The State Bank of Vietnam has recently released a draft circular guiding the production of gold jewelry and fine arts, the production and trading of gold bars, as well as the export and import of gold.

This move concretizes Decree No. 24/2012/NĐ-CP on gold trading management, amended and supplemented by Decree No. 232/2025/NĐ-CP, aiming to eliminate monopolies and create a more transparent playing field for businesses.

A significant change is the introduction of a licensing procedure for gold bar production—a previously non-existent requirement. Enterprises and commercial banks wishing to engage in production must submit an application, proof of charter capital, internal production process regulations, and post-inspection remediation documents (if applicable).

The State Bank adds new regulations on gold bar trading, eliminating monopolies.

Licensed enterprises must also apply for annual gold export and import quotas by submitting documents to the State Bank no later than November 15th each year. Based on these quotas, they must then seek approval for each export or import transaction.

To ensure objectivity, the State Bank will establish a Council for Quota Development and Adjustment, chaired by a Deputy Governor, to advise the Governor on annual quota allocation.

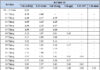

Processing times for certificates have been significantly reduced: eligibility certificates for gold jewelry and fine arts production from 30 to 10 days, file amendments from 15 to 5 days, gold bar trading licenses from 30 to 20 days, and temporary gold import permits for re-export from 15 to 10 days.

Submission methods have been expanded to include in-person, postal, and online via the National Public Service Portal, maximizing convenience for businesses.

In alignment with Decree 232, the draft abolishes certain provisions from Circular 16. Notably, the State Bank proposes removing import license requirements for raw gold materials previously applicable to jewelry producers, FDI enterprises, foreign contractors, and overseas gold mining investors.

Several redundant application components have also been eliminated, such as the “production and business plan” for FDI enterprises importing raw gold materials.

To enhance oversight, a new chapter on data connectivity and information provision has been added. Licensed enterprises and credit institutions must connect their electronic data systems with the State Bank, providing timely, accurate, and continuous information.

Required data includes personal identification, enterprise tax codes, gold bar transaction volumes and values, raw material inputs, output products, and import/export activities. All data must be retained for a minimum of 10 years.

The draft circular is currently open for public consultation from relevant agencies, organizations, and businesses before the State Bank finalizes and officially issues it.

A Single Touch, Encapsulating the Relentless Efforts of Regulators, Banks, and Tech Companies

“This is the insightful remark made by Mr. Phạm Anh Tuấn, Director of the Payment Department at the State Bank of Vietnam, regarding the theme of Vietnam Card Day 2025: ‘One Touch – A World of Trust.’”

Central Bank Boosts Credit Limit for Agriculture, Forestry, and Fisheries to VND 185 Trillion

The State Bank of Vietnam (SBV) has recently announced an expansion of its credit program for the agriculture, forestry, and fisheries sectors, increasing the total funding to VND 185 trillion. This initiative will be implemented through commercial banks, offering loans at interest rates 1-2% lower than the average market rate.

Commercial Real Estate Loans with a 200% Risk Weighting

As of July 31, 2025, Vietnam’s real estate credit outstanding balance reached VND 4,080 trillion, marking a 16.95% increase compared to the end of 2024, outpacing the overall credit growth rate, according to the State Bank of Vietnam. In line with the government’s directives, the central bank has implemented various credit measures to support the real estate market, facilitate access to capital for individuals and businesses, and ensure the safety and stability of banking operations.