Technical Signals of VN-Index

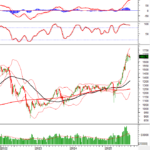

During the morning trading session on September 29, 2025, the VN-Index continued its recovery after successfully testing a strong support level and crossing above the Middle line of the Bollinger Bands.

Additionally, the Stochastic Oscillator indicator has provided a buy signal. If the MACD follows suit in the upcoming sessions, the upward momentum will be further strengthened.

Technical Signals of HNX-Index

In the morning session on September 29, 2025, the HNX-Index traded sideways within a Triangle pattern. Given the consistently low trading volume, this situation is expected to persist.

The Bollinger Bands are tightening significantly, so investors should closely monitor the HNX-Index‘s position relative to the Middle line. If the index remains above the Middle line when the Bollinger Bands expand again, the outlook will be more positive.

VHM – Vinhomes JSC

On the morning of September 29, 2025, the VHM stock price rose, accompanied by a Big White Candle pattern and trading volume expected to exceed the average by the session’s close, indicating optimistic investor sentiment.

Currently, VHM is well-supported by the 50-day SMA, and the Stochastic Oscillator has already given a buy signal. If these technical factors persist, the medium-term uptrend is likely to continue.

VSC – Vietnam Container Corporation

During the morning session on September 29, 2025, the VSC stock price increased and remained above the Middle line of the Bollinger Bands, with trading volume projected to surpass the 20-day average by the session’s end, reflecting positive investor sentiment.

The stock has successfully broken out of the Falling Wedge pattern’s upper edge, while the Stochastic Oscillator continues to rise after giving a buy signal. If the indicator keeps improving, the potential price target is the 38,000-39,000 range.

Furthermore, the MACD is narrowing its gap with the Signal line. If it provides a buy signal in the upcoming sessions, the recovery will be further reinforced.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:03 September 29, 2025

Vietstock Weekly (Sept 29 – Oct 3, 2025): Liquidity Lacks Momentum – Can the Market Break Through?

The VN-Index edged higher following a volatile week of trading. While the MACD indicator has maintained a buy signal since May 2025, its divergence from the Signal Line is narrowing. Meanwhile, the Stochastic Oscillator continues to weaken after a sell signal in overbought territory, suggesting short-term volatility remains a risk. Additionally, declining trading volumes in recent weeks indicate a lack of momentum, making a clear breakout unlikely unless liquidity improves soon.