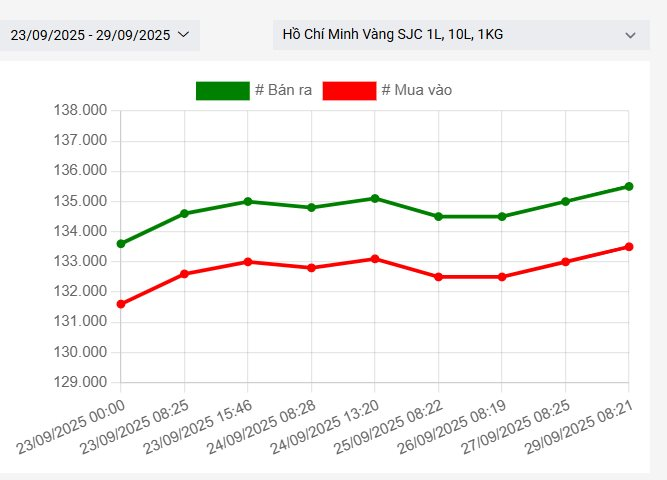

This morning’s trading session opened with SJC listing gold bars at VND 134.5 – 135.5 million per tael, a VND 500,000 increase from yesterday’s closing. The company’s gold ring prices remained unchanged at VND 128.8 – 131.5 million per tael.

SJC gold bar price fluctuations over the past week.

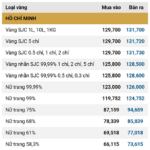

In Ho Chi Minh City, Mi Hồng listed gold rings this morning at VND 130.2 – 131.7 million per tael (buy – sell), a VND 200,000 increase from last week’s closing. Their gold bars are currently listed at VND 134 – 135 million per tael, unchanged.

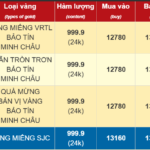

Meanwhile, prices at other major brands remained static. Gold bars at Bảo Tín Minh Châu, PNJ, and DOJI hover around VND 133 – 135 million per tael.

For gold rings, selling prices remain high. Bảo Tín Minh Châu lists at VND 129.1 – 132.1 million; PNJ at VND 128.8 – 131.8 million; and DOJI at VND 128.8 – 131.8 million per tael.

Globally, spot gold reached USD 3,778 per ounce this morning, a USD 30 increase from last week’s closing. Financial experts remain optimistic about gold’s upward trend continuing this week.

“I believe gold prices can go even higher as the world seeks an alternative to the USD,” said Chris Mancini, co-portfolio manager of the GOLDX fund at Gabelli Funds.

Aaron Hill, Chief Market Analyst at FP Markets (Australia), added: “Gold has the momentum to surpass USD 3,800, driven by central bank purchases (projected at over 900 tons in 2025) and ETF inflows. UBS and ANZ predict gold reaching this level by late 2025 amid geopolitical uncertainties. Expect a rapid surge rather than a prolonged accumulation phase.”

CME’s FedWatch tool indicates an 87% probability of a Fed rate cut next month and a 65% chance in December.

Fawad Razaqzada, analyst at City Index and FOREX.com, noted in a Kitco News report that a significant shift in rate expectations would be needed to impact gold’s rally.

“Gold remains supported by steady central bank buying, concerns over US debt, and persistent inflation. These factors, combined with speculative buying, should keep gold prices elevated for some time,” he said.

“However, if next week’s data significantly reduces December rate cut expectations, the USD could strengthen, capping gold’s gains. Conversely, if rate cut expectations solidify, gold will be further supported. Unless fundamentals change, I believe current factors will soon push gold past USD 3,800.”

Despite a light economic calendar next week, economists highlight gold and USD sensitivity to key employment data. Any further signs of US labor market weakness will bolster rate cut expectations, supporting gold prices.

Barbara Lambrecht, commodity analyst at Commerzbank, remains optimistic about gold but notes the market needs a new catalyst to surpass USD 3,800. She cautions against excessive short-term expectations.

“A third consecutive disappointing US jobs report, indicating clear weakness, could be the catalyst as markets would anticipate faster Fed rate cuts. However, our economists expect slight US labor market improvement,” she wrote.

While optimism prevails, some experts urge investor caution at current levels. While no major correction is predicted, a moderate consolidation or pullback is possible.

Gold Price Today, September 28: Analysts Predict Continued Uptrend

Both analysts and experts forecast that global gold prices will continue to rise next week, yet they remain approximately 15 million VND lower than the SJC gold bar prices.

Afternoon of September 18: SJC Gold Bars and Ring Prices Continue to Plummet

In the early hours of September 18th, global gold prices surged dramatically, reaching an all-time high of over $3,700 per ounce. However, this rally was short-lived as prices abruptly reversed and plummeted. Domestically, the opening of the market saw a similar trend, with both SJC gold bars and gold jewelry prices experiencing a widespread decline.