst Hanoi’s constrained land availability and escalating property prices, neighboring provinces such as Hà Nam, Hưng Yên, and Vĩnh Phúc have emerged as vibrant real estate markets. These satellite regions are witnessing a surge in housing supply, robust buyer demand, and competitive pricing, positioning them as attractive alternatives for both investors and homebuyers.

Establishing Real Estate Trading Centers to Drive Down Housing Prices

The Ministry of Construction is set to propose a pilot resolution to the Government for the establishment of a state-managed real estate trading center. This initiative aims to introduce legal oversight over the supply and transaction prices of real estate, encompassing both primary and secondary markets.